How Can We Help?

How to Complete a Payrun in 10 steps on Parolla

This guide will show you how to complete a payrun in 10 steps on Parolla. It is for you to refer to monthly or weekly until running your payroll becomes second nature!

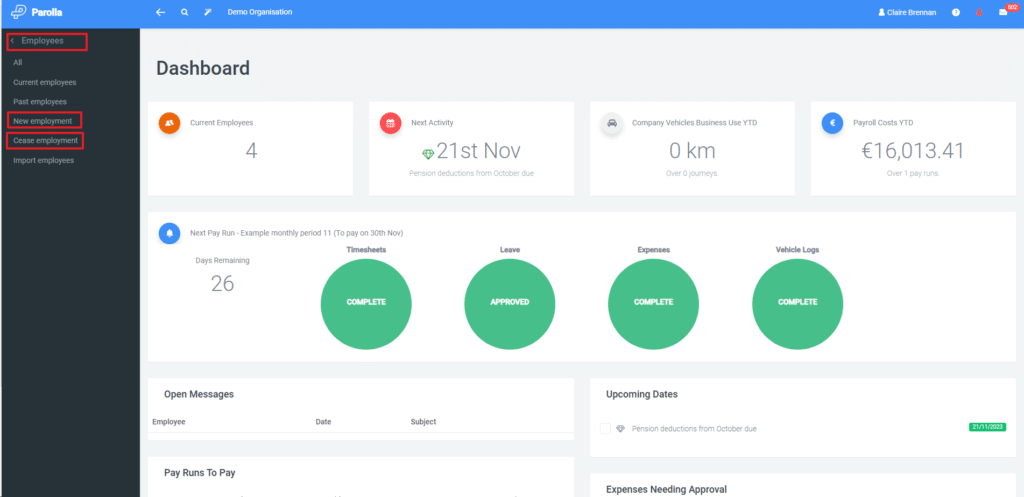

- Before you open the payrun log in via the dashboard and add new employees / returning employees and cease any leavers.

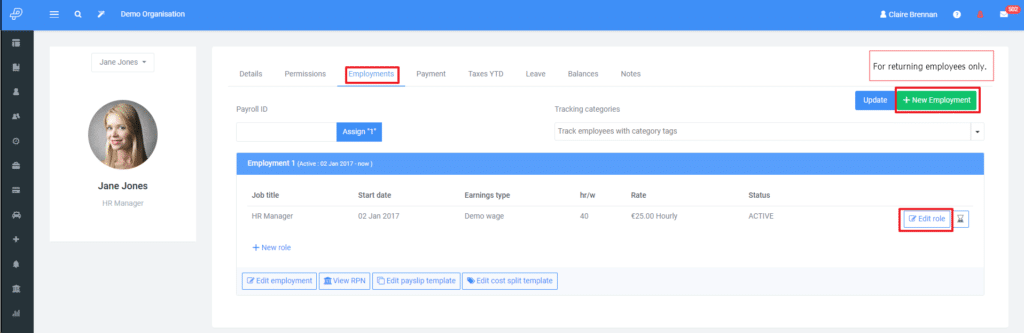

- Make any changes to employees’ profiles (rates of pay, bank details, email address etc). If an employee is retuning you need to add a new employment to their profile.

- Update any pensions and insurance amounts if they are permanent changes. Update the payslip directly if it is a once off change.

