How Can We Help?

Maternity, Paternity, Parental, and Parents Leave

Leave entitlements

Maternity Leave

All pregnant employees can take maternity leave for a basic period of 26 weeks and up to 16 weeks unpaid regardless of their employment status (full time, part time or casual).

Employees may be entitled to Maternity Benefit depending on their PRSI contributions for 26 weeks only.

An employee accrues public holidays and annual leave as per their contracted hours whilst on maternity leave.

Maternity leave should be mutually agreed between the employee and employer in writing or by using the MB 1 & 2 forms issued by the department of social protection.

Paternity Leave

Paternity leave gives a new parent 2 weeks off work (but not for the birth mother of the child). The leave should start any time in the first 6 months after the birth or placement in the case of adoption.

Employees may be entitled to Paternity Benefit depending on their PRSI contributions.

An employee accrues public holidays and annual leave as per their contracted hours whilst on paternity leave.

Parents Leave

Parents leave gives the parents the right to 7 weeks’ leave to look after their children under 2 years of age born or adopted on or after 1 November 2019.

It was announced in budget 2024 that Parent’s leave will be extended by 2 weeks to 9 weeks from August 2024.

The employee may be entitled to Parents’ Benefit depending on their PRSI contributions.

An employee accrues public holidays and annual leave as per their contracted hours whilst on Patents leave. Parents leave should be mutually agreed between the employee and employer in writing.

Parental leave

Parental leave gives parents the right to take 26 weeks of unpaid leave from work to look after their children under the age of 12.

An employee accrues public holidays and annual leave as per their contracted hours whilst on Paternity leave. Parents leave should be mutually agreed between the employee and employer in writing.

Benefit Entitlement

Depending on PRSI contributions the employee will be entitled to Maternity/Paternity/Parents Benefit which is administered via the Department of Social Protection (DSP).

All of the above benefits are subject to Income Tax, however, they are not subject to USC or PRSI.

Employees can apply for Maternity Benefit using an MB1 form. This form should be completed at least 6 weeks before the commencement of maternity leave.

When the employee applies for Maternity Benefit they can request to have the benefit paid directly to their own bank account or to that of the employer on the MB1 form. If they choose to pay it to their employer then the employer must complete an MB2 form.

There is a dedicated Maternity Benefit Section in DSP and they are very helpful and they pick up their phone! 01 471 5898/ 0818 690 690 maternityben@welfare.ie

The Income Tax amount is taxed by Revenue by reducing the employee’s tax credits and SRCOP on the employee’s RPN. Therefore, if the benefit is being paid directly by DSP to the employer and then passed onto the employee via payroll, no Income Tax should be applied to the actual benefit payment on the payslip.

Employer top-ups, or additional pay that wasn’t provided by the DSP, should be taxed as normal.

How to process the payslip

When the Benefit is paid directly to the Employee. (no payment or top-up payment by Employer)

If you are using Parolla to keep a track of annual leave and public holidays for all employees then you should create payslips for the employee on maternity/paternity/parents leave.

(If you are using another HR system/software to document annual leave and public holidays then their employee payslip can be deleted from the pay run.)

