How Can We Help?

Insurances

In this guide, we will go through setting up insurance in Parolla. The insurance can be set up in Parolla after you have created the employee profile.

Insurances are either a benefit or a deduction:

- Benefits are paid for by the company on behalf of the employee.

- Deductions are paid for by the employee via a deduction from the employee’s income.

Both can be with or without Revenue tax relief.

Types of Insurances

Some common types of insurance are:

- Medical

- Dental

- Life

Insurances Set up

There are 3 parts to setting up insurance in Parolla.

- Create the insurance provider as a recipient

- Create the insurance plan

- Add the employee’s payment particulars to the insurance plan

Required information

- Insurer name

- Employee insurance membership number

- Insurance contributions amounts

Creating the Insurance provider as a recipient

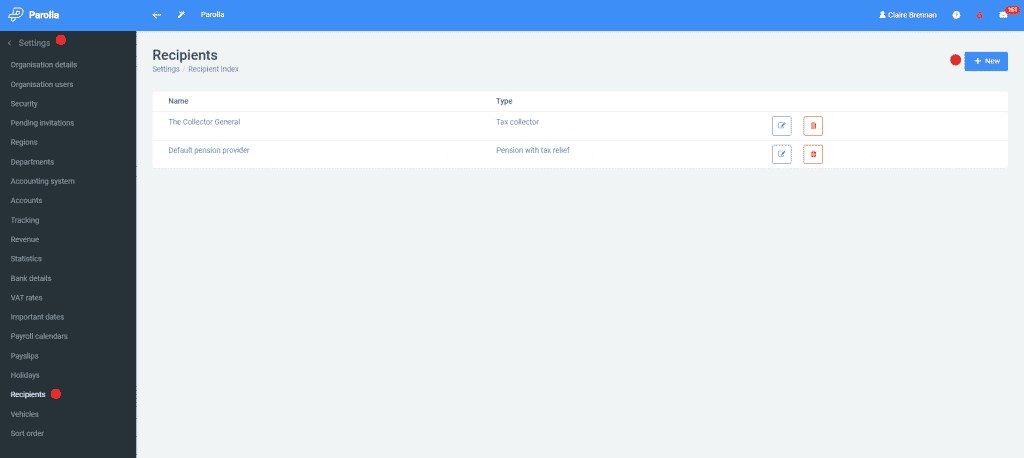

Go to the menu bar and choose Settings > Recipients > +New.

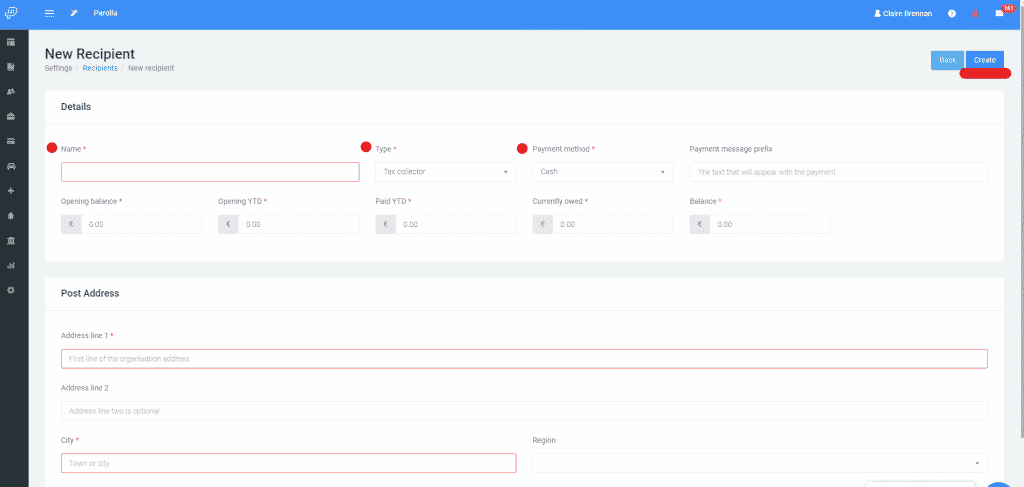

Input the details, the insurer option will appear in the type box. Click on Create

