How Can We Help?

Taxsaver Public Transport Setup

Taxsaver is a government scheme that allows employers to purchase annual public transport tickets on behalf of their employees. The cost of the annual ticket is deducted from the employees Gross salary/wage.

This saves money for the employee and the employer because it is a pre-tax deduction. They save up to 52% on the normal ticket price, depending on their tax circumstances.

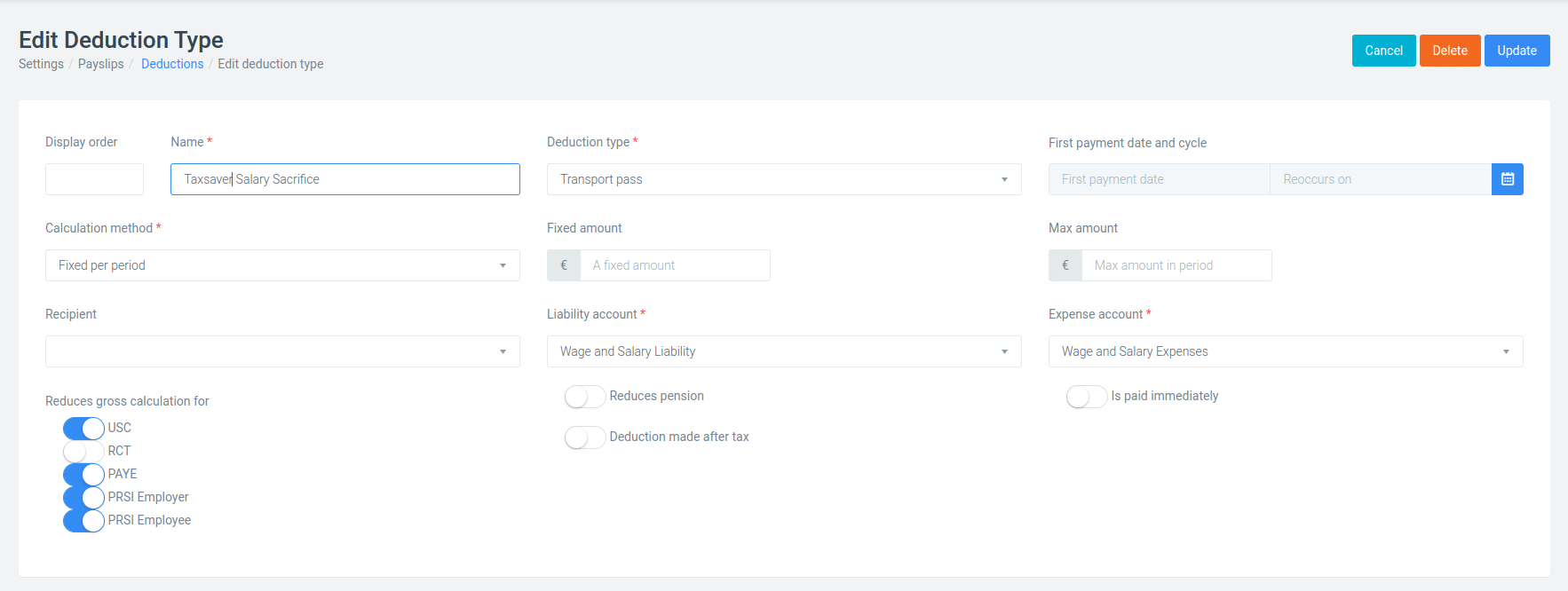

Create a Taxsaver Deduction Type

In the left hand menu of the page go to Settings > Payslip Items and select the Deductions tab.

There is already a Transport Salary Sacrifice deduction type in every organisation setup. You can rename it, or create a new deduction type. Select Transport Pass, and make sure that all taxes PAYE taxes are turned on for tax reductions, USC, PAYE income tax, PRSI er and PRSI ee.

Update to save the new deduction type.

