How Can We Help?

Reversing a Payslip or Pay Run

Purpose

All payslips and pay runs in Parolla are fully reversible. You can also delete and resubmit payslips to Revenue.

This guide gives you three methods of making corrections to your payslips.

Reversing An Entire Pay Run

Oh no, you mean the time sheets were from last week? And they’ve been entered into this week?

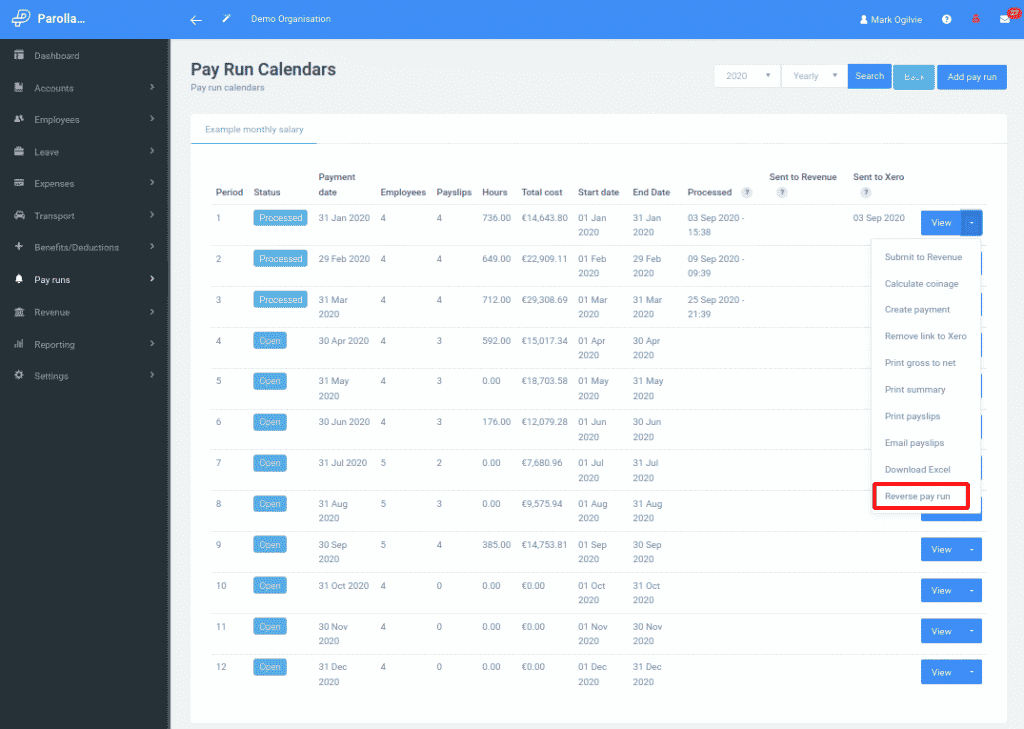

You can reverse an entire pay run using the drop-down menu to the right of the pay run.

This will unlock all the payslips in the run, and allow you to edit them again.

Reprocess the pay run as normal, and resubmit the run to Revenue if you need to.

