How Can We Help?

Employee Deductions

Sometimes it is necessary to make employee deductions from payslips. Some examples might be:

- Employees that were over paid in previous periods.

- Tools or courses purchased by the company and repaid overtime by the employee.

The types of deductions are generally either a Gross Deduction or a Net deduction referring to whether the money is deducted before or after tax calculations.

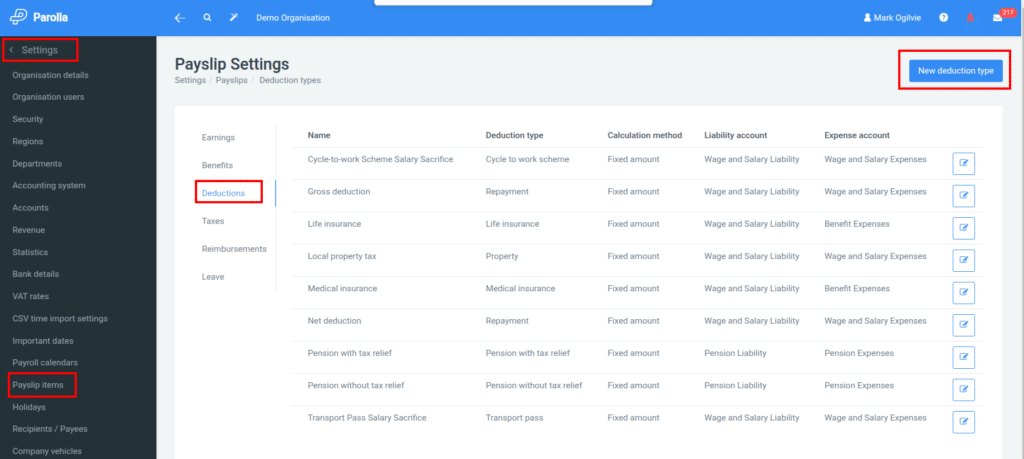

Creating Deductions

You can add deduction types under Settings > Payslip items > Deductions.

The deduction should be named something generic to apply to many scenarios, or something specific so suit your business.

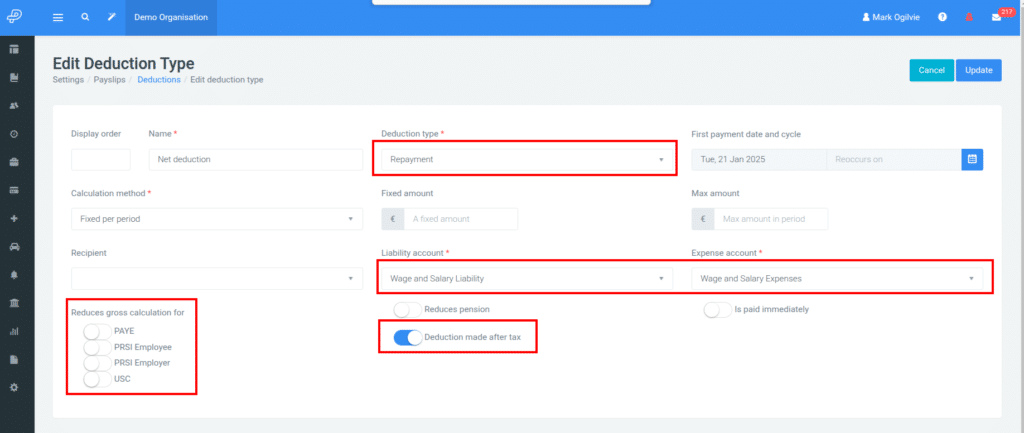

Net Deduction

A net deduction should not reduce gross taxable values. Make sure that the tax collection switches are turned off. And that the net deduction switch is on.

The Deduction Type might be a Repayment for example. The Calculation Method would be a Fixed Amount Per Period/Payslip.

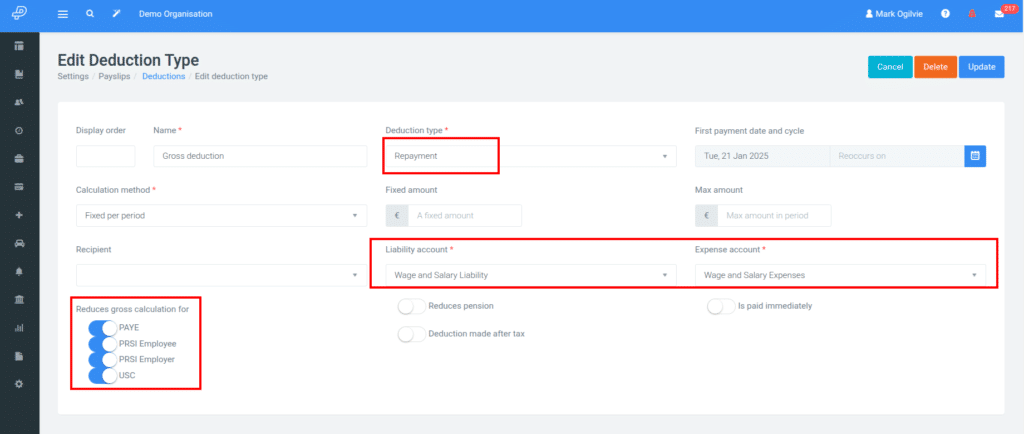

Gross Deductions

A gross deduction is where the amount is deducted from the employee gross pay before taxes. Therefore the taxable income for the employee is reduced.

