How Can We Help?

EWSS Sweepback

Employee Wage Subsidy Scheme (EWSS) was signed into law on the 1st Aug 2020.

The EWSS can be claimed for employees not on the Temporary Wage Subsidy Scheme (TWSS) for July and Aug 2020. This is known at the EWSS Sweepback.

The Closing date for EWSS Sweepback claims is the 14th Oct 2020

How to Claim EWSS via the EWSS Sweepback

Revenue have provided EWSS sweepback guidelines .

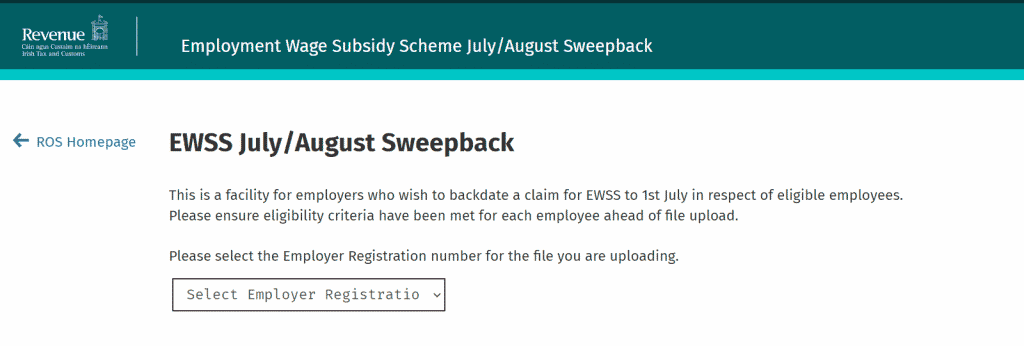

Eligible employers who wish to claim a subsidy on behalf of an eligible employee for July and August must initially download the Sweepback CSV template. This template is provided by Revenue on page 3 of the EWSS sweepback guidelines.

The CSV file must be completed and returned to Revenue via ROS.

Qualifying Criteria

- Employer must be able to demonstrate that the business will experience a 30% reduction in turnover or orders for the period July to December 2020.

AND

- this disruption is caused by Covid 19

This reduction in turnover or orders is relative to:

- the same period in 2019 where the business was in existence prior to 1 July 2019

- the date of commencement to 31 December 2019

- or

- where a business commenced after 1 November 2019, the projected turnover or orders.

Eligible Employers

- Employers must register on ROS for the scheme (the TWSS registration form does not transfer to the EWSS).

- Employers must have a Tax Clearance certificate to receive subsidy payments.

- Payroll submissions must be made to Revenue in line with PAYE modernisation rules which state that employers must report payroll details to Revenue each time an employee is paid. Employers must report these details on or before the pay date.

Eligible Employee Restrictions

- Proprietary Directors who do not retain “ordinary” employees are not eligible for EWSS.

- Connected persons (ie family members) who were not on the payroll during July 2019 to June 2020 are not eligible.

Subsidy Amounts

The subsidy amount paid will depend on the gross income of each employee. The EWSS will give a flat-rate subsidy, based on the number of qualifying employees on the payroll.

For every employee paid:

- between €203 and €1,462 gross per week, the subsidy is €203

- between €151.50 and €202.99 gross per week, the subsidy is €151.50

No subsidy is paid for employees paid less than €151.50 or more than €1,462 gross per week.

The PRSI rate of 0.5% will apply for each qualifying employee. The normal PRSI rate is applied to the payslips and will be reconciled in the sweep back/ monthly statement of account on ROS.