How Can We Help?

Setting up a Preferential Loan

This guide is intended to give some information on a Preferential Loan and how it can be set up through your payroll.

It is advised to consult your tax advisor/accountant before setting up a Preferential Loan through payroll for an employee.

What is a Preferential Loan

A preferential loan is defined by Revenue as:

“a loan made by you to your employee or former employee, or their spouse. It arises where the rate of interest applied to the loan in a year is lower than the specified rate. The specified rate is set by the Department of Finance.”

Where a preferential loan arises, it is deemed a benefit therefore Benefit-in-Kind applies to the repayments of the loan.

All taxes apply, PAYE, USC & PRSI.

Note: Always check what the current specified rates are at the time of setting up a preferential loan through your payroll.

Calculating the Benefit of a Preferential Loan

This benefit is treated as notional pay within the relevant tax year.

To calculate the monetary value of the benefit, you use the actual rate of interest paid by the employee within the relevant tax year and deduct it from the specified rate for that same year.

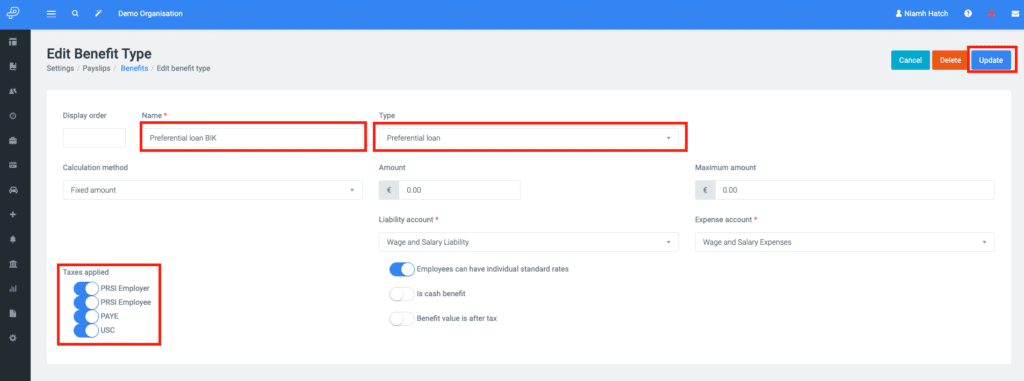

Setting up a Benefit Type

The first step is to set up a Benefit Type if there is not already one in your current setup within Parolla.

Go to the left menu > Settings > Payslips > Benefits > New benefit type.

You can also refer to our guide on Creating New Earnings Types.

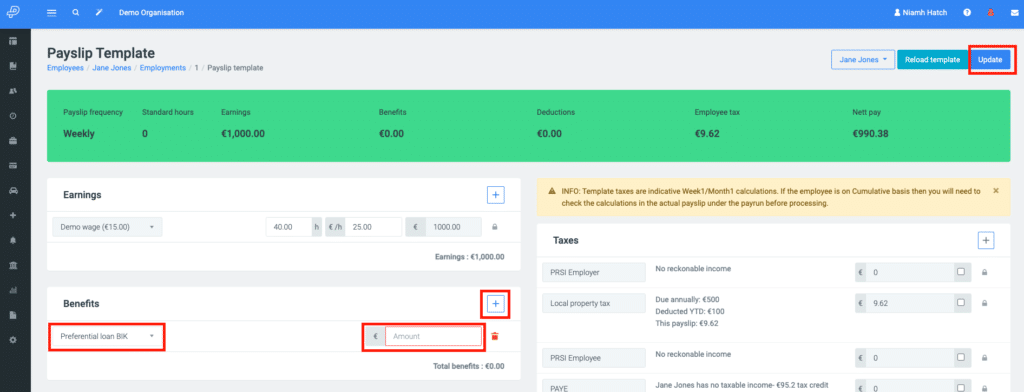

Adding Preferential Loan Benefit to the Employee Payslip Template

Go to the employee profile, choose the Employments tab, and Edit Payslip Template.

