How Can We Help?

Employment Wage Subsidy Scheme

How to set up the Employment Wage Subsidy Scheme

This is a guide to registering with Revenue and setting up the Employment Wage Subsidy Scheme Parolla.

Review of Scheme Eligibility

You must also be able to demonstrate, to the satisfaction of Revenue, that:

- your business will experience a 30% reduction in turnover, or customer orders, in the period from 1 January to 31 December 2021 for paydates on, or between, 1 July and 31 December 2021

- and

- this disruption to normal operations is caused by COVID-19.

The period of time used to establish the reduction in turnover, or customer orders, will vary depending on when your business commenced. The reference turnover period for business that commenced trading:

- prior to 01 January 2019, is 1 January to 31 December 2019

- between 1 January and 31 October 2019, is from when the business commenced to 31 December 2019

- on or after 1 November 2019, is the projected turnover or orders for 1 January 2021 (or when the business commenced, if later) to 31 December 2021, as if the pandemic had not occurred.

Subsidy Amounts

The level of subsidy the employer will receive is per paid qualifying employee and the date of payment:

| Gross pay (per week) | Subsidy Payable (per week) |

| Less than €151.50 | Nil |

| From €151.50 to €202.99 | €151.50 |

| From €203 to €1462 | €203 |

| More than €1462 | Nil |

Level 5 Rates override the standard rates for a shorter duration.

| Gross pay (per week) | Subsidy Payable (per week) |

| Less than €151.50 | Nil |

| €151.50 – €202.99 | €203 |

| €203 – €299.99 | €250 |

| €300 – €399.99 | €300 |

| €400 – €1,462 | €350 |

| Over €1,462 | Nil |

The PRSI employer rate of 0.5% will apply for each eligible employee. The normal PRSI rate should be applied to the payslips and will be reconciled in the sweep back / monthly statement of account on ROS. The employer PRSI credit will be offset against the employers other PAYE liabilities.

Qualifying Employees

- Employees of an eligible employer will qualify for a subsidy including existing employees, newly hired employees and re-hired employees.

- Any employee who was not eligible for TWSS in the period 1st July to 31st August will be eligible for EWSS for that period.

- Employees who were on TWSS up to the 31st of August will be eligible for EWSS from 1st Sept.

- Proprietary Directors can qualify for one eligible company, so long as they were on the payroll with at least one submitted payslip dated between 1st July 2019 and 30th June 2020.

- Connected persons who were not on the payroll during July 2019 to June 2020 are not eligible. Further guidance to follow from Revenue.

