Budget 2025 has been viewed as a bumper budget, but what impact is it likely to have on employers and their employees? Below, we will outline the key changes for Payroll.

Standard Rate Tax Bands

The standard rate tax band (SRCOP) which is currently set at 20% will increase by €2000 to €44,000 meaning that employees can earn more at the lower rate.

Action required by payroll operator: No action required. The SCROP increase will be included on the 2025 RPN which will automatically be uploaded to Parolla once released on the 9th Dec 2024.

Tax Credits

Personal, employee and earned income credits each increase by €125 from €1875 to €2000. This will mean that the majority of employees will have annual tax credits of €4000 at their disposal.

Home carer credit increase by €150 to €1,950

Single Parent Child Carer Credit increase by €150 to €1,900

Incapacitated Child Credit increase by €300 to €3800.

Action required by payroll operator: No action required. The tax credit increases will be included on the 2025 RPN which will automatically be uploaded to Parolla once released on the 9th Dec 2024.

Universal Social Charge (USC)

USC has 5 rate bands – changes have been made to the second and and third bands as per below.

- €0 – €12,012 – 0.5% (no change)

- €12,013- €27,382 – 2% (an increase of €1,622 from €25,760 to €27,382 for the upper threshold)

- €27383- €70,044 – 3% (a decrease from 4%)

- €70,045+ – 8% (no change)

- Self employed income over €100,000 – 11%

Action required by payroll operator: No action required. The rate bands are included in the 2025 RPN’s and the calculation methods will be updated automatically on Parolla for payrolls dated from the 1st January 2025.

Small Benefit Exemption

From January 2024 employers could give employee’s a maximum of 2 small benefits in the year tax free up to a total value of €1000. For 2025 this is to be increased to a maximum of 5 small benefits tax free up to a total value of €1500. All small benefits must be reported to Revenue as per Enhanced Revenue Reporting(ERR) requirements introduced in January 2024.

Action required by payroll operator: Inform HR department of this increase and continue to report any small benefits to Revenue as per ERR requirements.

BIK on Company Car’s

The temporary OMV €10,000 reduction was extended to 2025 for company provided vehicles. This is in addition to the electric vehicle OMV relief of €35,000 for 2025.

Action required by payroll operator: All vehicle benefit’s in kind will need to be recalculated for 2025. Go to settings > company vehicles and choose the person icon, then choose new or follow our guide on company vehicle benefit in kind.

PRSI Rates

Budget announcement day also coincided with an increase in all PRSI contribution rates by 0.1%. Provisions have also been enacted for a similar rate increase annually from 2025 to 2028. The objective of these changes is to help support the retention of the State pension age at 66.

Action required by payroll operator: No action required. The 0.1% increase to PRSI was implemented automatically on the 1st Oct 2024 on Parolla. There is no need to update anything on Parolla. The next PRSI update will also happen automatically on Parolla on the 1st Oct 2025. This is also projected to be a 0.1% increase to all PRSI rates.

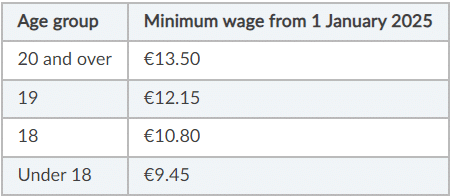

Minimum Wage

Minimum wage will increase from 1st January 2025 as per below.

Action required by payroll operator: Parolla does not update employees wage rates. Wage rates can be updated under the employment tab in the employees profile. Choose edit role and update the rate per hour and choose update. If you have an earning type already created for minimum wage you can update that rate under settings> earnings types and click on update all.

Conclusion

How will the above changes benefit the average worker? According to the Minister for Finance’s speech, these changes means that a full-time worker on the minimum wage will see an increase in their net take home pay of approximately €1,424 on an annual basis and a single person earning €20,000 or less in 2025 will now be outside of the income tax net.

All employees should experience an increase in their take-home pay due to adjustments in tax bands, tax credits, and the Universal Social Charge (USC). Importantly, these changes will incur no additional cost to employers. However, the increases in PRSI and the minimum wage will have a direct financial impact on employers and their businesses.