How Can We Help?

Creating an Organisation

Purpose

This document will take you through creating an organisation on Parolla and should be the first guide you start with. It will show you how to download your ROS Digital Certificate, set up payroll calendars, create cost centers and import your employee details from ROS.

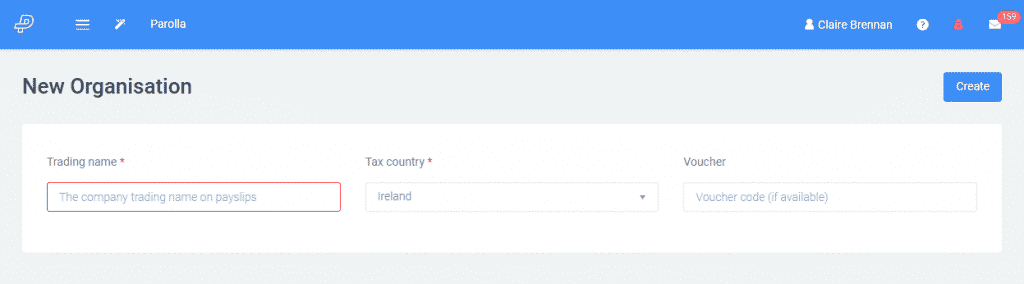

New Organisation

Enter the details of the organisation and hit Create.

If you have chosen to use the demo organisation, then a pre-populated demo organisation will appear. When you wish to enter the details of your own company, click on the wizard stick located to the left of the top navigational bar and choose Setup organisation.

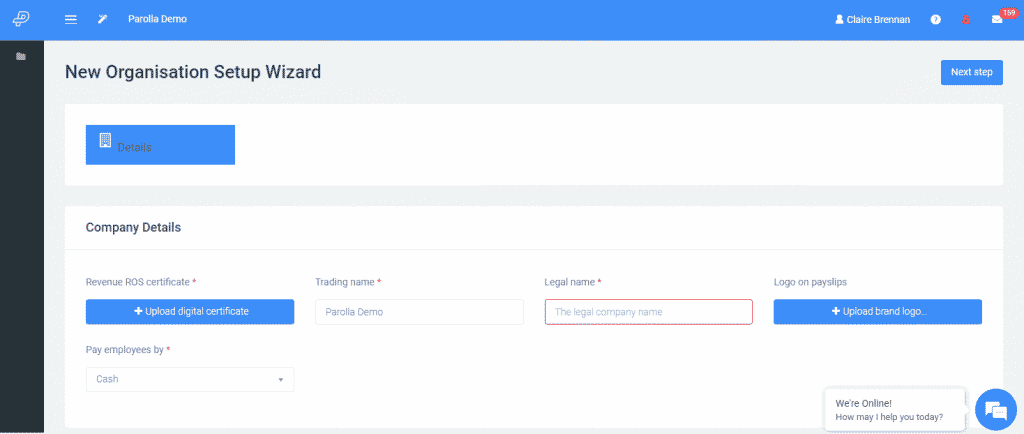

Details

Choose Upload Digital Certificate. The digital certificate recommended is a sub-cert of the company’s ROS Digital Certificate. By uploading the sub-user certificate, you link Parolla with ROS. This allows Parolla to access the PAYE tax details of your employees from ROS and allows you to seamlessly submit your pay runs to ROS.

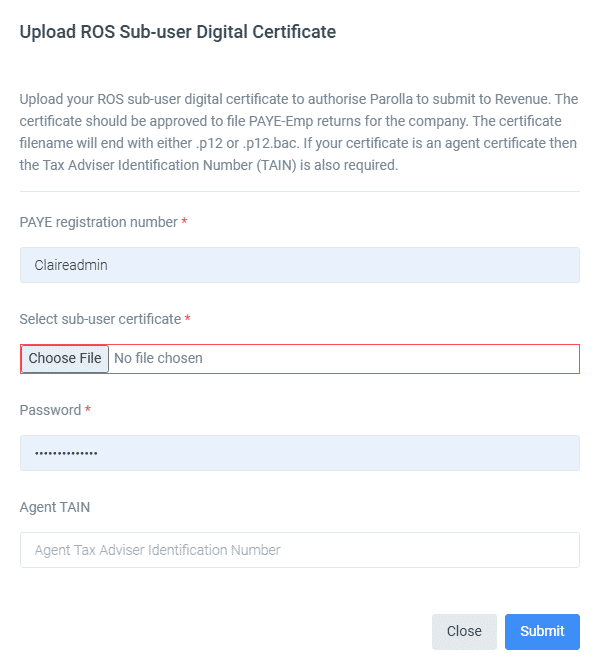

Sub-User Certificate Set up

A company and its accountant can both have access to a ROS admin certificate. Click here to register for ROS access.