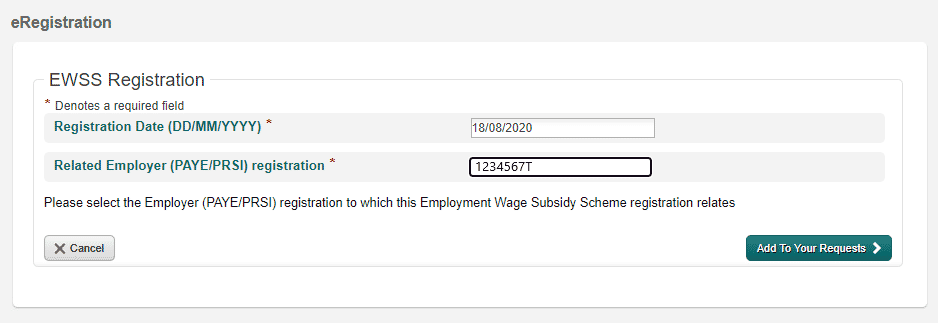

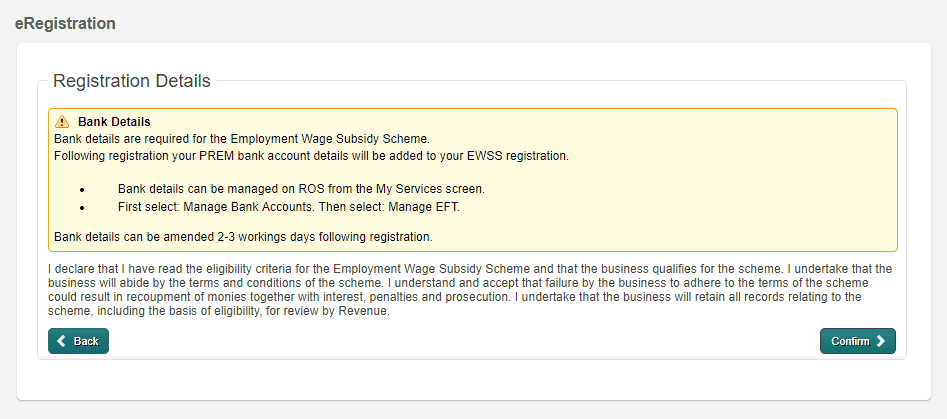

Registering for EWSS

- Employers must register on ROS for the scheme (the TWSS registration form does not transfer to the EWSS).

- Employers must have a Tax Clearance certificate to register and receive subsidy payments.

- Payroll submissions must be made to Revenue in line with PAYE modernisation rules which state that employers must report payroll details to Revenue each time an employee is paid. Employers must report these details on or before the payment date

De-registering from EWSS

Revenue requires a registered employer to conduct an eligibility review on the last day of each month.

Employers should immediately de-register from the employment wage subsidy scheme if at any time they become aware that they no longer meet the eligibility requirement.

