Hello, As many of you know, MyFutureFund is now up and running. Over the past month, we’ve been updating our guides and FAQs as new information has been delivered by NAERSA (the National Automatic Enrolment Retirement Savings Authority). Here’s a quick overview of what you need to know 👇 🔄 What has changed in Parolla From 22 January, submissions to NAERSA are no longer sent automatically alongside the … Read More

January 2026 Newsletter

To help you start the year smoothly, we’ve already downloaded your 2026 RPNs and ERNs and set up your payroll calendars. While these roll over automatically, we recommend reviewing key dates to ensure they suit your payroll schedule.

Auto-Enrolment remains a key focus. Please review your AEPN via the MyFutureFund portal or directly in Parolla, where contributions will be applied to payslips as instructed. Don’t forget the minimum wage increase to €14.15 from 1 January 2026, and to review BIK, PEOYS, and any Revenue documentation for the year ahead.

December 2025 Newsletter

Hello, Season’s Greetings to all our users 🎄 In preparation for the last pay run of 2025 and the first of 2026, here are the key payroll updates to help keep everything running smoothly. 📘 Auto-Enrolment – MyFutureFund (MFF) Employers have until the 31st December to log onto their MyFutureFund Employer Portal and set up their direct debit mandate. Enrolled employees will appear … Read More

November 2025 Quarterly Newsletter

Hello, It’s nearly time to wrap up 2025 and get ready for January 2026. Here are the key updates for this month. 📅 Pension Auto-Enrolment (A/E) Starting January 2026 Just as Revenue issues an RPNfor tax, the new pension system will issue an AEPN for Auto-Enrolment. Each AEPN will include a list of all employees who are automatically enrolled in the A/E scheme. AEPNs are … Read More

October 2025 Quarterly Newsletter

Hello everyone, It’s been a busy and exciting few weeks at Parolla, and I’m reaching out to share some highlights that you may have missed: 🎉 Xero Global App Awards 2025 FinalistWe’re thrilled to announce that Parolla and Parolla Plugins have been selected as finalists in the Xero Global App Awards 2025 in the following categories 📅Pension Auto-Enrolment in Ireland Ireland’s … Read More

Parolla Named as Finalist in the Xero Global App Awards 2025 🎉

We’re thrilled to announce that both Parolla Payroll and Parolla Plugins have been named as Finalists in the Xero Global App Awards 2025! 🏆 Parolla Payroll – 2025 Finalist Categories: 🏆 Parolla Plugins – 2025 Finalist Categories: This recognition on a global stage is a huge honour and a reflection of the value we strive to deliver for small businesses … Read More

SEPA Verification of Payee (VOP)

Electronic payments are evolving — and SEPA (Single Euro Payments Area) credit transfers are no exception. From 9 October 2025, a major new rule kicks in across the euro-area: banks and payment service providers (PSPs) must perform a Verification of Payee (VoP) check before executing a transfer. This change is designed to reduce fraud, prevent misdirected payments, and bolster trust … Read More

Pension Auto-Enrolment in Ireland: How It Will Work

December 2025 Update Pension auto-enrolment is on the way in Ireland, and it will have a significant impact on payroll processing. Here’s a clear overview of how the new system will operate, who will be eligible, and how it will be handled in Parolla. Key Features and Eligibility How Auto-Enrolment Will Work The National Automatic Enrolment Retirement Savings Authority (NAERSA) … Read More

What is Auto-Enrolment/ My Future Fund?

Auto-enrolment is a government-led program that automatically enrols eligible employees into a workplace pension scheme, ensuring they save for retirement. Employees contribute to the scheme, and their employers match these contributions, with the government providing additional top-ups. The new scheme, called MyFuture Fund, will launch in September 2025. The government aims to simplify the retirement savings process and increase participation … Read More

Company Vehicles Benefit in Kind (BIK)2025

As we navigate 2025, it’s crucial for both employers and employees to stay informed about the latest Benefit in Kind (BIK) regulations concerning company vehicles. The government has implemented several changes aimed at promoting environmental sustainability and ensuring equitable taxation. 🔹 Key Changes Effective from 2025: 🔹 Implications: 💡 Planning Ahead: For detailed information and specific calculations, refer to the … Read More

