How Can We Help?

Cycle to Work Scheme

This guide will give information on how to input a Cycle to Work Scheme into Parolla as a non-taxable employer benefit.

Background to Cycle to Work Scheme

Under the scheme, an employer can buy a bicycle and safety equipment for an employee. This will not be a taxable benefit-in-kind.

The tax exemption does not apply if the employee pays for the bicycle and the employer reimburses them. The employer must pay for the bicycle. Most bike shops run a voucher system where the employee chooses a bike and gives the voucher to their employer for them to pay for the bike.

Limits of the scheme

There are three limits, depending on the type of bicycle purchased.

- €3000 for cargo and e-cargo bikes

- €1500 for pedal electric and e-bikes.

- €1250 for all other cycles.

These rates are effective from 1st January 2023.

Check out the Revenue website for full information on the scheme and qualifying criteria.

Inputting the Cycle to Work Scheme into Parolla

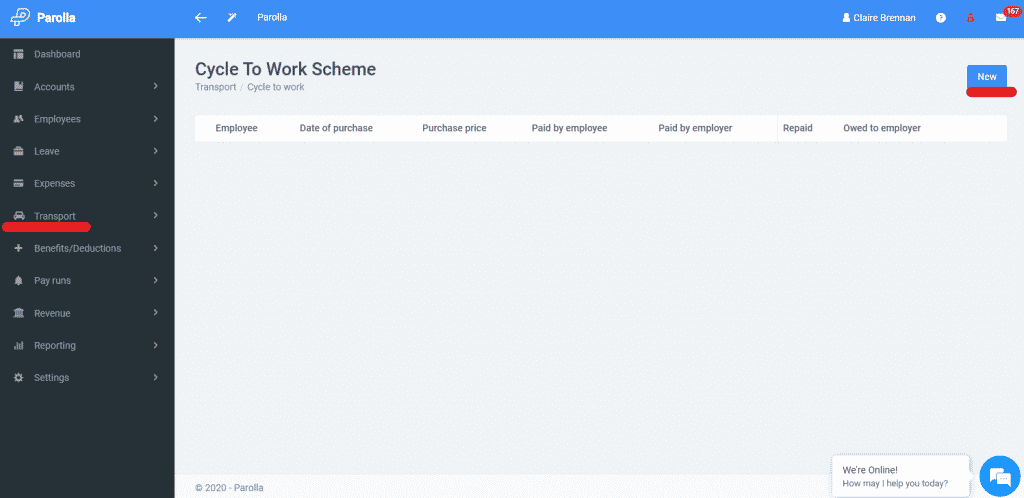

Go to the menu and choose Transport > Cycles > New

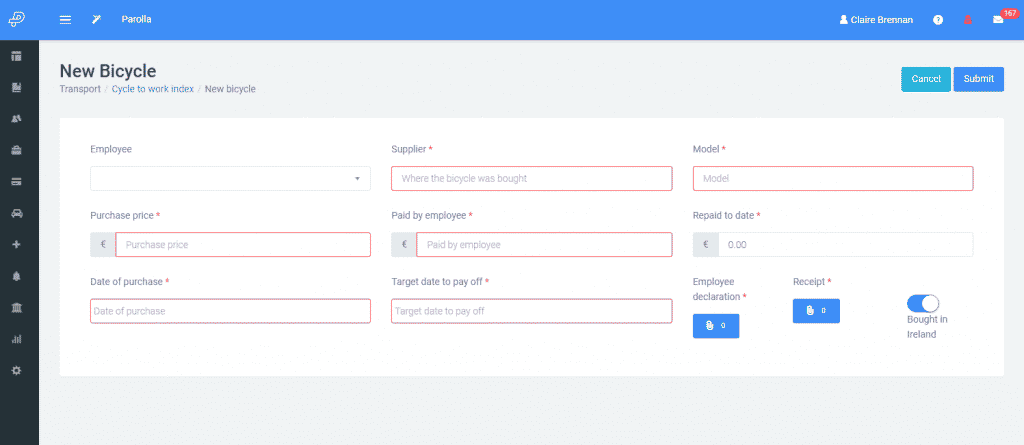

Fill in the relevant details. The bike must be repaid within a maximum of 12 months. If the purchase price was over the value limit the employee can pay the difference, this won’t appear on the pay slips.

The employee declaration is generally included in the voucher documents provided by the bike shop.