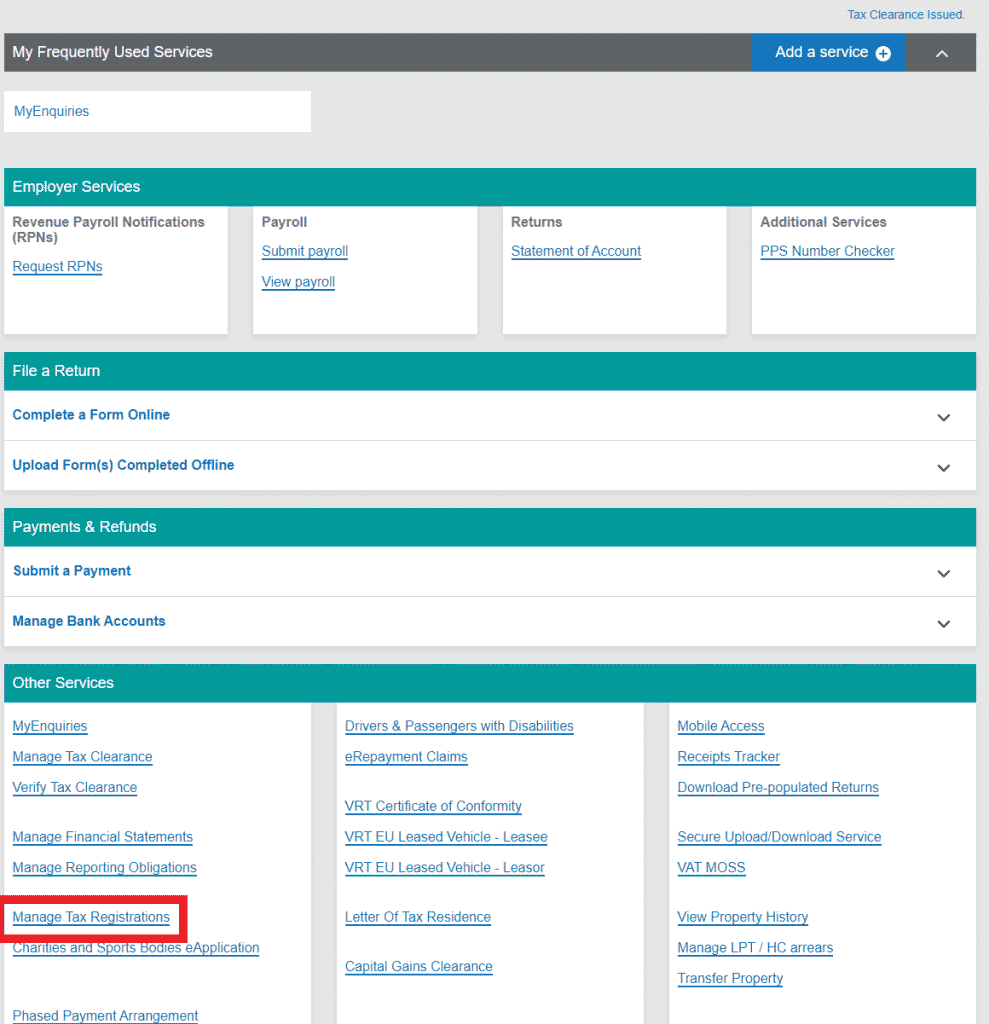

Registering for EWSS on ROS

Eligibility Review Form

You must undertake a review of your eligibility for the scheme. This review must be done on the last day of every month (other than the final month of the scheme). If, after this review, you no longer meet the eligibility criteria as outlined on the previous page, you should take the necessary action and withdraw from the scheme.

The review must compare the actual and projected business performance over the period January 2021 to December 2021 for pay dates in the period 1 July to 31 December 2021.

Note

You must retain evidence of appropriate documentation, including copies of projections, to demonstrate continued eligibility over the specified period.

From 30 June 2021, you will be required to complete an online monthly Employer Eligibility Review Form. This form will assist you in ensuring your continued eligibility for the scheme. The form must be completed and submitted through Revenue Online Service (ROS).

The initial submission should be made between 21 and 30 July 2021. You will need to provide details of the following:

- actual monthly Value Added Tax (VAT) exclusive turnover or customer order values for 2019

- actual monthly VAT exclusive turnover or customer order values for the first six months of 2021

- and

- monthly projections for the remainder of 2021, July to December 2021.

By the 15th of every subsequent month during the scheme, you will need to provide details of the actual results for the previous month. You will also need to review the original projections you provided to ensure they remain valid.

Failure to complete this return will result in suspension of payment of your EWSS claims.