January 2025 Newsletter

Happy New Year to all our users,We hope you had a wonderful Christmas and are looking forward to what 2025 has in store. To help you start the year smoothly, we’ve already downloaded the 2025 RPN’s and prepared the 2025 calendars for you. While the calendars seamlessly carry over from 2024, we encourage you to take a moment to review … Read More

December 2024 Newsletter

Hello Everyone, As the year comes to a close, we’d like to take a moment to thank you for your continued support throughout 2024. We look forward to supporting your payroll needs in 2025. With many of you preparing for some well-deserved time off this week, we’ve highlighted a few key items you may have questions about. 2025 RPN’s & … Read More

Preparing For 2025

Build And Check Your 2025 Payroll Calendars The Revenue published the employee 2025 RPNs’ (employee tax certificates) on the 1st of December 2024. The 2025 payroll calendars can now be created by clicking the “build 2025” button within the pay run. If you don’t choose to create the calendar in advance it will build automatically on the 1st January 2025. … Read More

2024 November Newsletter

Hello Everyone, We hope this Parolla November newsletter finds you well. As we approach the end of the year, we aim to keep you informed with regular updates and news tailored to your daily work. Here are a few highlights we think you’ll find valuable. End of Year Reviews In the next 10 days we will run a Revenue Review for 2024 … Read More

Understanding Cloud Payroll: Benefits and Features for Businesses

Cloud payroll refers to a payroll processing system such as Parolla that operates over the internet.

Beginners Guide to Payroll in Ireland

Setting up a company Payroll in Ireland for the first time? First of all, CONGRATULATIONS! It’s a huge accomplishment to reach the point where you can offer payment to others, and it’s worth celebrating. For those new to payroll, it can feel overwhelming, so we’ve put together some simple steps to help guide you through the process. Setting up a … Read More

Preparing For 2024

Build And Check Your 2024 Payroll Calendars The Revenue published the employee 2024 RPNs’ (employee tax certificates) on the 8th of December 2023. The 2024 calendars can now be created by clicking the “build 2024” button within the payrun. If you don’t choose to create the calendar in advance it will build automatically on the 1st January 202. Verify that … Read More

Preparing for 2024’s Enhanced Reporting Requirements

A comprehensive guide by Parolla Introduction: As we approach January 2024, the implementation of Enhanced Reporting Requirements (ERR) is imminent, marking a significant shift in how employers report expenses. Parolla is at the forefront, offering an integrated software solution to streamline this process. Here’s everything you need to know to stay compliant and efficient. Understanding Enhanced Reporting Requirements: The ERR … Read More

Statutory Sick Pay (SSP) in Ireland

Introduction Starting 1st January 2023, Ireland has introduced a mandatory sick pay for employees, known as the Statutory Sick Pay (SSP). This guide outlines everything employers and employees need to know about this new legal requirement. What is Statutory Sick Pay (SSP)? SSP is the legally mandated minimum sick pay that employers must provide. This entitlement was set to increase … Read More

Tips & Gratuities

The introduction of the Payment of Wages (Amendment) (Tips & Gratuities) Act 2022 is intended to bring clarity to the definition and treatment of tips, gratuities, and service charges. In particular, how these relate to employee pay. It came into effect on 1st December 2022. The introduction has more of an impact on some industries than others; hospitality, taxi services, … Read More

Employee Self Service Portal

The Employee Self-Service portal is an innovative tool for easy employee access to their personal payroll data, anytime they want to. The ESS portal puts the employee in the driving seat and reduces the amount of input required by the employer. Using this time-saving tool helps reduce or even eliminate the need to reply to many employee queries. It can also make … Read More