Enter the amount of BIK and click Update. This will bring in this Benefit line item in each pay run until it is removed from the template or manually deleted on an individual pay run.

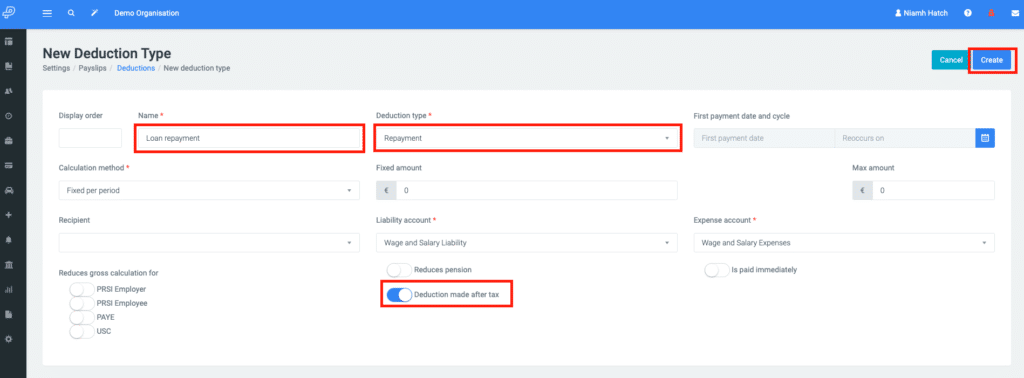

Setting up a Deduction Type

If the loan amount is to be deducted from the employee payslip, this deduction should be from the Net pay amount, therefore after tax.

Go to the Payslips in Settings, choose Deductions, and click New Deduction Type.

This can be added to the employee payslip template in the same way as the Benefit line item.

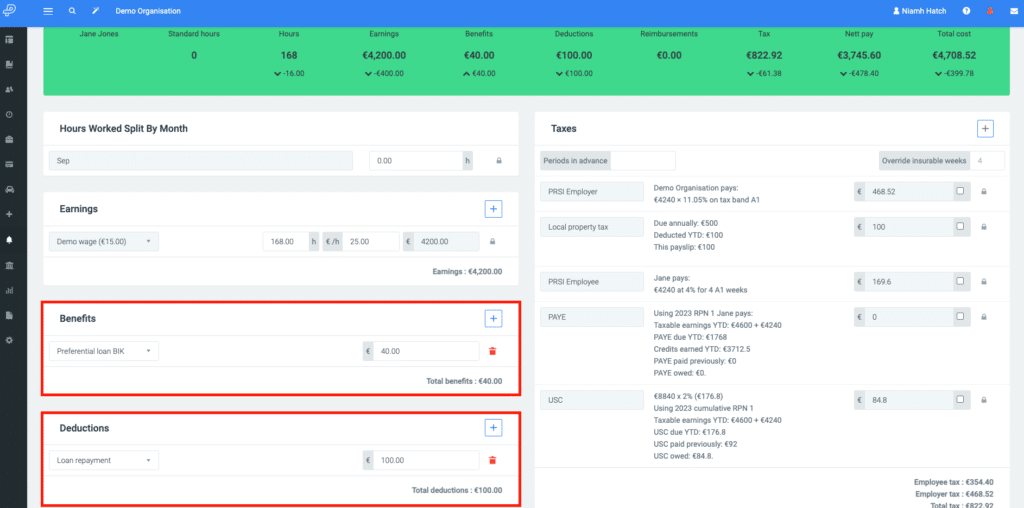

The payslip should be reloaded if the pay run has already been opened. Once the new information regarding the loan is pulled into the pay run, it should look like the one below.

It is the responsibility of the employer/payroll administrator to track the benefit amount and deductions relating to a Preferential Loan.

When the loan is repaid in full and the deduction and BIK no longer applies, both line items should be removed from the employee template to ensure it is not processed in error.