Accountants, you will need a sub-user certificate of your agents’ certificate with PAYE EMP filing permissions, the agent TAIN and the client companies’ employers’ tax registration number. Please refer to the tutorials on our website.

Downloading your ROS Sub-User Digital Certificate to Parolla

Input your PAYE registration number which is available in all ROS correspondence. Upload your Sub-User Digital Certificate which you retrieved from ROS (file ending .p12.bac and enter your ROS password)

The Agent TAIN is for accountants only.

A message will appear in the top right in green to let you know the Digital Certificate has been successfully uploaded.

The legal name will appear automatically. You can complete the trading name, upload your logo if you wish, and input the method by which you intend to pay your employees.

Click on Next step.

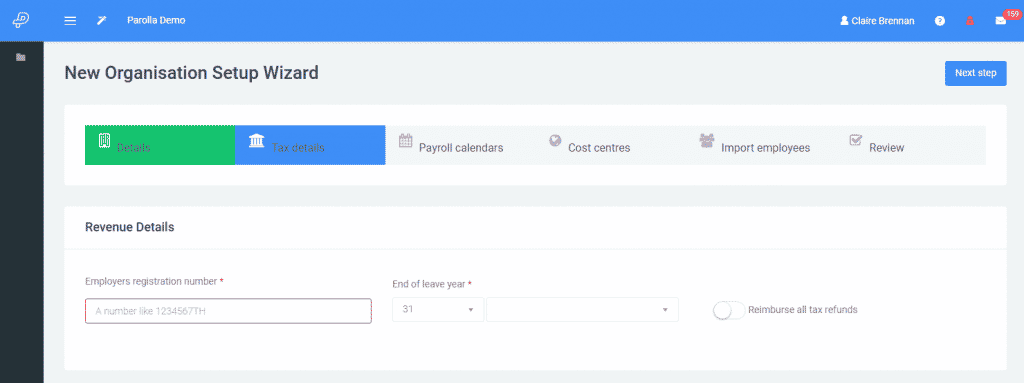

Tax Details

Enter the date of your end of leave year and swipe the reimburse tax refunds if you wish to reimburse tax refunds on payslips with zero earnings.

Click on Next step.

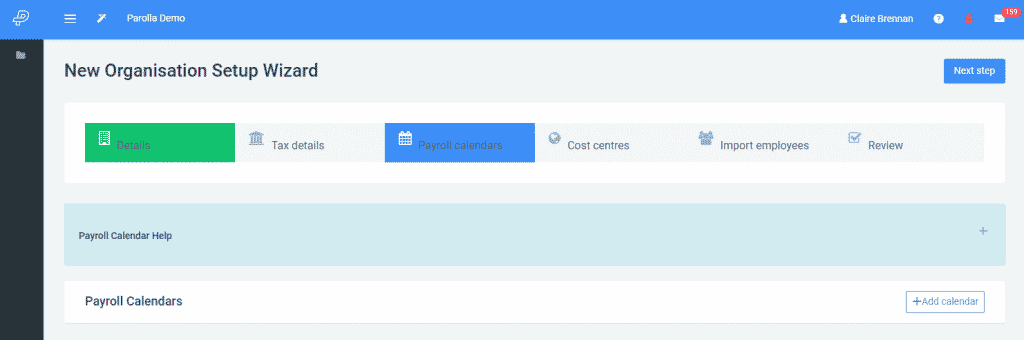

Payroll Calendar

Every company needs at least one payroll calendar. Click on the + button for payroll calendar help and on the +Add calendar to create a calendar.