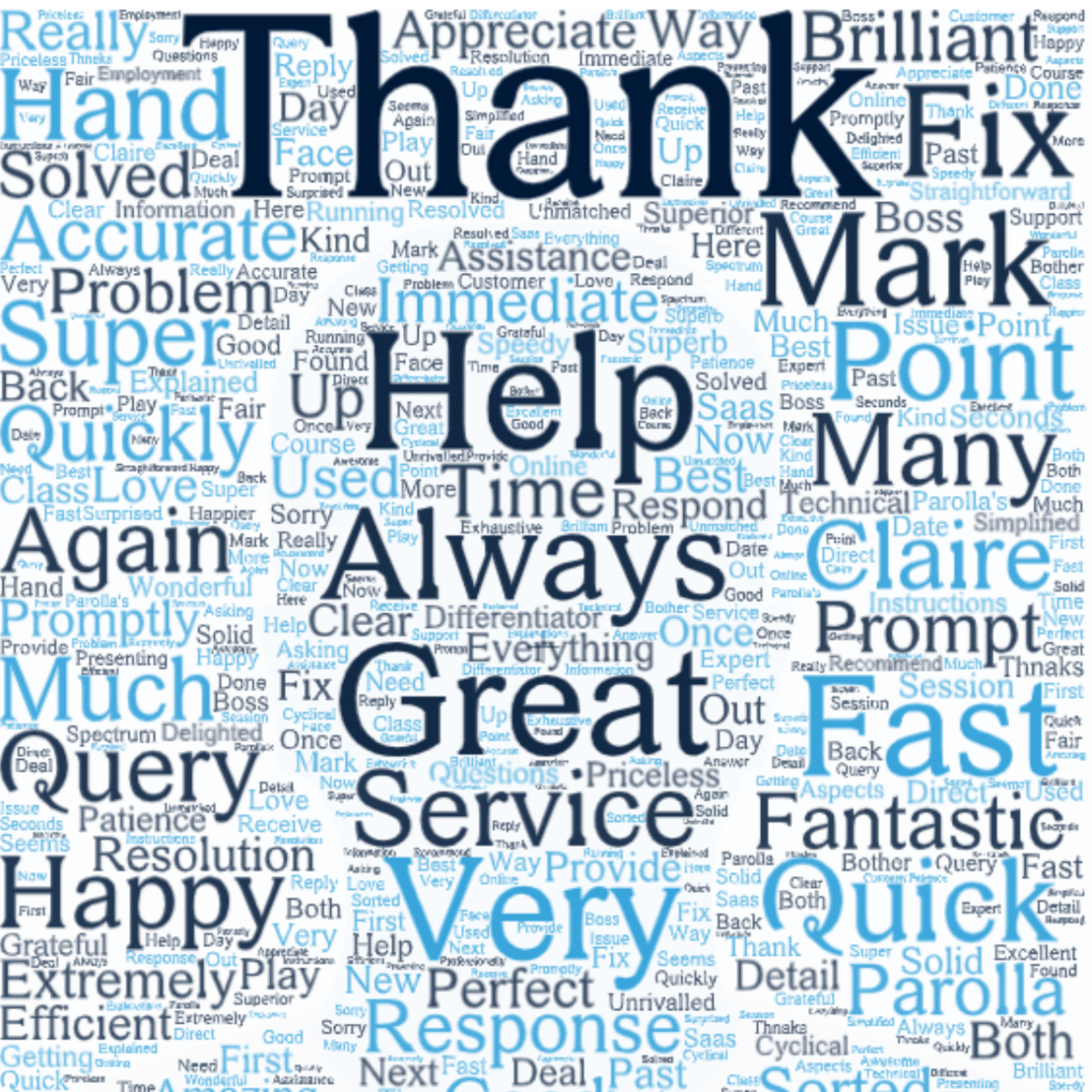

Great Support Feedback

We built a word cloud image from all the great support feedback received via our chat system over the past few years. I particularly liked that ‘Kind’ came up as a frequent word. It has been a lot of fun looking into the image for some of the less frequent, but supportive comments left for us. We use SalesIQ from … Read More

How a Learning Management System Helps New Employees Learn Payroll Processes

A learning management system helps make payroll processes easier by educating new hires on filing payroll on time & accurately, saving you time & money.

- Page 1 of 2

- 1

- 2