How Can We Help?

Redundancy

Redundancy is a complicated and emotional process for the employee and the employer. It is important to ensure that both parties are informed and aware of their rights and responsibilities.

We recommend that professional advice is taken. This article discusses some of the issues, and how to apply redundancy payments in the Parolla payroll system.

An employees final payslip is often made up of the following elements:

- Earned income – taxable as normal

- Accrued leave paid out as income – taxable as normal

- Statutory redundancy – eligible for tax relief

- Termination payments – some eligible, some ineligible for tax relief

Statutory Redundancy

Determine if statutory redundancy applies

Statutory redundancy is a payment that employers in Ireland are legally required to make to employees who have been made redundant. The payment is intended to provide financial support to employees who have lost their jobs due to circumstances outside of their control. If you are an employer in Ireland, it is important to understand the process of applying statutory redundancy to ensure that you are compliant with the law and treating your employees fairly.

Before applying statutory redundancy, you need to determine if it applies to your situation. It is applicable when the role ceases to exist, for instance due to:

- The employer ceases to carry on business

- The role is no longer required

- The method of performing the work has changed and the employee is not trained or qualified for the role

The employee must also be eligible and meet the following criteria:

- Be 16 years or older, and

- Have a minimum of 104 weeks of continuous service, and

- Be insurable under PRSI Class A. (This requirement doesn’t apply to part time employees, who can be Class J)

Calculate the amount of statutory redundancy due

Once you have determined that statutory redundancy applies, you need to calculate the amount due to the employee.

The formula for calculating statutory redundancy payment is as follows:

- Two weeks’ pay for every year of service, plus

- One additional week’s pay

Years are partial, so someone with three years and nine weeks service would be entitled to:

2 x (3 years + 63/365 days) + 1 additional week = 7.35 weeks of their weekly pay.

But what is a weeks pay? It is the employees current normal weekly rate, including average regular overtime, and BIK, up to a maximum of €600 per week.

An online calculator is available here at MyWelfare.ie.

Statutory redundancy payments are exempt from Income Tax, PSRI and USC, and are not reported as Gross Pay.

Provide written notice to the employee

Once you have calculated the amount of statutory redundancy due, you need to provide written notice to the employee. The notice should include the amount of redundancy payment, the date of termination, and the reason for the redundancy. The notice should be provided in writing and should be delivered to the employee at least two weeks before the termination date.

Termination Payments

In addition to statutory redundancy, employers in Ireland may also choose to make a termination payment. Sometimes called ex-gratia payment, voluntary redundancy, golden handshake payment etc.

Unlike statutory redundancy payments, termination payments are voluntary and are not a legal requirement. These payments are typically made to employees as a gesture of goodwill or to compensate for circumstances not covered by statutory redundancy.

It is important to note that terminations payments do not replace statutory redundancy payments. Employers are still required to pay statutory redundancy to eligible employees.

Termination payments are tax free up to a certain value!

An employee is entitled to a Basic Exemption from paying tax on Termination payments, or in some cases up to an Increased Exemption Limit.

Basic Exemption

An employee basic exemption is calculated as:

- €10,160 plus €765 euro for each complete year of service.

Subject to a lifetime limit of €200,000 not being exceeded.

Any termination payment below both the basic exemption, and the lifetime limit, is tax free, and not part of Gross Pay.

Increased Exemption

The basic exemption can be increased by €10,000 where the employee is:

- Not a member of the employers occupational pension scheme, or

- If they are a member of the scheme, has not received a tax free lump sum and forgoes their right to receive a tax free lump sum at a future date.

If the employee is a member of a occupational pension scheme then there are a few more options that need be considered. Please seek advice from your accountant or tax professional.

Increased exemption can only be claimed once in a 10 year period. The employer should get a signed declaration from the employee that they meet the qualification criteria, and that the employee confirms they:

- Have not claimed the Increased Exemption in the past 10 years.

- They are not a member of the employers occupational pension scheme, or if they are, that they give up their right to a tax free lump sum in the future.

Again, the exemption is only up to a tax free lifetime limit of €200,000.

Standard Capital Superanution Benefit

The third method is the Standard Capital Superanuation Benefit (SCSB)

It benefits employees with high earnings and long service. SCSB is calculated at 1/15 of the average annual emoluments for the last 36 months in employment. This is multiplied by the number of full years of service. Any tax free lump sums received are subtracted from this benefit.

This is more complicated than it sounds, and attention needs to be paid to the types of pensions, the applicable emoluments considered to be pay.

Payment In Lieu Of Notice

Payment in lieu of notice (PILON) is where an employee’s contract is terminated, and they are given a payment instead of a workable notice period.

The treatment for personal income taxes on this can be a bit tricky as it depends on the terms of the employee contract.

If the PILON is defined as being payable under the terms of the employee contract, then it is considered a contractual payment and is subject to IT, PRSI and USC.

If the PILON is not defined in the contract, and it simply states that the notice period is a period of time, then the PILON is considered to be a Termination Payment as above. The payment may qualify for tax relief on termination subject to exemption limits.

Calculating Taxable and Non Taxable Termination Payments

The process to determine what is taxable and non-taxable is as follows:

- Calculate the total value of the termination payment from all components.