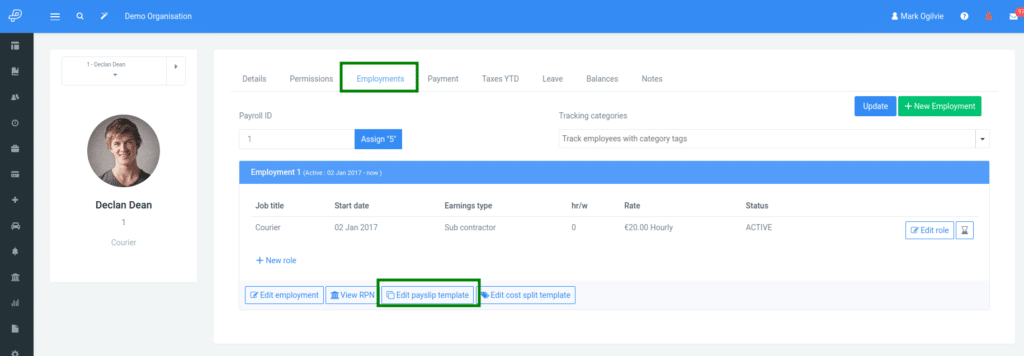

Apply Taxsaver To An Employee

Navigate to the employees Employments tab. Edit their Payslips Template.

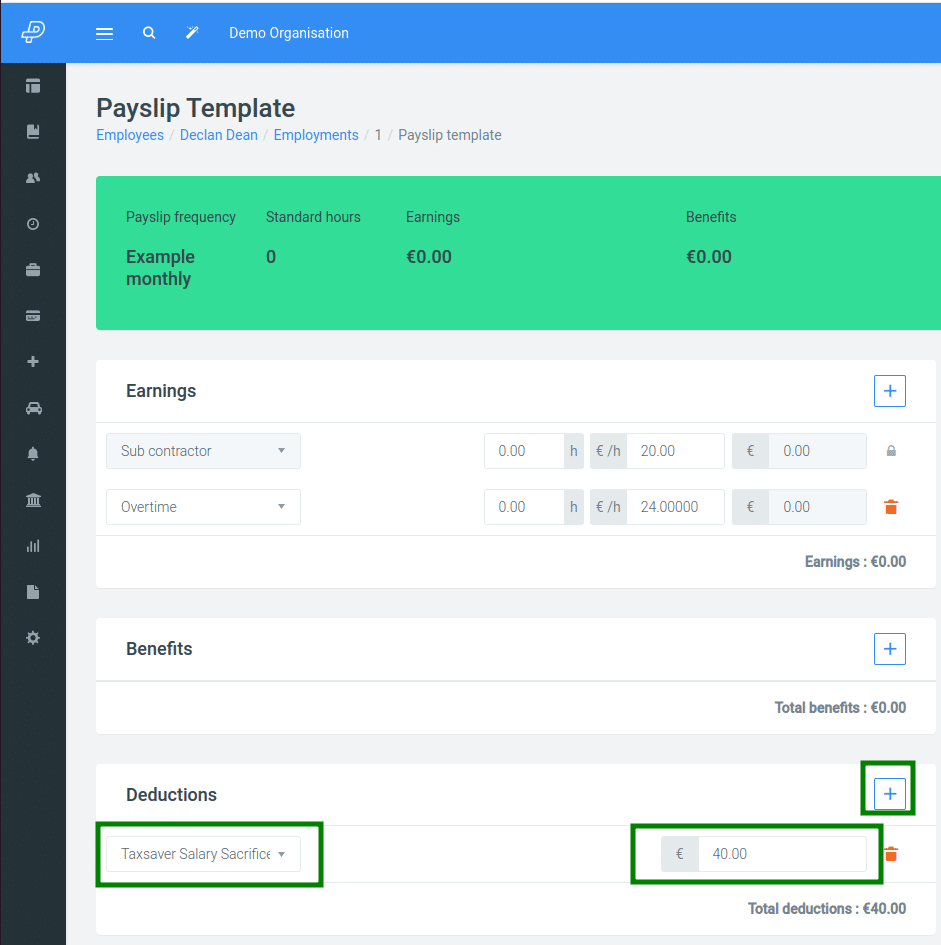

Add a new deduction line to their template. Select the new Taxsaver type. Enter the amount that should be deducted from each payslip. This amount depends on the employee ticket purchased, and how many pay runs you want to apply the deduction over.

