How Can We Help?

Optimise Revenue Payroll Submissions Compliance

Track and Optimise Revenue payroll submissions compliance with Parolla’s set of reporting and note taking tools.

Revenue closely monitors payroll submissions, looking for patterns of consistently late filings or re-submissions with changes made after the 15th of the following month.

When should I be submitting to Revenue?

Payroll submissions should be made to The Revenue, “On or Before” the date of payment to the employee. Anything after that date is considered late.

The Employer then has until the 15th of the following month to make any changes to the submissions.

See The Revenue submission requirements here.

What do The Revenue track?

If a business frequently submits late or makes excessive corrections, the compliance team may initiate a Level 1 Compliance Intervention to investigate the reasons behind the delays.

How can Parolla help?

To help businesses stay compliant, Parolla allows you to add notes to each submission and re-submission at the time of filing, ensuring clear records of any changes.

If you are ever selected for a compliance intervention, Parolla provides a detailed report with all the required information, making the process smoother.

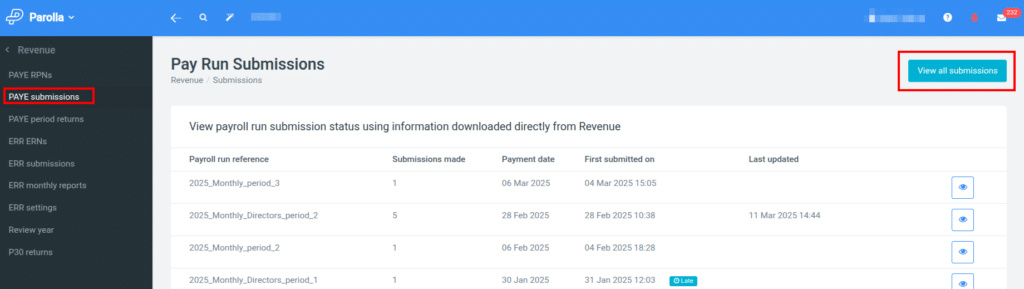

The report can be found in the left hand menu under Revenue > PAYE Submissions then clicking on the button to View all submissions

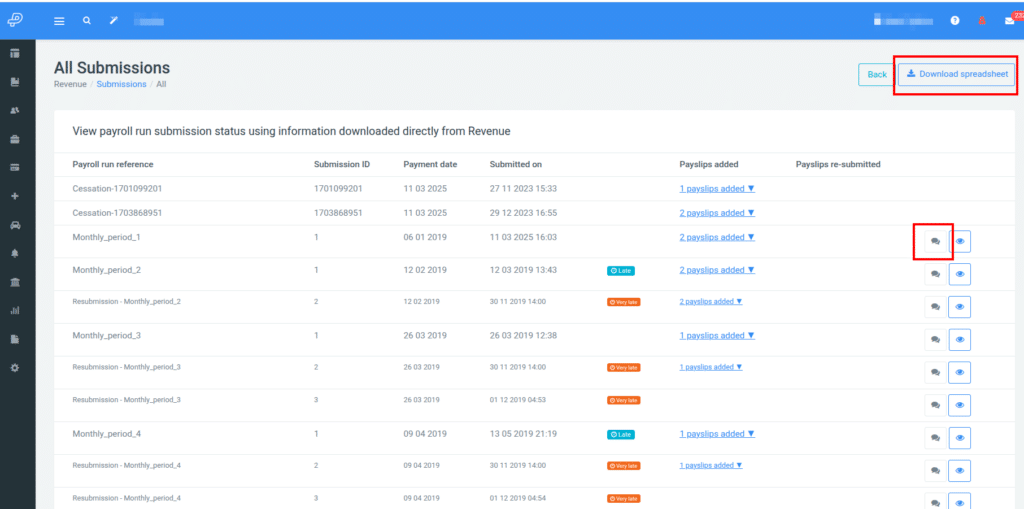

Once in the report page you can view whether submissions were made on time, late or very late. Late submissions are made after the payment date but before the 14th of the following month (Revenue’s deemed date). Very late submissions are after the deemed return date. You can also add notes to the individual submission with a reason for the late filing or changes.

The download button allows you to get a filtered and sortable Excel output.

Parolla also has a couple of other features to checking submission status

You can review individual pay runs by following this guide.

Track revenue payroll submissions and review the entire year to date, as per this guide.

Typically with Level 1 Compliance Interventions are designed to assist taxpayers in being voluntarily compliant. Under a Level 1 Intervention, taxpayers can address any compliance matters through Self-Correction or by making an Unprompted Qualifying Disclosure as appropriate.

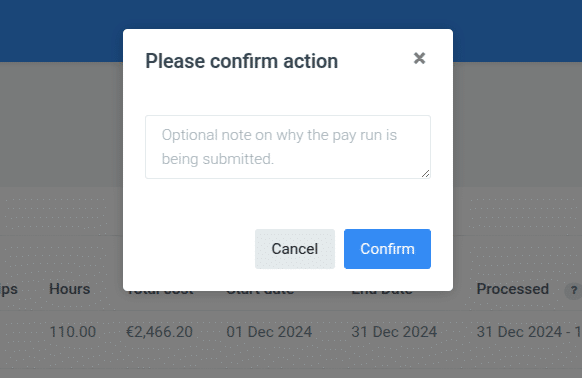

If you know that your submission is going to be late, or if you have to make a resubmission, then it can be worthwhile to take a few extra minutes and just record the reason for the submission at the time. We provide a text input field for you to do that.