It is a year since the Temporary Wage Subsidy Scheme (TWSS) was introduced. The scheme operated from 26nd March 2020 until the 31st August 2020.

In September 2020 Revenue requested that all employers submit to Revenue the amount of TWSS subsidy paid to employee’s. This was stage one of the TWSS Reconciliation. Parolla automatically completed this stage of the reconciliation for all clients as per their records on Parolla on the 5th Oct 2020. The details of this submission can be viewed in Parolla under Reporting> TWSS Reconciliation.

Stage Two

Stage two takes the reported subsidy paid details submitted on the 5th Oct and match’s it against monies paid by Revenue to each employer for TWSS. Any differences will now be reconciled. Further information is available on the Revenue website

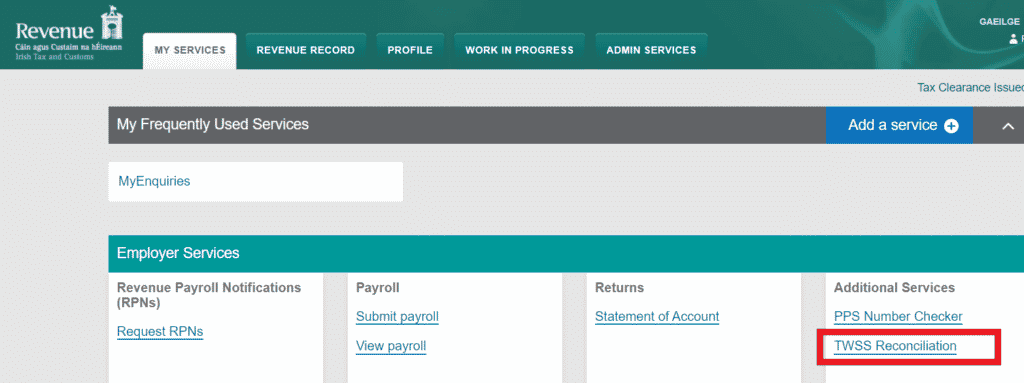

The reconciliation summary will be available under the “MY SERVICES” tab in ROS under “Employer Services”.

A full CSV file is available and should be reviewed.

The reconciliation will result in one of the following:

- a payment due to Revenue,

- a payment due to the employer

- the amounts will match.

If the difference between the amount you paid to your employees and the amount which Revenue paid to you (the employer) is less than €500, in total, Revenue considers your statement to be balanced and no repayment is required.

Employers have until the 30th June 2021 to accept Revenue’s reconciliation.

Most people who used the scheme in April 2020 will have received an overpayment for this period. This is due to the scheme paying the maximum amount of €410 per week per employee that month. Entitlement for that period was more likely €350 or lower per employee weekly.

If your case is already under review Revenue will have been in contact with you directly. Your reconciliation CSV file will not yet be available.

If you don’t agree with the Revenue CSV reconciliation file then the best course of action is to contact them via ROS my enquires.

Revenue expect a large influx of enquires in the first weeks and have given employers until the 30th June to resolve any differences.

We have observed some figures on the ROS website where the summary details do not match the totals within the reconciliation file. This has occurred where re-submissions were made for the same pay periods.

Revenue guidance can be found here