Create the Insurance Plan

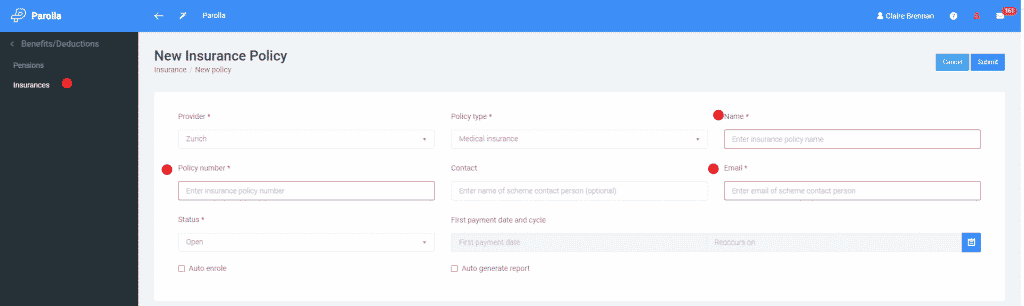

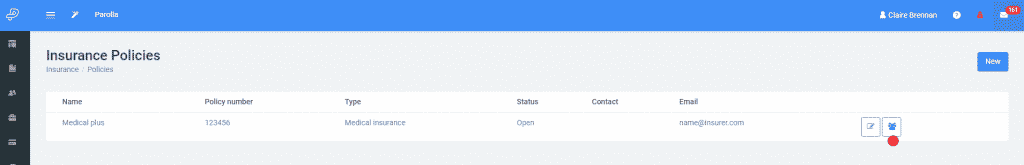

From the menu bar choose Benefits/Deductions > Insurances > New

The insurance recipient will now appear as an option in the provider box. Fill in all available details and submit.

Adding employee payment particulars to the insurance plan.

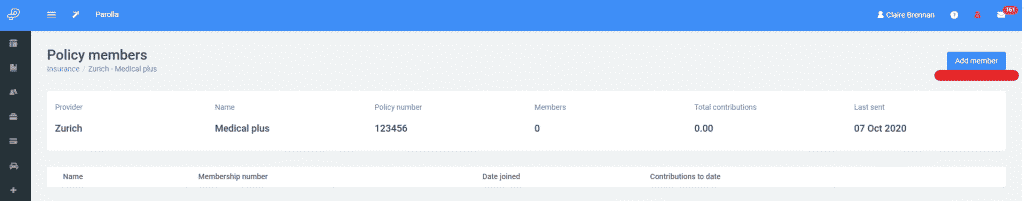

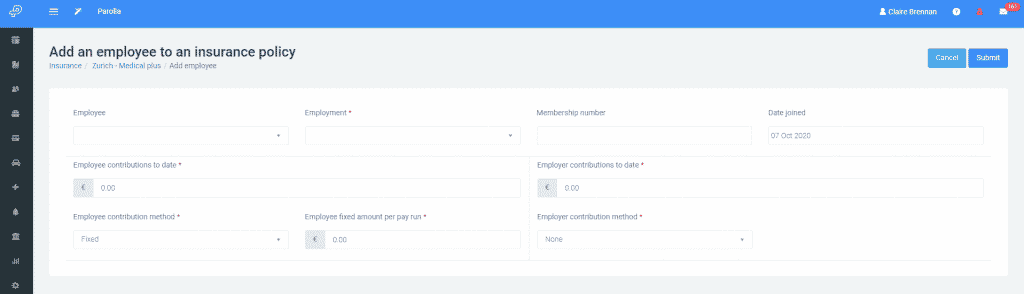

Next, add the relevant employees as members of the insurance by clicking on the people icon.

Click on the add member button in the top right of the screen.

Since PAYE modernisation Revenue requires the insurance details to be submitted with the pay run. The insurer and/or membership number may be required.

Tax Implications and Setup

Medical Insurance

When paid by the employee outside of the payroll

When an employee pays their own medical insurance, outside of their employment, then they receive tax relief at the standard rate. This is achieved by the insurer reducing their premium by the value of the relief. This is Tax Relief at Source. There is nothing for the employer to do here.

When any part is paid by the employer to the insurer

When an employer pays any part of the medical insurance to the insurer, then this is considered to be a taxable Benefit In Kind. But there is no tax relief at source applied.

The employer should enter the Gross Value of the insurance premium in the employee’s payslip as a taxable benefit. The gross value is the net premium paid to the insurer plus the value of tax relief at source.

