How Can We Help?

Managing RCT with payroll using Parolla

What is Relevant Contracts Tax (RCT)?

Managing RCT with payroll using Parolla. Relevant Contracts Tax (RCT) is a tax that applies to certain payments made by principal contractors to subcontractors, primarily within the construction, forestry, and meat processing sectors in Ireland. The tax is managed by the Irish Revenue and is designed to ensure that subcontractors meet their tax obligations.

RCT is applied when a principal contractor makes a payment to a subcontractor for specified services. It’s crucial that businesses handling payments to subcontractors are compliant with RCT regulations, as non-compliance can lead to penalties or interest from the Irish Revenue.

See Revenue guidance here.

Benefits of Running RCT with Payroll Using Parolla

Integrating RCT processing with regular payroll offers significant benefits to businesses, particularly those working with both employees and subcontractors:

- Streamlined Operations: By managing RCT alongside payroll, businesses can handle all employee and subcontractor payments in one system, reducing the need for separate workflows or software solutions.

- Compliance Assurance: Parolla’s system is designed to automatically calculate and apply RCT based on Irish Revenue guidelines. This reduces errors, ensures accurate tax withholdings, and minimises the risk of non-compliance.

- Accurate Reporting: Parolla generates RCT-specific reports that meet Revenue’s requirements, making it easier to track and report subcontractor payments.

- Time and Cost Savings: Automating RCT processing within the payroll system saves administrative time, reduces manual data entry, and minimises the risk of errors that could lead to costly penalties.

Information Required for RCT Processing with Parolla

To ensure RCT is applied accurately and reported correctly, the following information is typically needed:

- Subcontractor Details:

- Name and tax identification (PPS number or VAT number)

- Contact details and relevant business information

- Subcontractor’s status in relation to RCT (new or registered with Revenue)

- Contract Details:

- Description of the contract and services provided

- Start and expected end dates of the contract

- Contract value or payment amount agreed upon with the subcontractor

- Payment Details:

- Payment schedule and frequency (e.g., weekly, monthly)

- Payment amount, including any deductions or adjustments

- Bank account or other payment information for the subcontractor

- RCT Rate:

- The applicable RCT rate for each subcontractor, which can vary based on Revenue’s determination (0%, 20%, or 35%)

- Revenue Filings and Compliance Details:

- Confirmation of registration with Revenue for RCT purposes

Using Parolla to Manage RCT and Payroll Together

With Parolla, businesses can seamlessly integrate RCT obligations into their payroll process, helping manage both employees and subcontractors within a single platform. Parolla automatically calculates, applies, and tracks RCT deductions as per Revenue guidelines. It also generates required documentation for Revenue submissions, reducing the administrative burden and ensuring full compliance with RCT requirements.

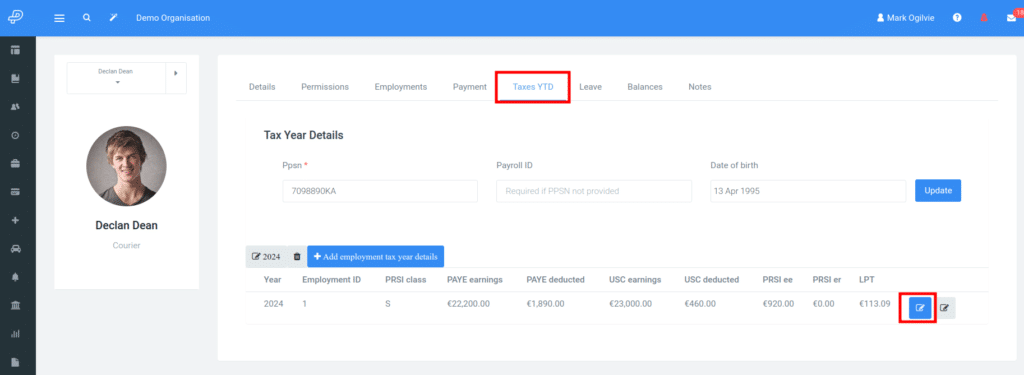

Modify the employee tax settings for the required year:

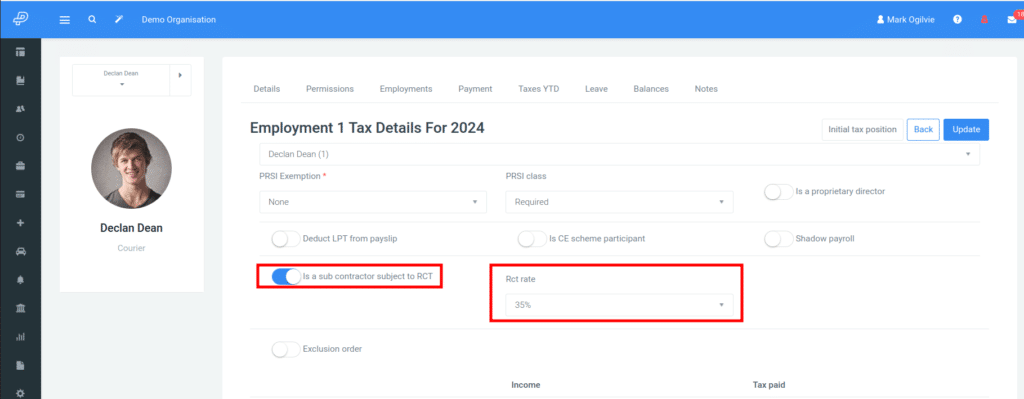

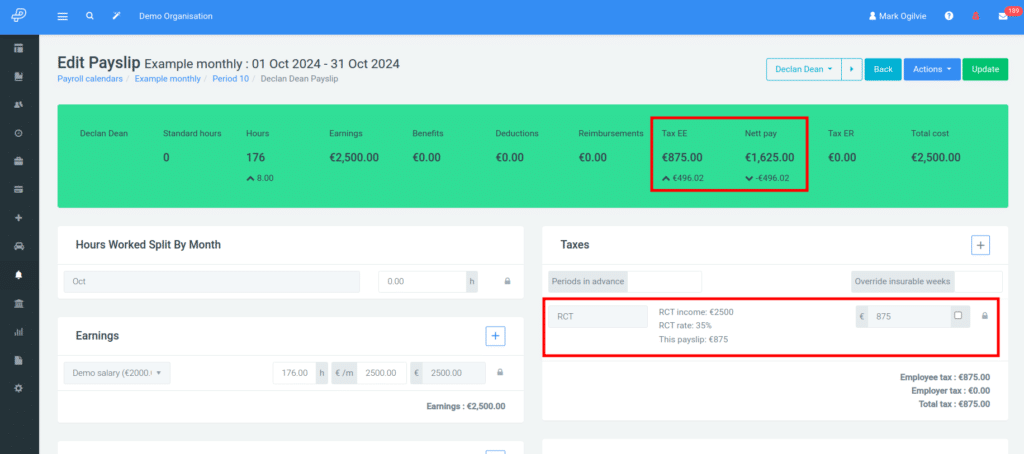

Select RCT and the rate required:

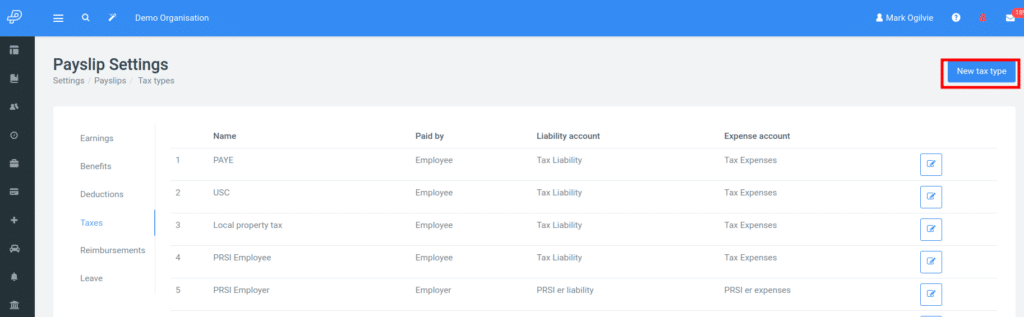

Create an new tax type under Settings > Payslip Items > Taxes

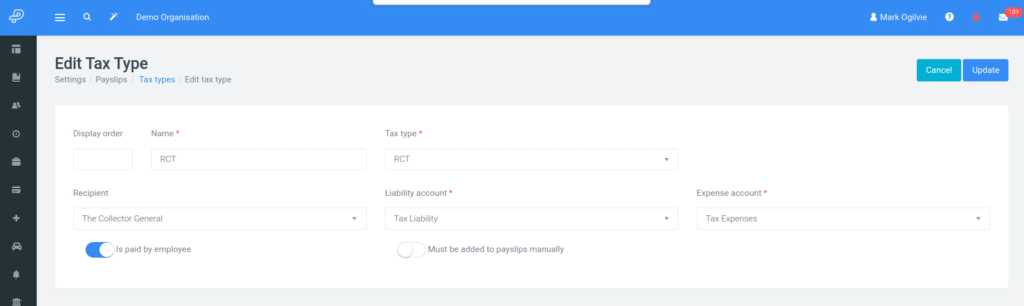

Configure RCT Taxes:

Check the new payslip:

Conclusion

For businesses that need to pay both employees and subcontractors, Parolla’s RCT management within the payroll system provides a streamlined, compliant, and cost-effective solution. By managing RCT with payroll using Parolla, in one software, businesses can ensure accurate tax deductions, reduce administrative workload, and maintain compliance with Irish Revenue requirements.