Create the leave item

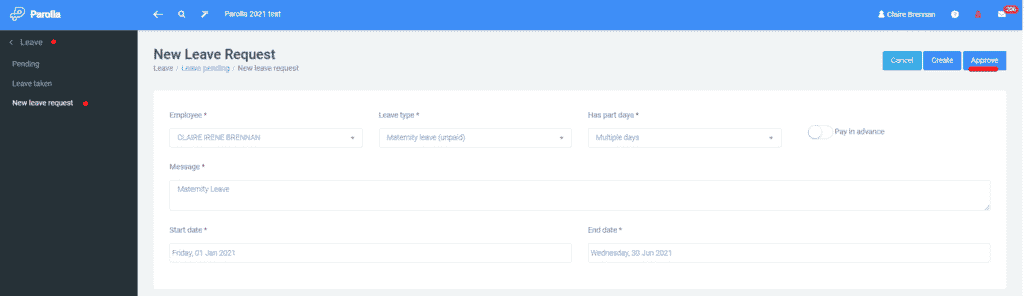

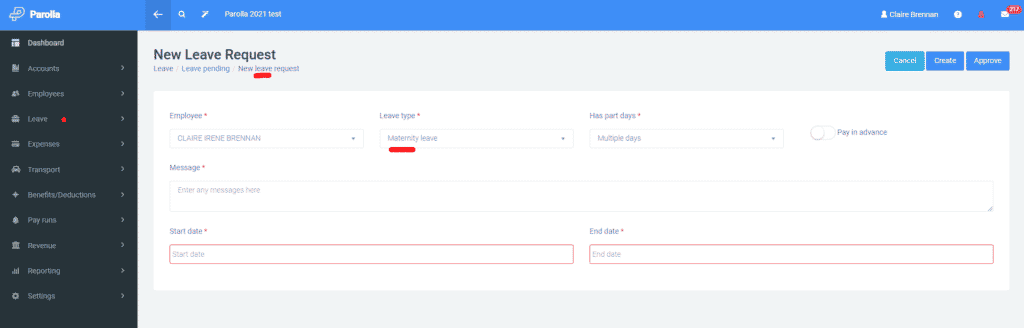

In the menu, choose Leave and New leave request and fill in the details of the leave type and dates.