The employee claims the tax relief themselves via their Personal Tax Certificate as set up in their myAccount. This will adjust the employee’s RPN and tax liabilities.

See the Revenue guide here.

Outside of the payroll system, the employer must return the value of the Tax Relief at Source to the Revenue. This can be done in a number of ways such as a Form 11 or CT1 form.

See the Revenue Guide here

Note that if the employer is not actually paying the insurer directly, but instead giving the employee an ‘allowance’ for medical insurance, then this is just considered to be earned income and is fully taxable.

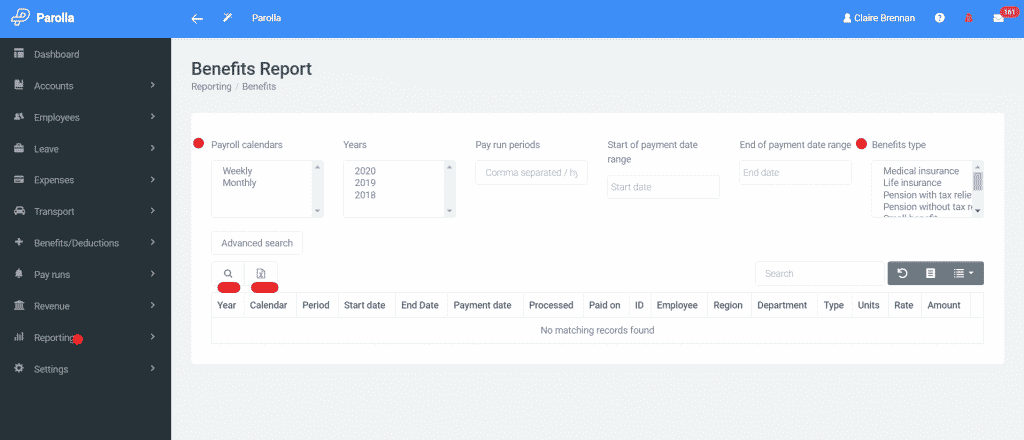

Insurance Contributions Report

An insurance contributions report is available to assist with reconciliation or insurance payments to providers.

Go to Reporting > Benefits/Deductions

Choose the date range and relevant calendar. Advanced search allows you to choose individual employees.

Common Problems

I have added an employee as a member of an insurance policy but it doesn’t appear on the payslip?

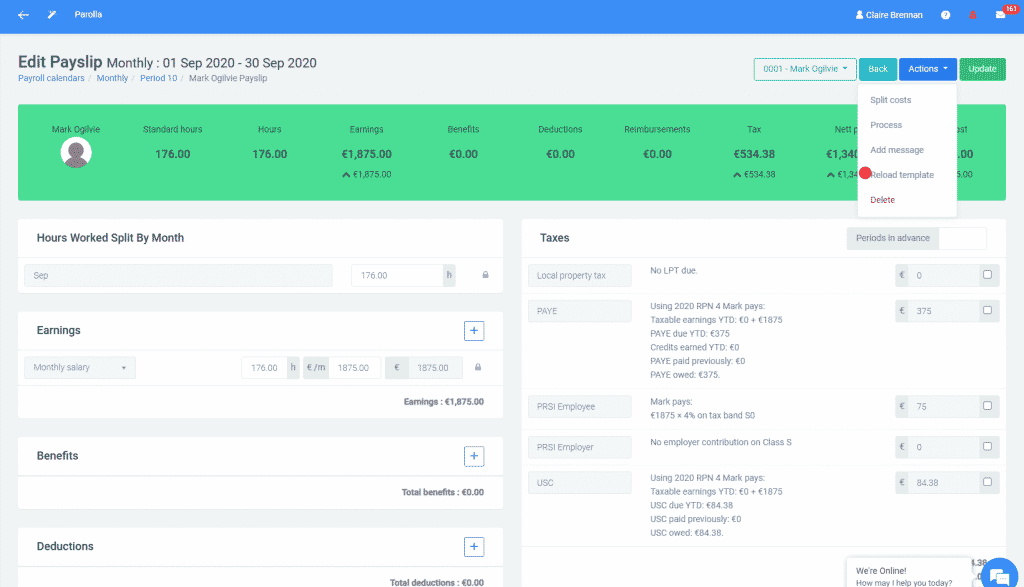

To resolve this click Reload template in the pay run.