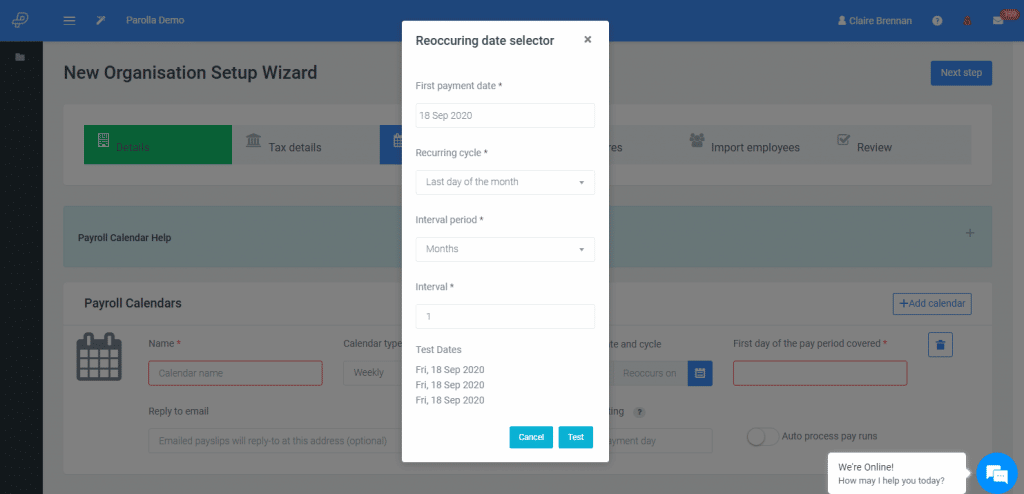

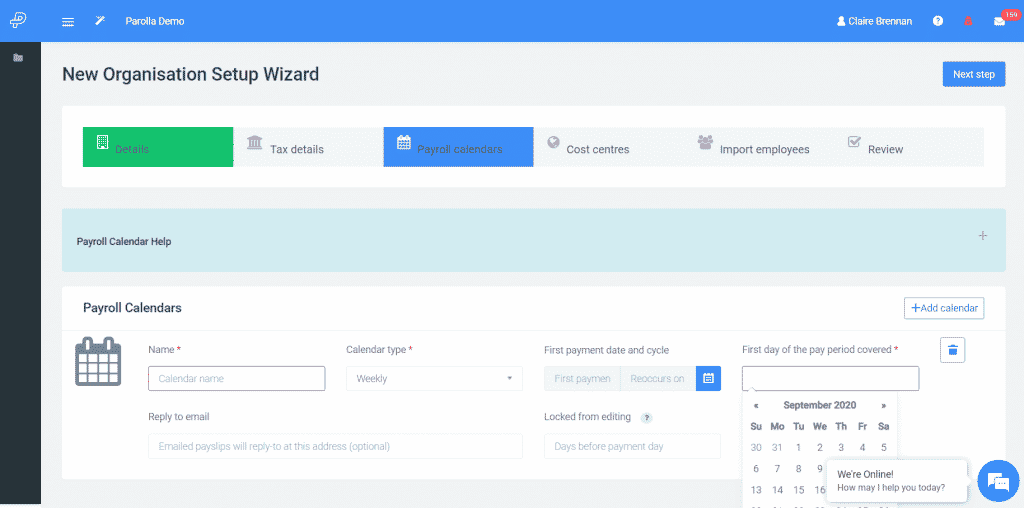

Name the calendar and choose the Calendar interval type. Click on the blue calendar box under first payment date reoccurs. Choose the next date that you will make a payment (first payment date), the recurring cycle, interval period, interval, and click on test. Check the future payment dates. Click USE

Next, choose the first date the pay period covers.

This is the first day of the working week/ fortnight/ month.

Remember Revenue calculates weeks as per the payment date not from dates worked.

Input the email address of the person at your company who will respond to any email queries regarding payslips issued.

Multiple calendars can be created if you have employees on quarterly, monthly, fortnightly, and weekly pay periods. Do not create multiple weekly/monthly calendars if everyone is on the same weekly/ monthly pay cycle – the same calendar can be used for all.

Click on Next step.

When a calendar is first created, Parolla automatically creates your pay run cycle based on the dates provided. From this point onwards, the dates are fixed. If you need to change dates then create a new calendar, assign your employees to it and delete the original.