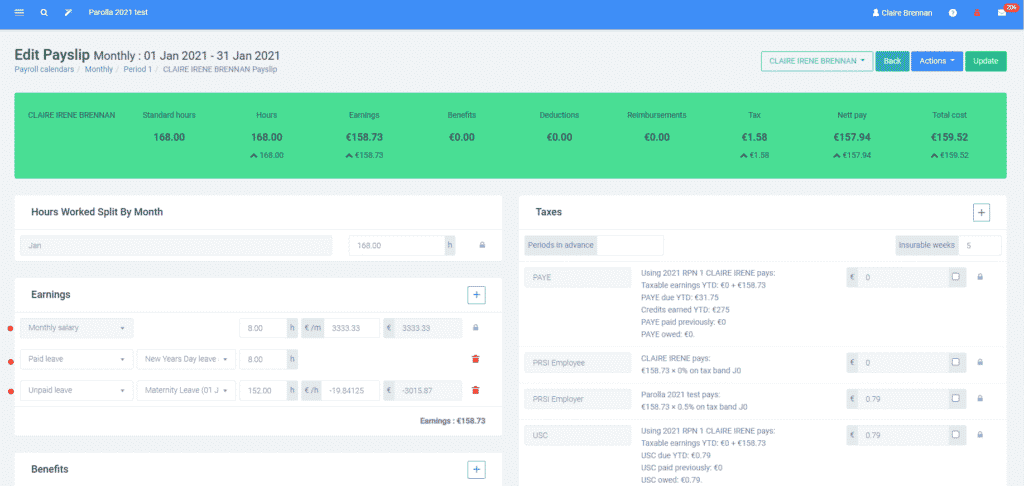

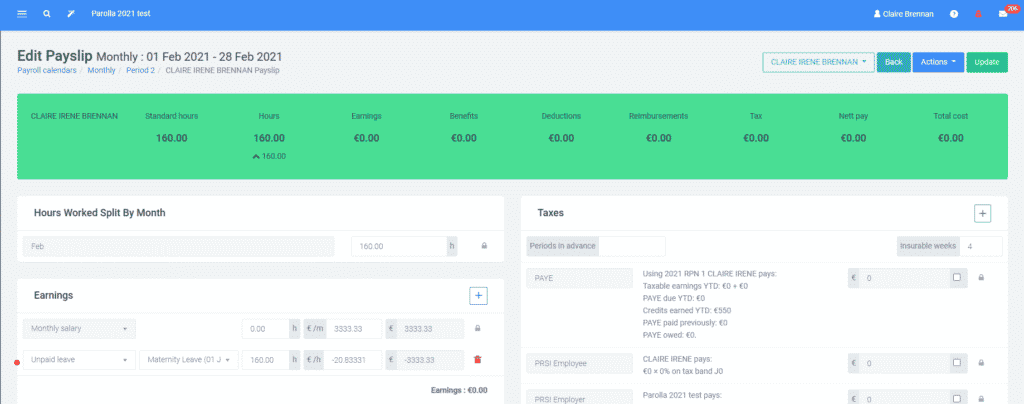

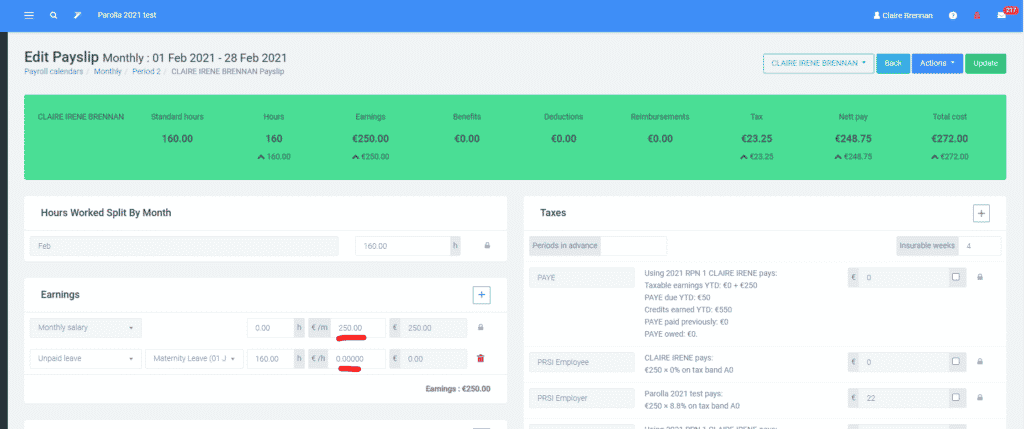

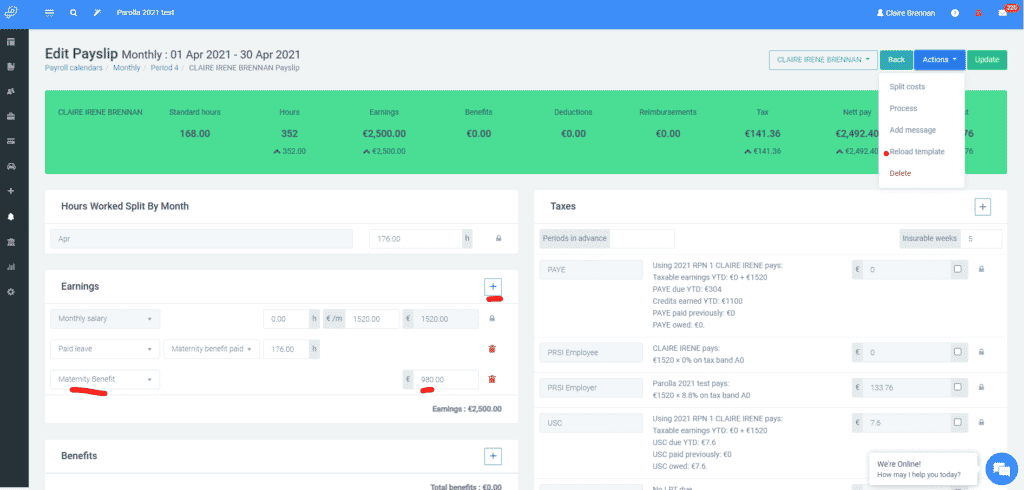

Below is an example of a payslip for a salaried employee. (Remember to reload the payslip if you had previously opened/built the pay run). If paid weekly the hours worked split by month should equal the total hours in the earning section of the payslip.

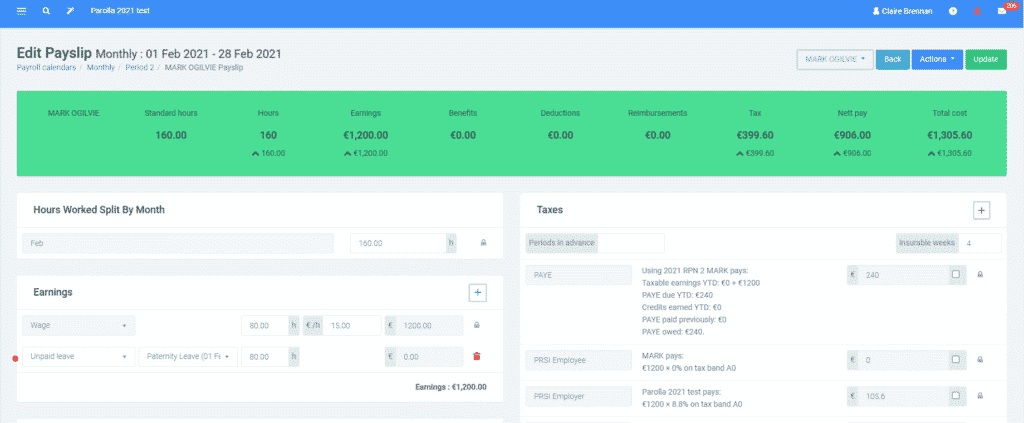

Below is an example of a payslip for an hourly waged employee.