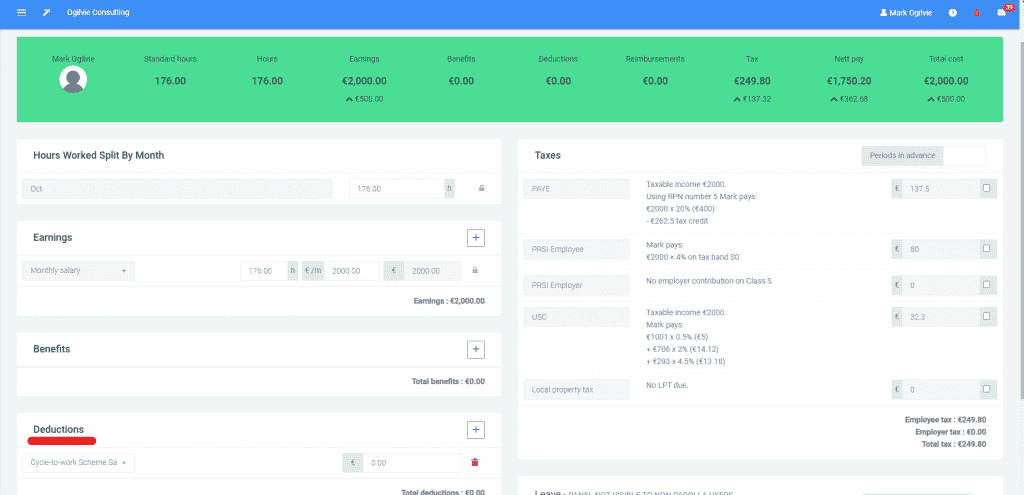

The Cycle to Work amount will now appear in the deductions section of the employee’s payslip.

Monitoring payments made to the scheme

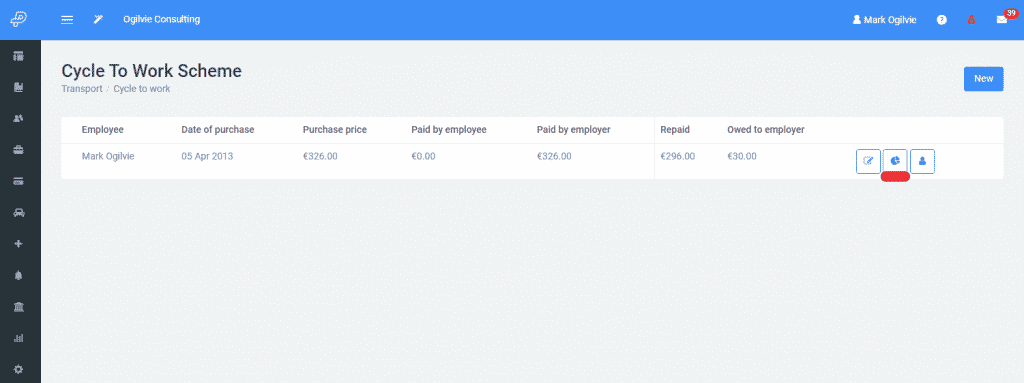

You can monitor the amount paid to date by clicking on Transport > Cycles and View as per below.

Common Issues

The scheme doesn’t appear on the payslip.

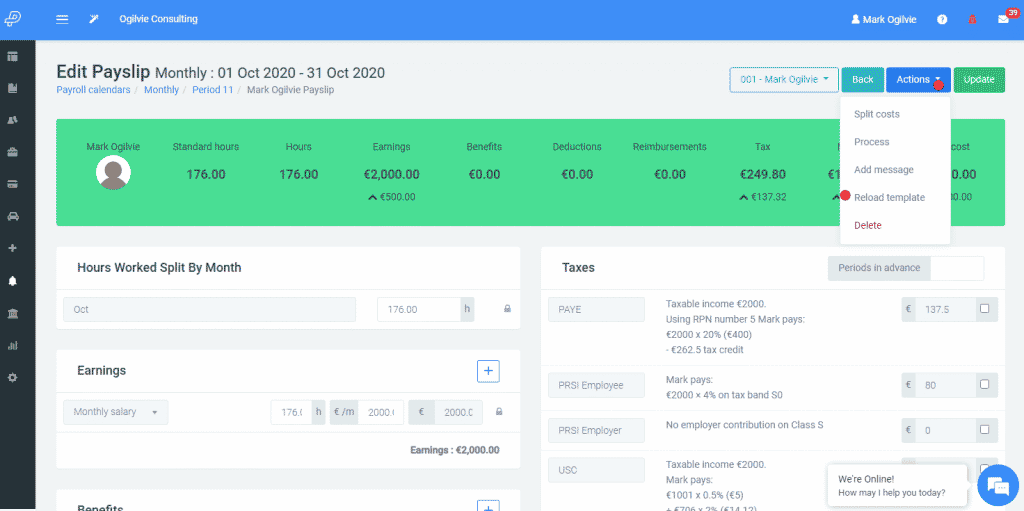

If you have entered the scheme after opening (creating) the pay run, the individual’s payslip will need to be reloaded. Please see below.