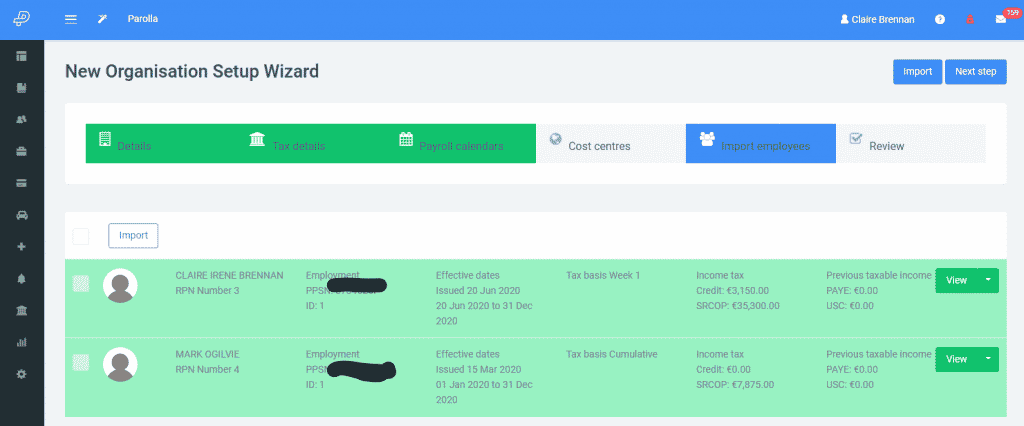

Import Employees

All of the company’s employees’ Revenue Payroll Notifications (RPNs) will appear. Choose the current employees and click on Import and all imported employees will appear in green.

In the case of completely new companies, no RPN’s will appear. These can be requested at a late stage of your set up.

Click on Next step.

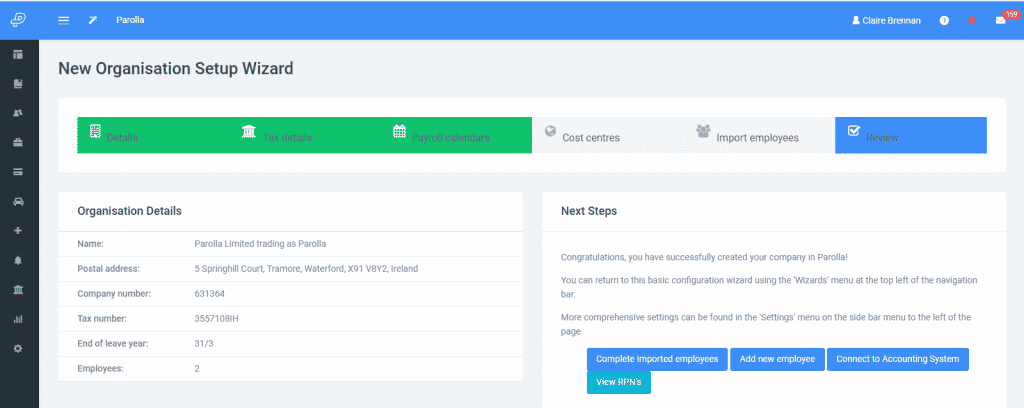

Review

Your organisation is now set up. Choose the next step, generally Complete imported employees. Refer to the guide entitled Creating Employee Profiles.

Common Problems

I don’t have a ROS Digital Certificate

You cannot retrieve or send any information to Revenue without a ROS Digital Certificate.

It is possible to set up some parts of your Parolla account, but without a ROS Digital Certificate, we cannot get your employee tax details from Revenue. Without their tax details, you cannot calculate a payslip.

How do I get a ROS Digital Certificate?

Contact Revenue, or go to this site, and register for a certificate. It can take Revenue three to five days to issue a certificate.

The certificate won’t open; the password is incorrect

The password for opening the ROS Digital Certificate is the same one that you use when logging into the ROS portal.

If you are getting an error in Parolla, then we suggest trying to access ROS using the same certificate that you are uploading to Parolla. Take note of the successful password and use that.

The certificate doesn’t have the correct permissions

In order to file PAYE information the sub-user certificate must have ‘File‘ permissions for the PAYE-Emp information.

If the certificate does not have the above permissions then Revenue will send back an error message via Parolla.

The software cannot establish a link between the account and the certificate

Agent certificates are a special type of certificate where the agent has access to different companies. To make this link, Revenue must know the Agent TAIN (Tax Agent Identification Number) and the Employer Registration number.

When you’re opening an Agent Digital Certificate, make sure to enter the Agent TAIN in the appropriate box.

The Tax Agent Identification Number isn’t working

The Agent TAIN format will be 6 characters long. Normally 5 numbers followed by a letter. It is not a name or email address.