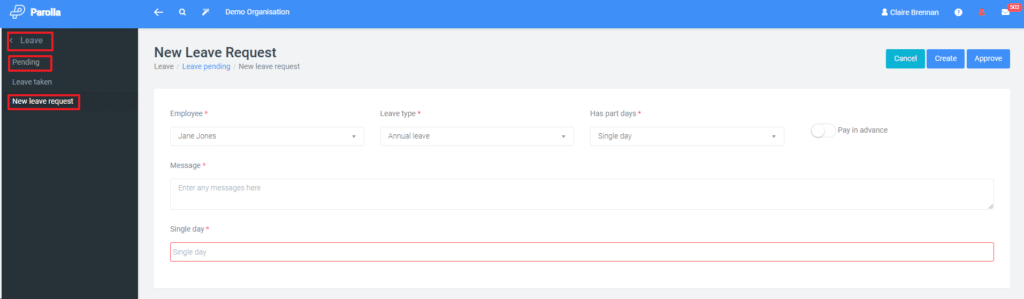

- Enter or approve any leave items in the leave section or you can enter them directly to the payslip.

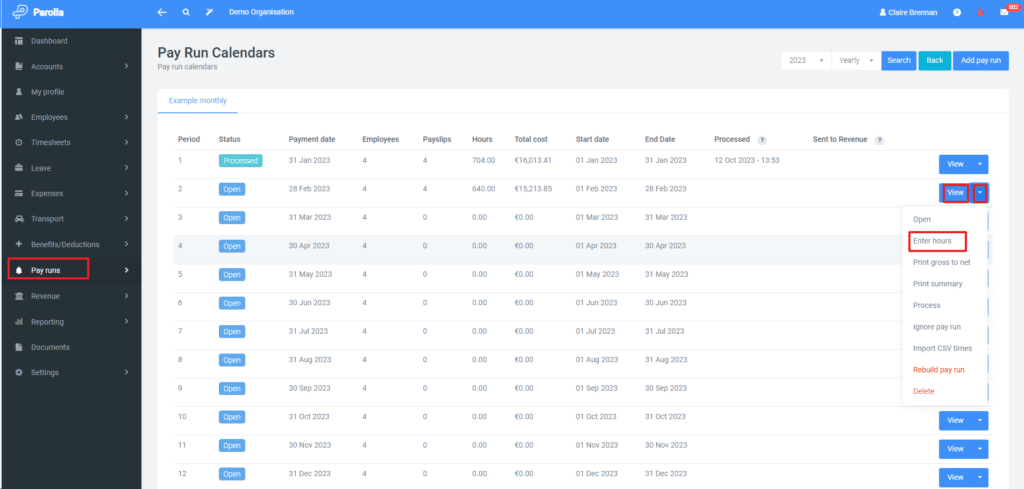

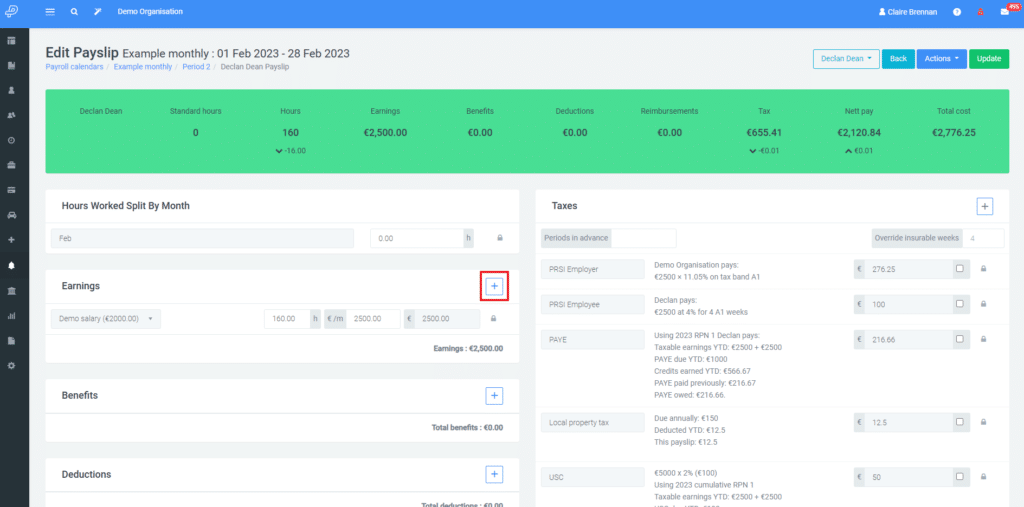

- Open/ build the payrun by clicking on view if you wish to view all the payslips. Click on rebuild payrun if you have already opened the payrun before making your updates. Add hours, additional earnings types or any leave items directly onto the payslip. Click on enter hours if you are working from a timesheet.