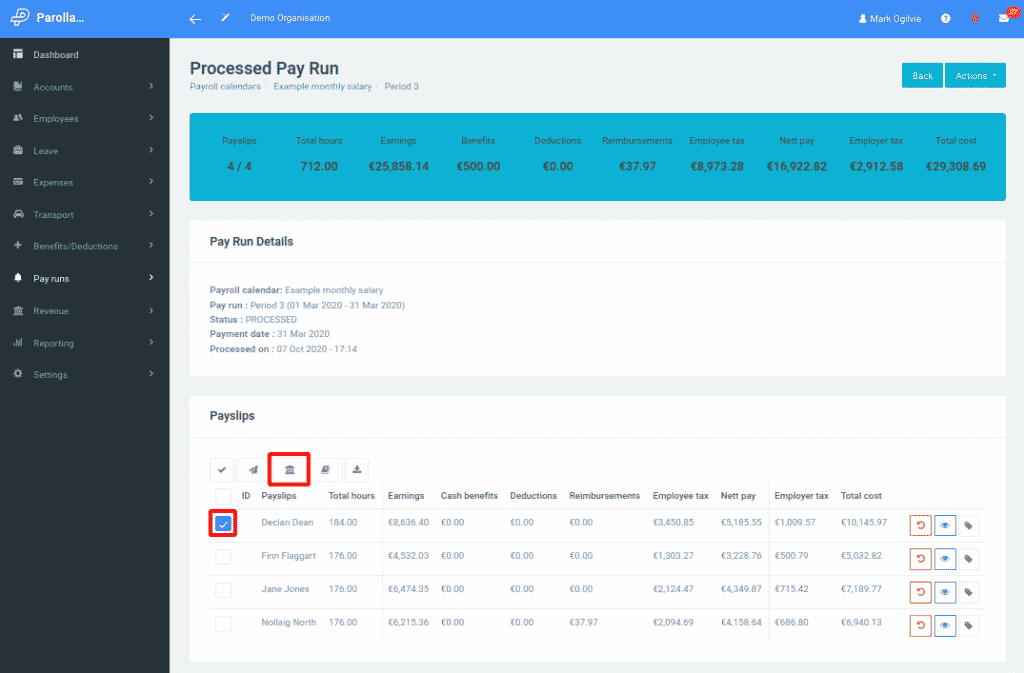

Reversing Individual Payslips

If you need to be a bit more targeted, say if there was just one correction to make, then we suggest reversing an individual payslip.

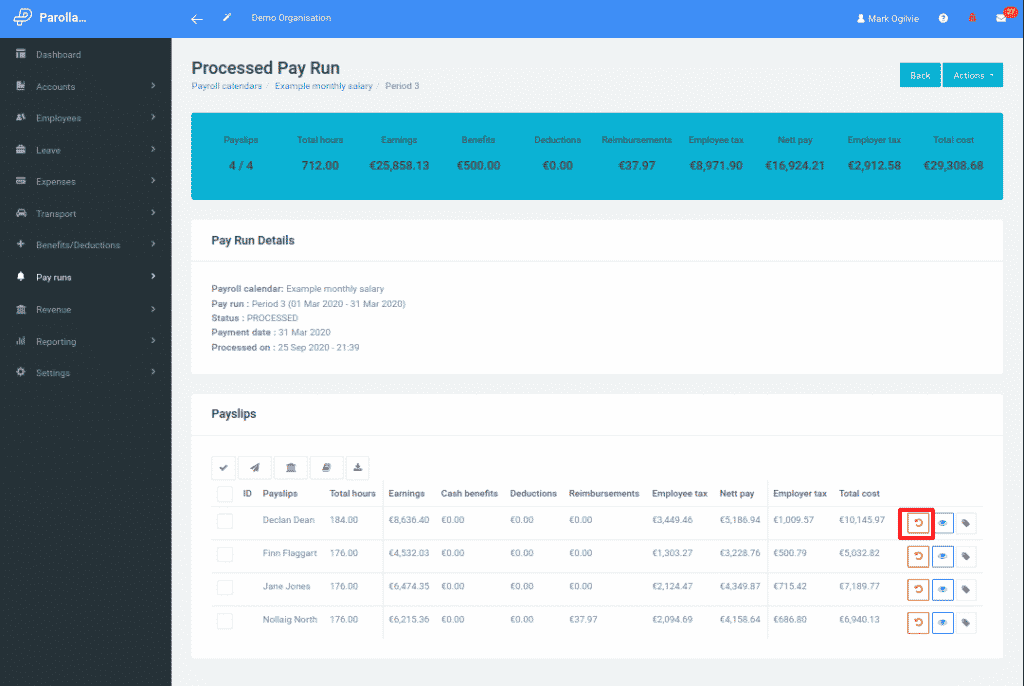

Use the Reverse Payslip button to the right of a processed payslip.

