As part of our commitment to keeping you informed about important regulatory changes, we want to bring to your attention a key update that will impact transactions across Europe starting in 2025. The SEPA (Single Euro Payments Area) Credit Transfer (SCT) file format is undergoing a significant upgrade that will affect how businesses process payments. What Is SEPA Credit Transfer? … Read More

Unscheduled database downtime 9:30 am, 26th July 2024

We experienced unscheduled database downtime from 9:30 am to 1:30 pm on Friday the 26th of July. The issue was caused by a incorrectly configured database update. The database was restored from backups generated at 9 am of the same morning. Data missing between 9 am and 9:30 am was re-populated from live session logs.

Preparing For 2024

Build And Check Your 2024 Payroll Calendars The Revenue published the employee 2024 RPNs’ (employee tax certificates) on the 8th of December 2023. The 2024 calendars can now be created by clicking the “build 2024” button within the payrun. If you don’t choose to create the calendar in advance it will build automatically on the 1st January 202. Verify that … Read More

Preparing for 2024’s Enhanced Reporting Requirements

A comprehensive guide by Parolla Introduction: As we approach January 2024, the implementation of Enhanced Reporting Requirements (ERR) is imminent, marking a significant shift in how employers report expenses. Parolla is at the forefront, offering an integrated software solution to streamline this process. Here’s everything you need to know to stay compliant and efficient. Understanding Enhanced Reporting Requirements: The ERR … Read More

Statutory Sick Pay (SSP) in Ireland

Introduction Starting 1st January 2023, Ireland has introduced a mandatory sick pay for employees, known as the Statutory Sick Pay (SSP). This guide outlines everything employers and employees need to know about this new legal requirement. What is Statutory Sick Pay (SSP)? SSP is the legally mandated minimum sick pay that employers must provide. This entitlement was set to increase … Read More

Parolla Plugins is Xero’s Preferred Partner

It’s been a big start to 2023 for us. Parolla Plugins is Xero’s preferred partner in Ireland! The partnership allows Xero customers to make use of our Parolla Plugins web application free of charge, with Xero picking up the tab. So what does Parolla Plugins do, and how does it help Xero customers? Parolla Plugins is an updated version of … Read More

Tips & Gratuities

The introduction of the Payment of Wages (Amendment) (Tips & Gratuities) Act 2022 is intended to bring clarity to the definition and treatment of tips, gratuities, and service charges. In particular, how these relate to employee pay. It came into effect on 1st December 2022. The introduction has more of an impact on some industries than others; hospitality, taxi services, … Read More

Employee Self Service Portal

The Employee Self-Service portal is an innovative tool for easy employee access to their personal payroll data, anytime they want to. The ESS portal puts the employee in the driving seat and reduces the amount of input required by the employer. Using this time-saving tool helps reduce or even eliminate the need to reply to many employee queries. It can also make … Read More

Changes to Company Vehicle BIK for 2023

Update For 7th March 2023! A temporary 2023 change has been introduced for relief on OMV and the upper mileage band. These changes have been incorporated in the Parolla calculation process as of 8th March. 1st of January 2023 will see changes to company vehicle Benefit in Kind (BIK) calculations. These changes affect cars, vans and electric vehicles. Company Cars … Read More

Great Support Feedback

We built a word cloud image from all the great support feedback received via our chat system over the past few years. I particularly liked that ‘Kind’ came up as a frequent word. It has been a lot of fun looking into the image for some of the less frequent, but supportive comments left for us. We use SalesIQ from … Read More

How a Learning Management System Helps New Employees Learn Payroll Processes

A learning management system helps make payroll processes easier by educating new hires on filing payroll on time & accurately, saving you time & money.

Advanced Payments and Tax Implications in 2024

How to account for paid-in-advance holiday pay that spans two tax years.

2022 Revenue Payroll Notifications

New 2020 RPNs’ are available for download from Revenue.

Public Holidays Ireland

Public holidays are complicated. Who is entitled to them? What exactly are the entitled to? We give you some of the basic rules that cover most employees.

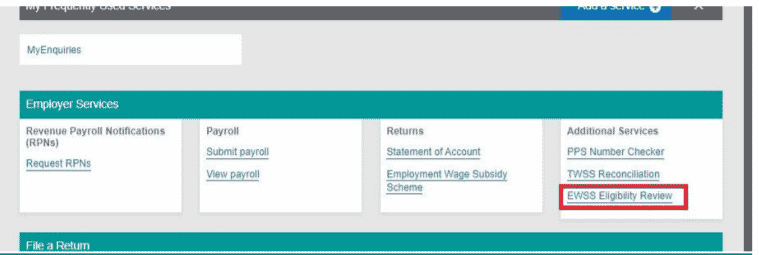

EWSS Eligibility Review July 2021

EWSS has now been extended to December 2021 as per the Finance Bill issued at the end of June 2021. The updates are outlined in full in the latest Revenue EWSS guidelines. There are two main items to note Extension date of the EWSS Scheme EWSS Eligibility criteria and mandatory review reporting Extension date of EWSS Scheme EWSS remains in … Read More

Preparing for Reopening Summer 2021

Guidelines have now been made available from Government for the reopening of business in 2021 and many are busy getting ready for the season ahead. For some this may be the first time that the business will have opened in 2021 or the operation may be finally moving from skeleton staff to a more comprehensive workforce. Payroll Checklist Check that … Read More

What it says in the papers….

Parolla Feature in the Irish Times On Saturday the 8th May 2021 Claire and Mark from Parolla featured in the Irish Times weekend paper. This came about after Mark volunteered Claire to talk to Jen O’Connell about lockdown burnout, how it happened and what we are doing to get over it. Lockdown was a stressful time for so many of … Read More

How To Give Your Best Customer Support

We’re consistently commended for our best in class levels of customer support. We aim to answer our customers questions promptly, correctly, and with respect. I recently contributed to an article on customer support in Software as a Services products. I was asked to outline some of the principles and tools that we apply. Answering your customers question correctly and sportively … Read More

Gender Reporting

Gender reporting is an upcoming requirement for companies to publish data on gender balance in pay scales across bands for all employees. In Europe women earn on average 14% less than men. The figure for Ireland in 2018 was 14.4%. The Gender Pay Gap Information Bill was published in 2019, but was delayed, and is now being redrafted for 2021. … Read More

EWSS or PUP?

Trying to decide if it is better for you to claim EWSS or get your employees to claim PUP? If the business has remained open and the employees are still working albeit sorter hours, eg restaurant which is still serving takeaway, employees cannot claim PUP. EWSS can be claimed If the business is closed and the employees have been temporarily … Read More

Employment Wage subsidy Scheme 4

It was announced on 19 October 2020 that Ireland will be placed on level 5 of the Plan for living with COVID-19 from midnight Wednesday 21st October. As a result, the COVID-19 Pandemic Employment Payment (PUP) will be increased. The EWSS is also being amended to align with the amendment to PUP until the end of January 2021. This means that there will … Read More

Multi Factor Authentication Security

As of 15th September 2020 we have implemented multi factor authentication as an optional security enhancement for all users. Multi-factor authentication is an electronic authentication method in which a computer user is granted access to a website or application only after successfully presenting two or more pieces of evidence to an authentication mechanism: knowledge, possession, and inherence. Wikipedia Multi factor … Read More

Employment Wage Subsidy Scheme 3

If you had employees who weren’t eligible for TWSS you may be able to claim the EWSS Sweep back for them for July and Aug. This includes any new employees. Revenue request that you complete a Sweepback CSV Template with the following information. Revenue employer registration number PPSN of the relevant employee Employment ID of the relevant employee On the … Read More