Build And Check Your 2025 Payroll Calendars

The Revenue published the employee 2025 RPNs’ (employee tax certificates) on the 1st of December 2024. The 2025 payroll calendars can now be created by clicking the “build 2025” button within the pay run. If you don’t choose to create the calendar in advance it will build automatically on the 1st January 2025.

Verify that the 2025 calendar dates align with your expectations.

Any employees who were ceased or employed after the 1st of December will still have had their 2025 RPNs created by Revenue. You should check for these in the first pay run of 2025 and cease anyone who actually left in December 2024

Enhanced Revenue Reporting Digital Certificates

Similar to the RPN the ERN was also released on the 1st December and are available to download. They will automatically download on the 1st January.

*From 1 January 2025, there will be an increase in the maximum exemption, from €1,000 to €1,500. This can include up to 5 non-cash benefits per year (an increase from 2 benefits per year).*

PRSI Class Revisions for State Pension Recipients

Changes arrived in 2024 for employees aged 66 to 70 regarding state pension and PRSI. Employers must ascertain if these employees are receiving the state pension to determine the correct PRSI class.

To aid in this, the new 2025 RPN’s contain an addition field which is populated by the DEASP and tells you if the employee is in receipt of a state pension.

The upper limit on PRSI exemption was lifted in January 2024 from 66 to 70, except for those who:

- Are already in receipt of the State Pension Contributory

- or who have already reached age 66 as of the 1st January 2024

Employers will need to confirm with all employees who are between 66 and 70 and born after 1st Jan 1958, whether they are in receipt of the state pension, in order to assign the appropriate PRSI class.

See DEASP guidance here.

Managing Annual Leave into 2025

Coming into the new year, you should check and confirm how much unused annual leave is to be carried over.

Annual leave should be taken within the leave year. Employees and employers can agree to take annual leave within 6 months of the relevant leave year.

Any further carrying-over (also called holding over) of annual leave would need to be agreed between you and your employer.

See our guide on annual leave here.

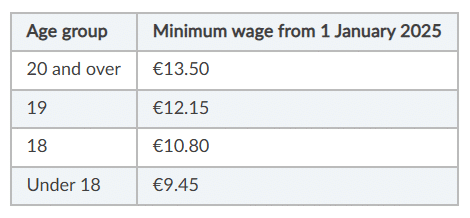

Revised Minimum Wage Rates

The minimum wage for workers will rise from €12.70 to €13.50 on 1st of January 2025. Please adjust your employee minimum wage rates under the employee role in their employment tab in Parolla.

Our guide on creating and editing employments is here.

Estimate Personal Use of Company Vehicles

When an employee uses a company vehicle then this is considered to be a taxable Benefit In Kind.

The value of the benefit depends on the value of the vehicle, the amount of personal usage envisaged, and the number of days that the vehicle is available to the employee.

Each year you should revisit the employee setup of their BIK, and confirm the estimated personal mileage and the rate of BIK applicable.

See our Company Vehicle Benefit guide here.

Enhanced Sick Pay Entitlements

The paid sick leave entitlement will increase from five days to seven days from 1st January 2025. Parolla has been updated accordingly. Just be aware that the business will need to cover these days with up to €110 per day.

There are whispers of the seven days being deferred until 2026 in light of current stress on SME’s, however the current legislation is for seven days in 2025.

See Citizens Information here.

Confirm Employee Tax Details For Coming Year

The Revenue Payroll Notifications (RPN’s) provides most of the tax information for an employee. You also need to confirm the following for the coming year as this is not transmitted on an RPN.

- The employee PRSI Class. Particularly if they are changing from youth J class, or approaching pensionable M class ages.

- Any Exclusion Orders need to be reconfirmed and updated.

- Whether the employee will deduct Local Property Tax from their pay.

- If the employee is a Community Employment scheme participant.

- If the employee is still a proprietary director in the company.

Coming Later in 2025

Pension Auto Enrolment from September

The intention of the initiative is to automatically include employees who earn more than €20,000 and are aged between 23 and 60 years in a pension plan

The implementation of automatic enrolment in pension schemes is now hoped to be September 2025 for “operational readiness”. It may not mean that it is being utilised until January 2026.

Parolla will be supporting this feature when it becomes available. Here’s a link to a brief read on what we know so far.

There is also lots to read Citizens Information about auto enrolment.

Updated PRSI Rates

PRSI rates were raised by 0.1% across the board in October 2024. From January 1st 2025 the rates will remain the same, but the threshold for the higher bands of Class A employer contributions will increase from €496 to €527 per insurable week. So the total cost of PRSI to the employer should go down.

There will be a further increase of 0.1% on both employer and employee contributions in October 2025.

Download the advanced guide here.