How Can We Help?

Paying Early Over Christmas & New Year

Paying outside of your regular scheduled payment dates can trigger all sorts of complications under real-time reporting.

Historically, it has been done in order to:

- Give staff an early payment to tide them over the holiday period

- Clear the decks for the payroll operator to have a decent break

An employer might have once considered:

- Paying the following year’s first pay run early, before the end of this year

- Paying an additional bonus week at the end of this year

Both of these have significant issues under real-time reporting, that did not exist prior to 2019.

Revenue guidance on General End of Year issues can be found here: https://www.revenue.ie/en/employing-people/documents/pmod-topics/payment-date-alignment-and-general-issues.pdf

But first, some background:

Payment Date According to Revenue

Revenue determines all taxes according to the Date of Payment. This is defined as the day that the money becomes available to the employee.

They are not concerned with when that money was earned.

The pay periods are numbered from the start of the year. A weekly payslip with a payment date between the 1st to the 7th of Jan will be period 1. Payment dates falling between the 8th to 14th incl will be period 2. etc.

For monthly pay runs, any payment date in January will be period 1.

Tax Credits and Standard Rate Cut-Off Points

An employee is entitled to Tax Credits and Standard Rate Cut Off Points (SRCOP) according to their circumstances. They can adjust these on the myAccount website with Revenue.

For weekly pay cycles, the annual tax credit and SRCOP are divided by 52 weeks to get the weekly equivalent values.

Once an employee has applied these tax credits and SRCOP to a pay run, then they are ‘used’. They cannot be claimed again.

So if an employee were to receive two payments, say one on the 1st of January and another on the 5th of January, then the credits and SRCOP for Period 1 must be split over both pay runs. Or, the first pay run would have used all allowances, meaning that the second pay run has no credits or SRCOP available and will be taxed more than the first run.

Period 53

A year is 365 days, which doesn’t divide evenly into 52 weeks. Some years a payroll calendar will actually have 53 weeks.

This occurs when your first payment date is the 1st of Jan, in which case the 53rd-period pay run payment date will be the 31st of December.

In a leap year, you can have a 53rd period with scheduled payment dates of the 30th and 31st of December.

Additional Credits for Period 53

As mentioned earlier, an employee’s annual credits are converted to weekly credits by spreading them over 52 weeks. So by week 52, an employee has used all their credit allowances.

To avoid hardship, and over-taxing in period 53, Revenue allows employees an ‘additional’ period of tax credits if their pay run is a scheduled period 53.

So if your pay run is scheduled to pay on the 31st of December (or the 30th in a leap year) then employees actually receive one year’s worth of tax credits plus an additional period’s worth.

There are a couple of rules to avoid abuse of this concession:

- The 53rd period must be a “normally scheduled” period. You cannot create an unscheduled week 53 and claim additional tax credits.

- The payroll schedule must be consistent over the past two years. You cannot change the schedule each year to claim additional week 53 credits.

Note that payroll systems must report the regular number of scheduled pay runs to Revenue with each payslip. So Revenue does know when a period is scheduled or not.

A period 53 should only occur once every 7 years, or in a leap year. So if an employer consistently has period 53 pay runs with tax credits then Revenue will notice.

Exceptions to Pay In Advance

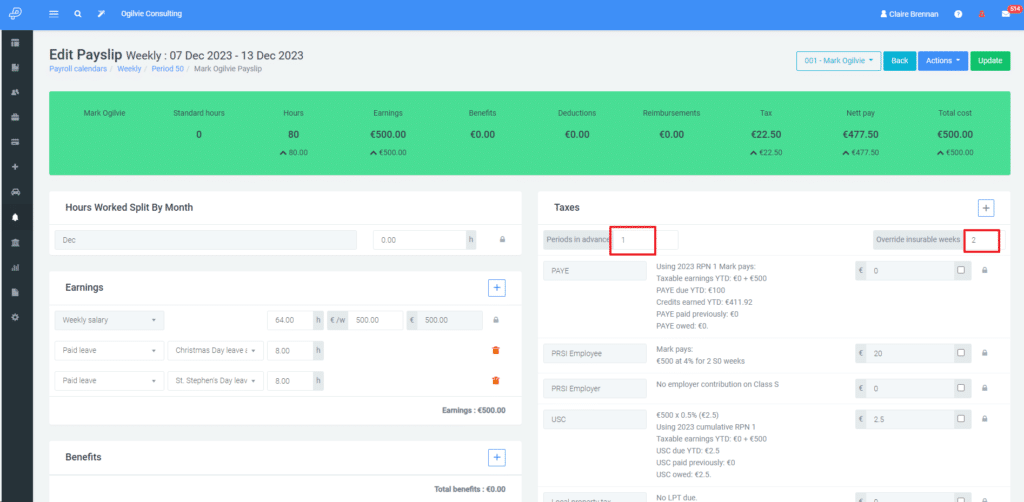

Payroll systems allow you to create a payslip that is ‘paid in advance’. Meaning that the payslip can contain the credits for future pay periods against the income for future pay periods. This allows employees to go on leave, take pay for say the next two weeks, and still be taxed correctly on that amount. The PRSI weeks should also be updated in this case.

The exception is where the ‘paid in advance’ period spans the end of the year.

If this is the case, you need to submit pay runs for the periods in the year in which they fall.

This came into effect when real-time reporting was implemented, in order to correctly track income against the year it is paid.

Exceptions for Bank Holidays

If your scheduled payment date falls on a bank holiday then you are permitted to make the payment on the nearest bank day before the public holiday.

So if your scheduled payment date was the 1st of January then you can make the payment on the day before (31st December) and still submit the pay run as Period 1 of the correct year.

Implications of Paying Early or in Advance

Returning to our scenario of paying an employee early over the Christmas & New Year period.

Remember that it is the payment date that determines the tax period, not when the period covers.

If you pay someone on the 24th of December (period 52), and then pay them early for period 1 of the next year on the 27th of December (also period 52) then as far as Revenue is concerned these are both period 52 payments.

In this case, the period 52 tax credits and SRCOP must be split over both pay runs. The likely outcome is that the employees will be taxed at a higher rate on the second pay run.

Of course, you may then be ‘skipping’ period 1 of the following year, and the next pay period might be period 2. In this case, employees who are on a Cumulative Tax basis will get the benefit of two weeks’ worth of tax credits on that pay run. However, employees on the Week1/Month1 calculation method will not.

There is also the added complication that DSP cap the number of insurable weeks in a year at 52. So by paying someone an early pay run at the end of the year, they will not get the PRSI insurable week as they will be skipping the first period in the next year. You will need to make sure to modify the period 2 pay runs to account for the missing insurable week.

Implications of Paying an Additional 53rd Week

Employee’s are only entitled to a year’s worth of tax credits. If you create additional runs, then they must share the tax credits for the period that the payment falls in.

If you create a ’53rd Week’ with a payment date of the 31st of December or 30th of December in a leap year, then this would fall foul of the rules around scheduled pay runs. The Revenue already know what day of the week payments are normally made from your previous submissions.

As such an employee in a 53rd period is not entitled to any tax concessions for an additional period of tax credits and SRCOP.

This is reasonable, otherwise, it would be possible to create a 53rd period every year and claim more credits than an employee was entitled to.