How Can We Help?

Revenue Review Year

Purpose

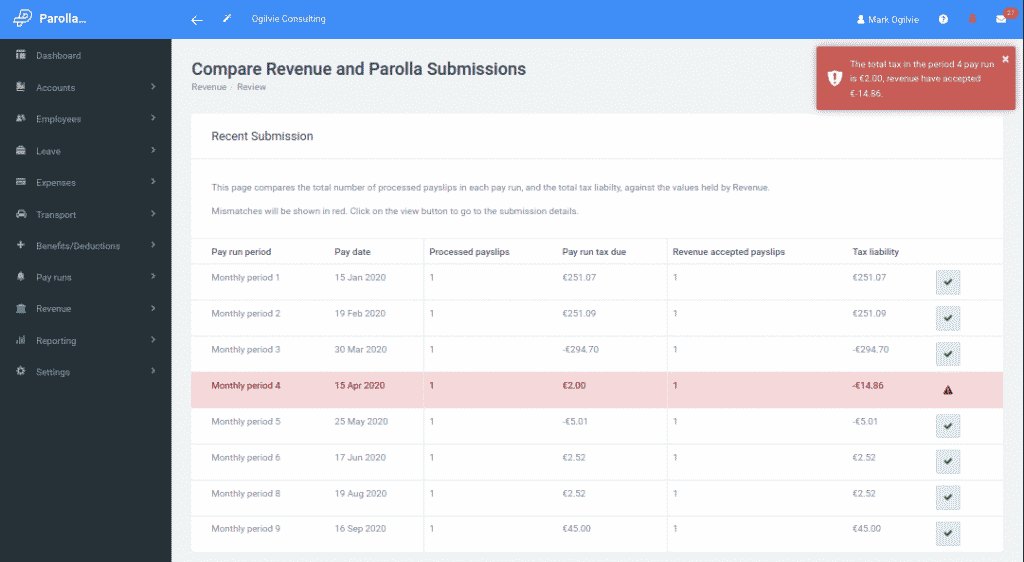

The Revenue Review Year page is used to compare the pay run data submitted to Revenue against the information in the Parolla pay runs.

Background

Sometimes, in the course of a busy day, you can quickly make changes to your pay run and forget to notify Revenue.

This page will run a comparison of all pay runs in Parolla against all the Revenue submissions in the year to date.

The page will check:

- That the total number of processed payslips in the pay run matches the total number of active payslips in ROS.

- That the total tax liability for the pay run in Parolla matches the total tax liability with ROS.

- If any payslip has been re-processed or changed since the date of the accepted payslip submission.

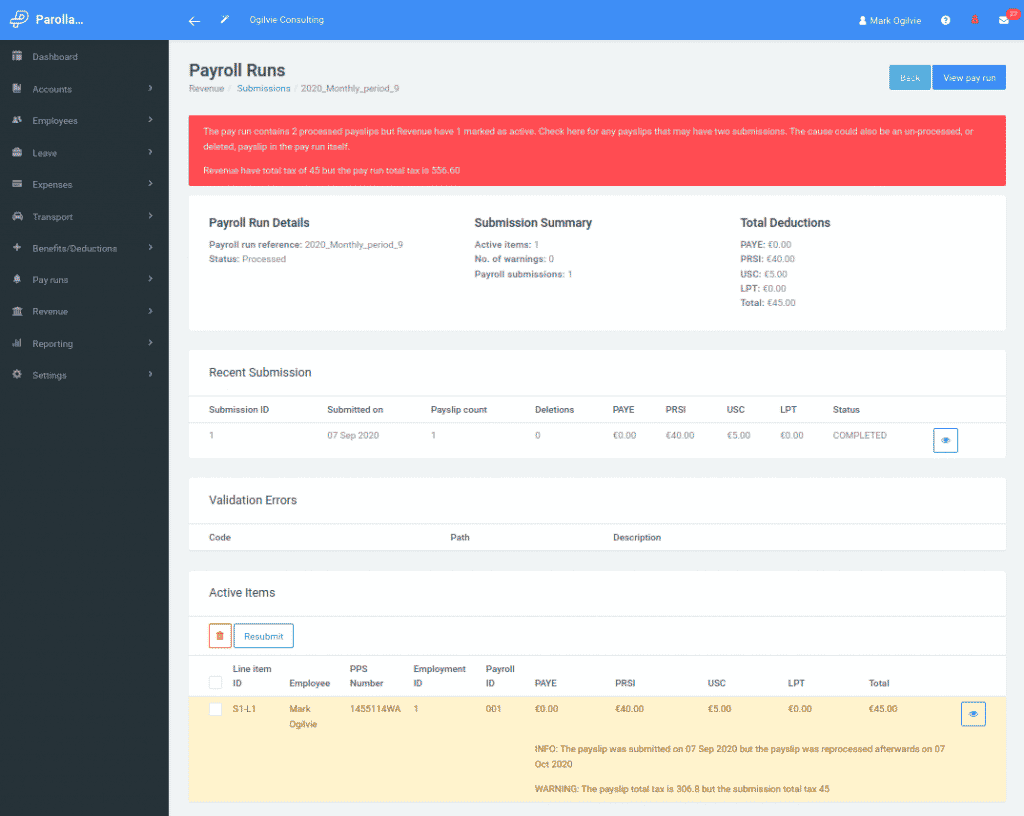

Using the button to the right of the pay run will take you to the Revenue Submission Page, where further information on the specific issues will be available.

In the example above, the system has identified that one of the payslips has been reversed and reprocessed, but not resubmitted.

It has also identified a mismatch in tax details; and that the pay run contains an additional payslip that hasn’t been submitted.

Common Issues

Duplicate Submissions

It is possible to send submissions to Revenue multiple times. Parolla will catch this and raise an error for you to investigate it.

You can delete the additional submission from this page by selecting the submission check box and clicking on the orange trash button.

Missing Payslips

Sometimes you may have added a payslip to a pay run and not submitted it. Go to the pay run and submit that payslip individually.

Deleted Payslips

You may have reversed and deleted a payslip in the pay run, but not notified Revenue and retracted the submission.

You can delete the submission from this page by selecting the submission check box and clicking on the orange trash button.

Tax Number Not Matching

This is a broad method of catching differences between systems. If the tax number on Parolla doesn’t match Revenue then it means you need to investigate further.

Typically it will mean a payslip difference or a payslip that has been reprocessed with different values.