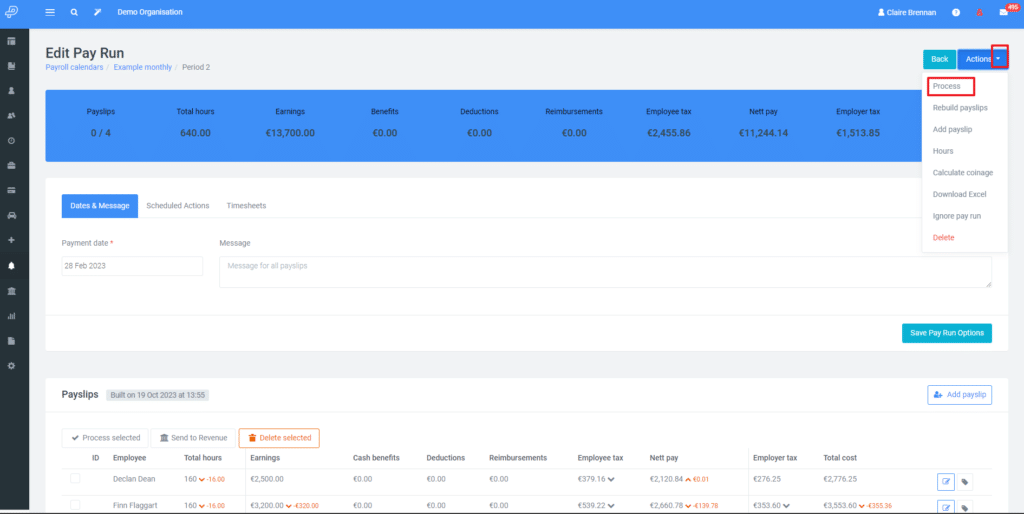

- Process the payrun.

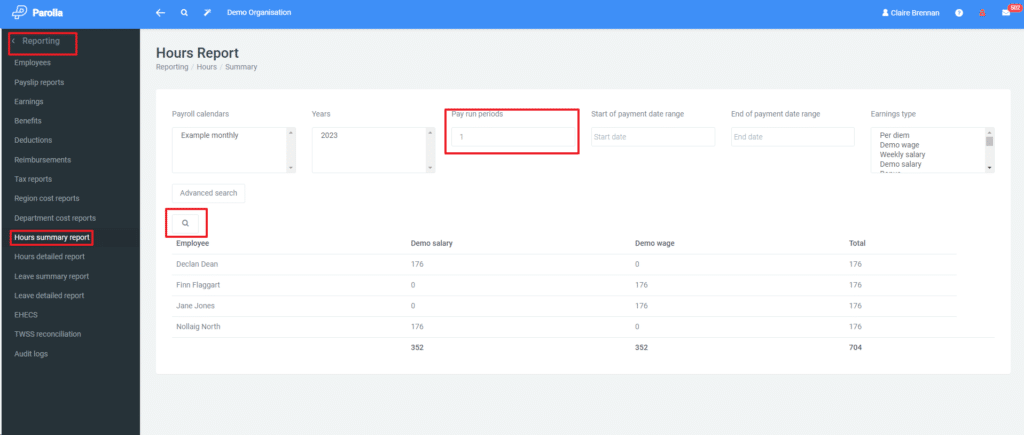

- In the reporting menu you can download the hours summary or detailed report. You can cross-check the report against your timesheet data. You can also use the gross to net report for the cross check. Reverse any individual payslip that have an error and re-process them.

- Create the Sepa payment file or make the payment to employees via your banking portal.