Every new pay run built will use this template as the default amount to deduct for the employee. You can change the amount in the actual payslip if required.

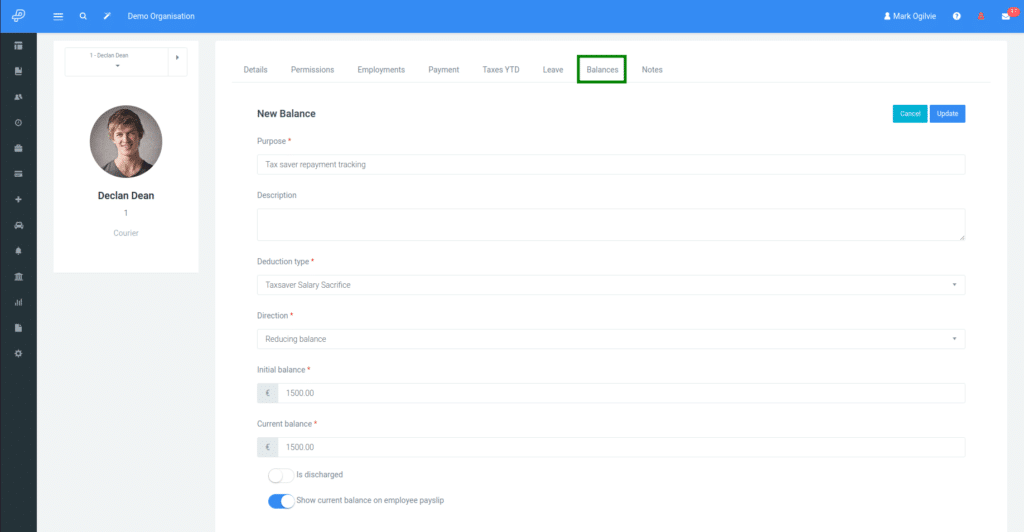

Setup A Tracking Balance (optional)

If the pass was an annual ticket, you may want to set up a tracking balance to monitor the employee’s deductions against the ticket value.

To do this, go to the employee’s Balances tab and create a new Tracking Balance.

Provide a name and description for the balance, and select the Taxsaver deduction to track against. Enter the initial purchase price of the ticket and the current balance.

Employee Payslip

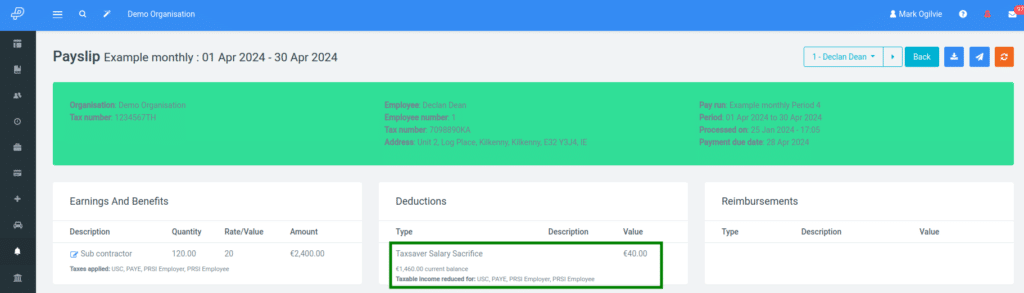

The employee payslip will show the new deduction line, along with a list of the taxes which have been saved.

If a tracking balance was setup, then the current balance will also be displayed.

Make sure to check the balance remaining or to set a reminder. You can add Notes to the employees that will generate a reminder on a nominated date in the future.