Where The Employer Continues to Pay the Employee

If the salary continues, even partially, input a zero value for the rate for unpaid leave and input the top-up amount in the monthly salary section.

Where the Benefit is paid directly to Employer from DSP

In this case, the employee applies for the benefit and chooses for it to be paid directly to the employer. The employer must then complete an MB2 form.

The DSP will confirm eligibility for the benefit and inform Revenue to adjust the employee’s SRCOP (Standard Rate cut-off point) and tax credits for PAYE via the RPN. Therefore no PAYE, PRSI, or USC should be applied to the benefit.

Create the leave item first. In the menu, choose Leave and New leave request. Fill in the details of the leave type (maternity leave paid) and dates.

Create a New Earnings Type

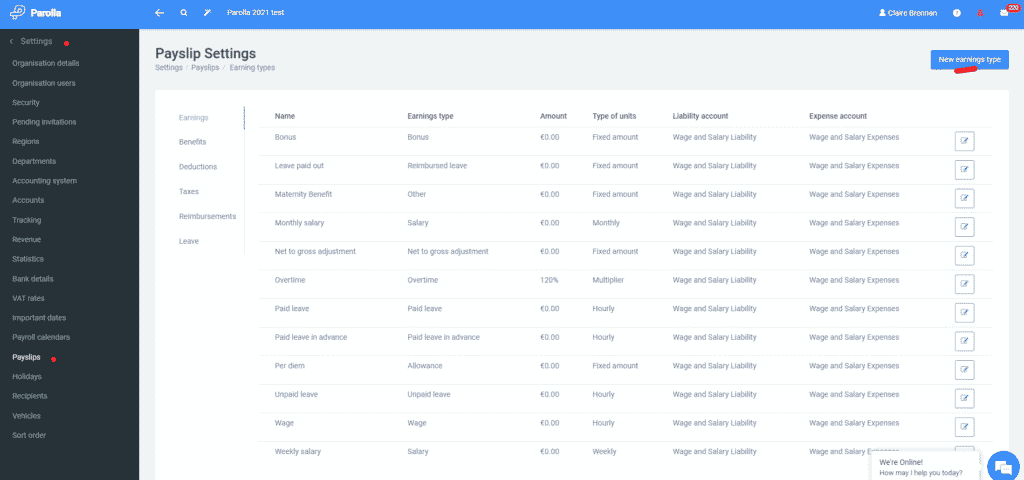

Go to Settings > Payslips and choose New earnings type

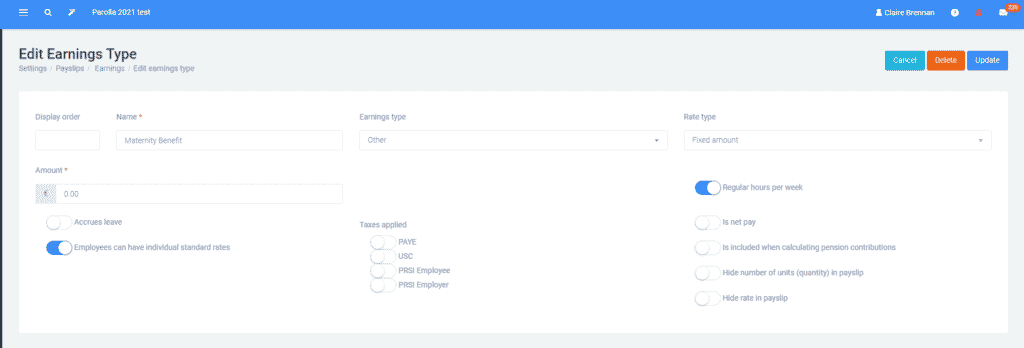

Set up the earnings type as per the example below and ensure that PAYE, PRSI, and USC are not applied.

Return to the pay run and edit the payslip. You may need to reload the payslip for the paid leave item to appear.

Next, add the maternity benefit line and input the amount that has been paid from DSP for that period (€250 per week).

Lastly, adjust the salary amount to include the top-up to ensure the total earnings are at the agreed amount.

The paid leave item should remain as the hours required to calculate leave entitlement.

Public Holidays

If a public holiday occurs during the leave period the employee is entitled to payment for these days. They can either be paid at the time, as per the payslip below or accrued until the employee returns.