- Calculate the basic exemption

- Calculate the increase exemption if necessary

- Calculate the SCSB if necessary

- Apply the higher exemption limit to the termination payment.

- If the termination payment is less than the exemption limit then the entire payment is tax free.

- If the termination payment exceeds the exemption, then the value of the exemption limit is tax free

- Any amount greater than the exemption limit is taxable, and reportable as gross pay.

Termination payments that exceed the exemption limit are taxable for Income Tax and USC, but not PRSI ee or PRSI er.

Make the payment

Finally, you need to make the redundancy payment to the employee. The payment should be made on or before the termination date, and the employee should be provided with a statement of the amount paid.

If you are unable to make the payment, you may be required to apply to the Department of Employment Affairs and Social Protection for a refund of the statutory redundancy payment. In this case, you must provide evidence that you are unable to pay the redundancy.

Configuring Parolla For Redundancy Earnings Types

You may need three different earning types depending on the value of any Termination Payments

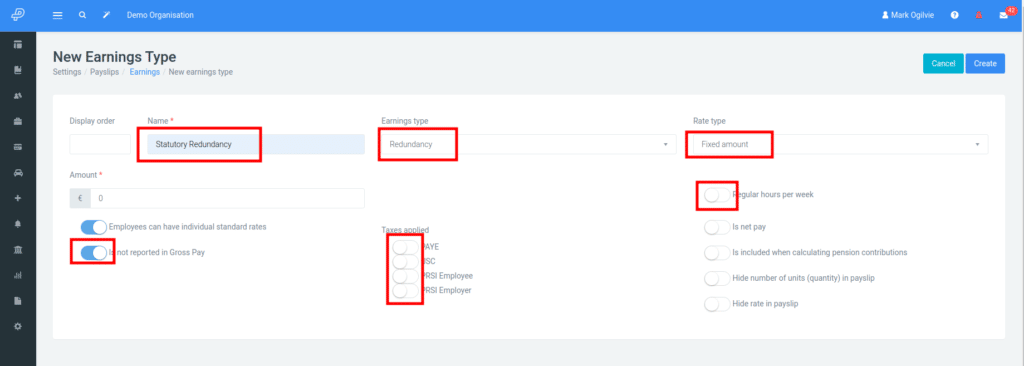

Statutory Redundancy

Select redundancy earnings type, fixed amount rate type. Turn off all taxes, select not reporting in gross pay. Turn regular hours off.

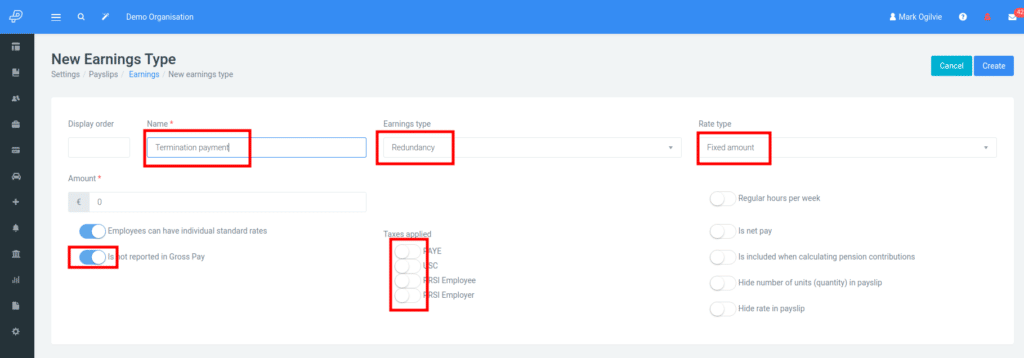

Termination Payment

Basically the same as Statutory Redundancy above.

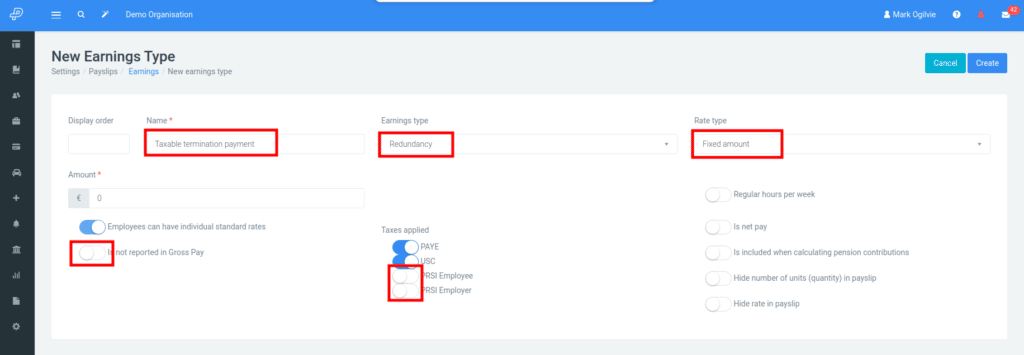

Taxable Termination Payment

For taxable termination payments, turn off PRSI ee and PRSI er, and make sure that the earnings type is reported for gross pay by turning the selector off.