Setting Up Parolla

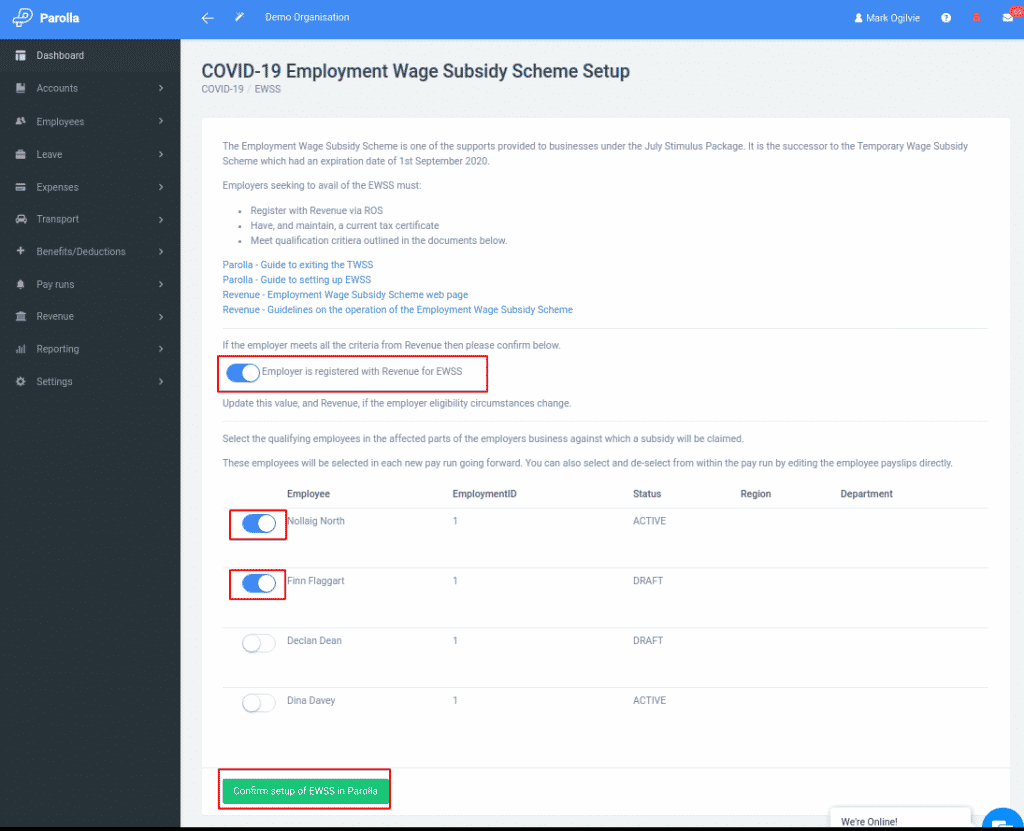

Setting up EWSS

The wizard menu contains a link to the EWSS setup page.

Confirm the employer meets the eligibility requirements and select the qualifying employees:

This will update the employee template payslips with the EWSS flag that gets submitted to Revenue with the Payslip Submission Requests.

The qualifying employees that are being claimed for subsidy are shown on the right of the page.

If the employee should not be qualifying, due to being a connected employee to a proprietary director, or not in the affected business group, the you should de-select them. Revenue would also prefer for employees with weekly wages outside the subsidy bands to be deselected.

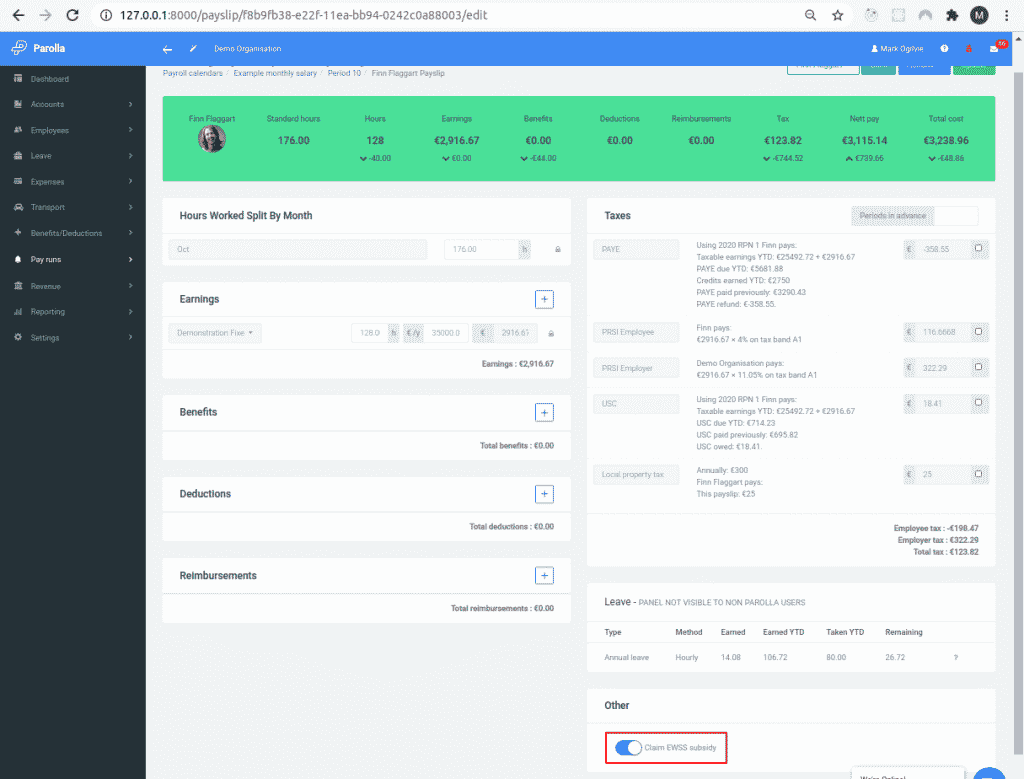

You can change the qualifying employees either by using the EWSS wizard, or if it just this pay run, you can update the employee in their payslip.

Process and submit the pay run as normal.

Ensure that the pay run is submitted to Revenue on time.