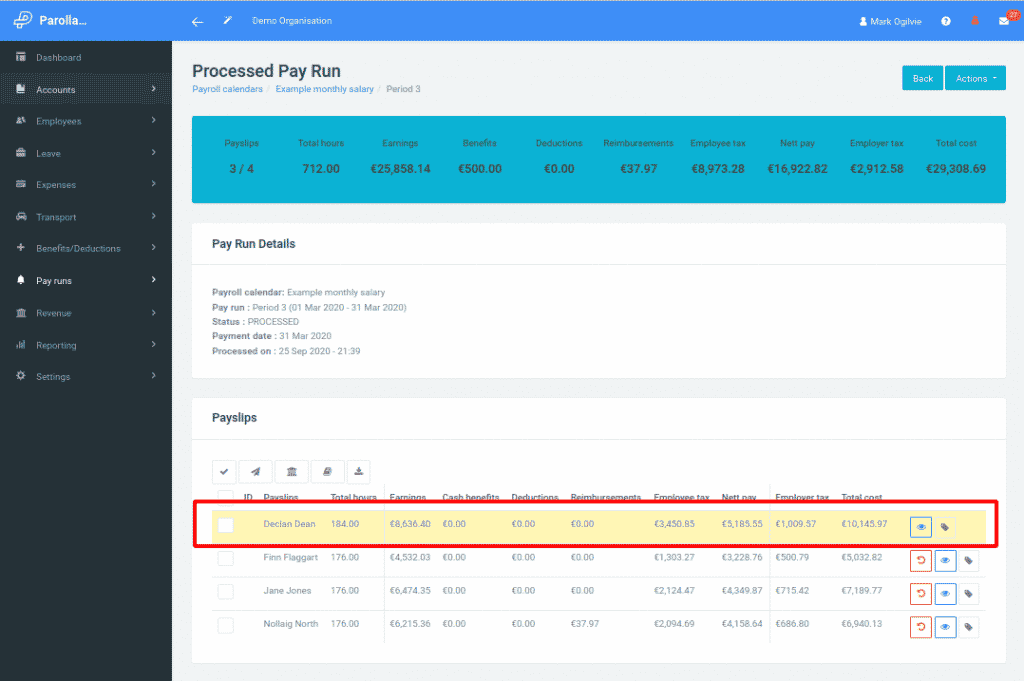

An unprocessed payslip in a processed pay run is highlighted for attention. It will also be identified as a potential error on the Revenue Review Year page, and on the Review Submissions pages.

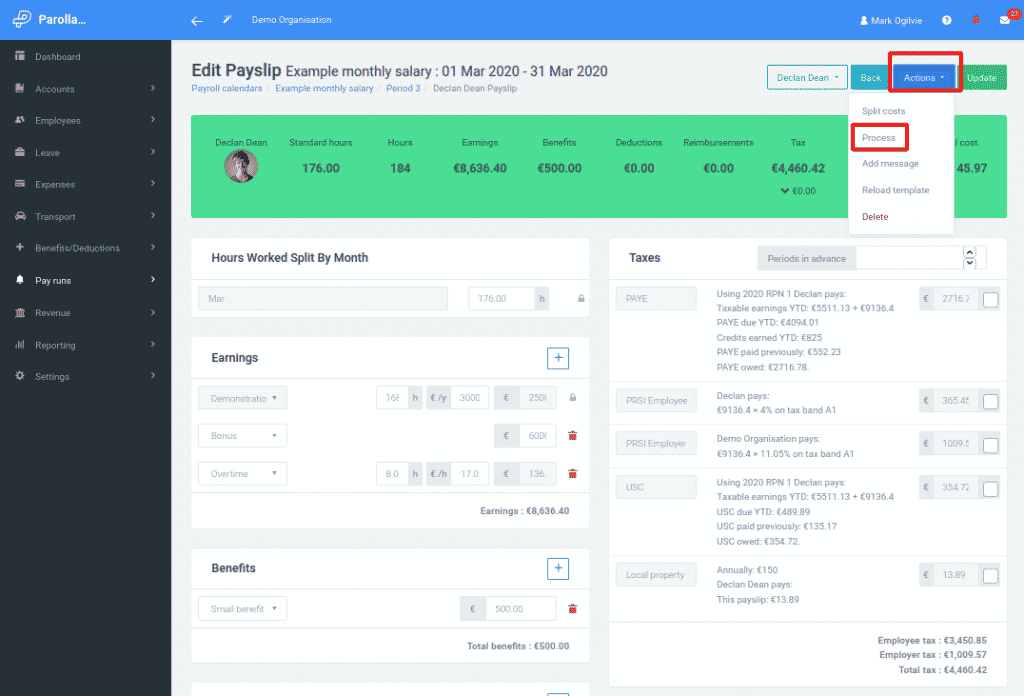

Make your alterations in the payslip itself, then reprocess using the actions menu drop-down.

Updating Revenue

Finally, if the modified payslip needs to be notified to Revenue, then you can resubmit the payslips individually.

Select the payslip to resubmit, and use the resubmit button to send it to Revenue.

Common Issues

Unusual Tax Rates

We keep a track of the employee’s taxes year to date. If you reverse a payslip out of order and try to reprocess it using the employee’s current tax position, then the deductions will be overstated.

Either reverse payslips in sequence back to the date you need or override the tax calculations in the payslip.

Out of Date RPN Warning From Revenue

It is possible that the employee’s RPN may have been updated since the pay slip was originally created. Or that you have intentionally selected to use an earlier RPN version.

This is only a warning, and Revenue will still accept the submission.