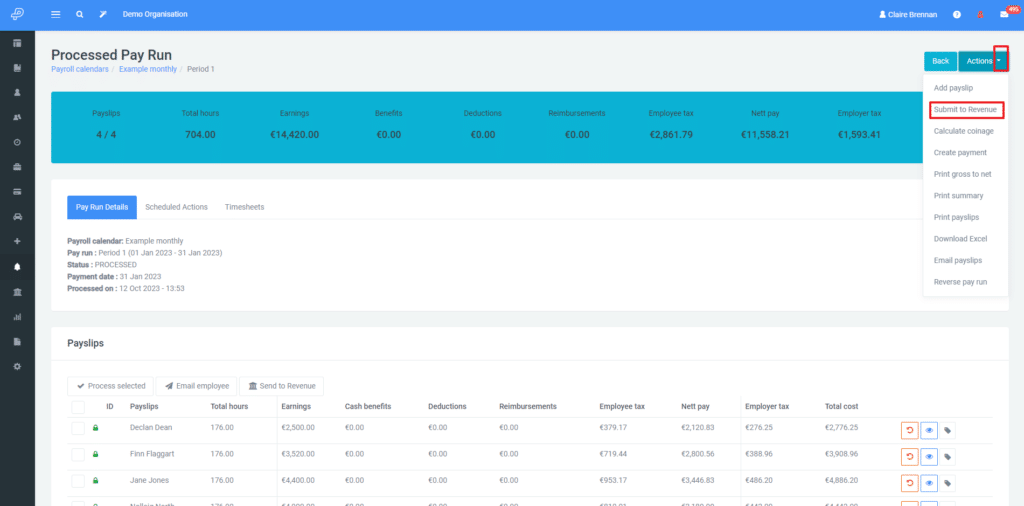

- Submit to Revenue. Submissions to Revenue should be made “on or before payment date”.

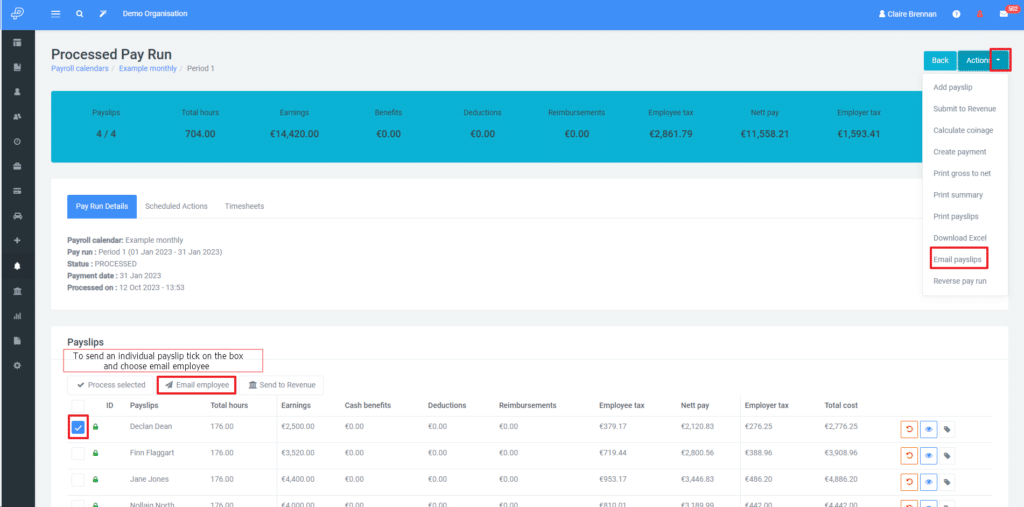

- Email the payslips in bulk or individually.

The payment for taxes due is made via ROS at the end of the month following the submission. A direct debit can be set up in Ros.

You can view the amounts due in ROS under the My Services tab > Employer Services or in Parolla under Revenue > submissions.