Revenue will accept re-submissions up to the 15th of the following month. However, if there is no submission by the 15th of the following month there will be no subsidy paid.

EWSS reporting in ROS

EWSS differs from TWSS in that it is a grant paid directly to the employer and details of EWSS should not appear on the employees pay slip.

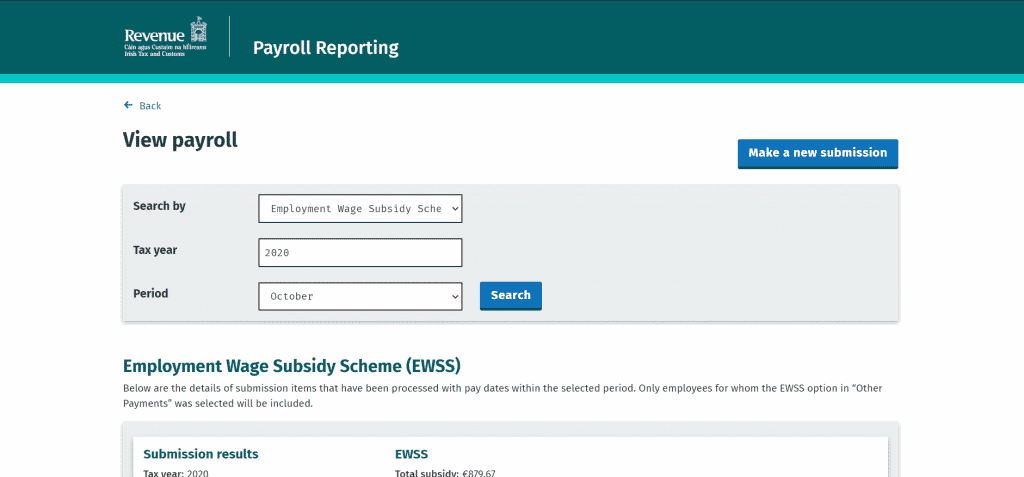

To track EWSS and PRSI credits associated to EWSS log onto ROS and on the My Services page choose View payroll

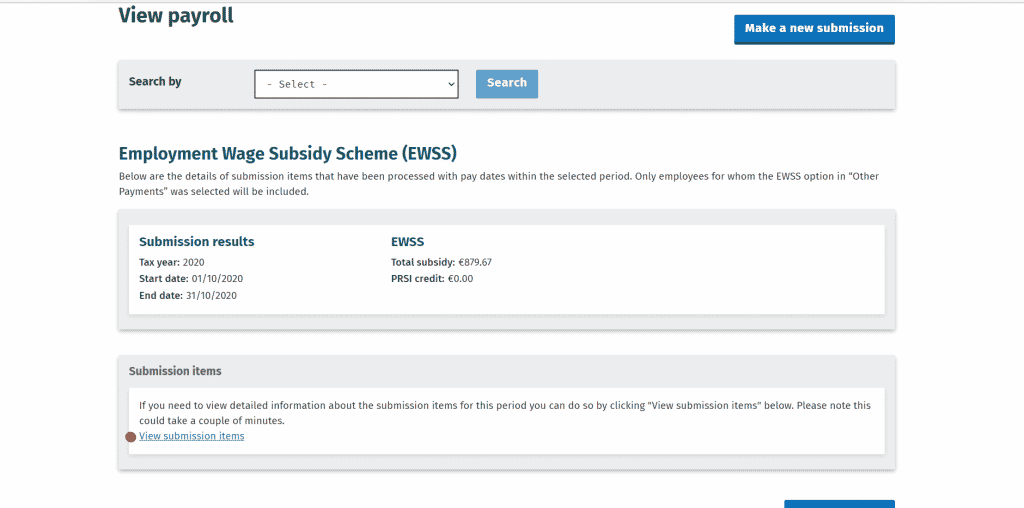

You will get a summary of the amount of EWSS and PRSI credit calculated based on the submissions with pay dates in the month so far.

You can view submission items where EWSS was claimed and the warning messages, if any, will show up there.

The View button will bring you into the pay slip as submitted