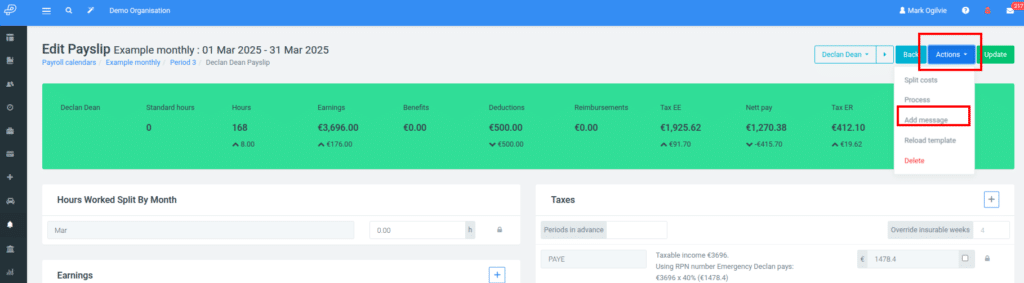

Adding Notes

If you have a generic description on the deduction then it would be useful to add a note to the payslip explaining the reason for the deduction.

This note, or message, will be added to the employee PDF payslip as well as to the email that goes out to the employee.

Keeping Track Of Deductions

If the deduction is going to be a recurring one, you might consider adding it to the employee Payslip Template, so that it gets built in each pay run.

If the value is to be repaid over time you might also set a Balance Tracking on the deduction. See our guide on Balance Tracking here.

Alternatively, add a Note to the employee so that it raises a flag on the scheduled repayment date. See our guide on Employee Notes here.

Examples

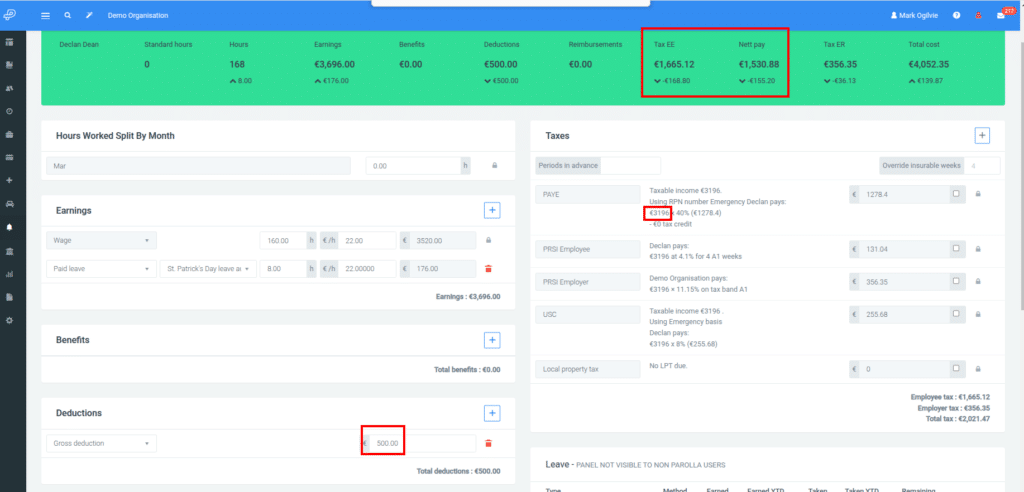

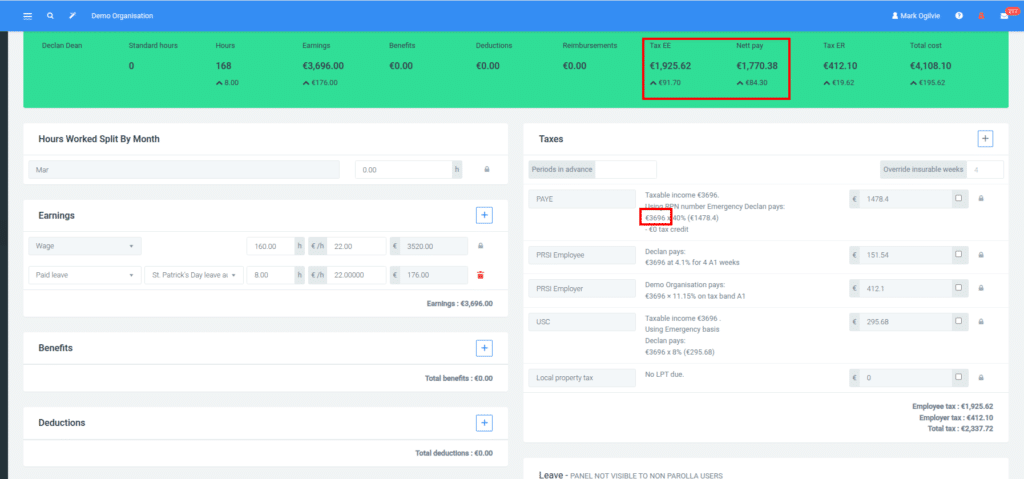

Take the following pre-deduction payslip as an example:

Normally the employee has a taxable income of €3696, an employee tax amount of €1925.62 and a net take home pay of €1770.38.

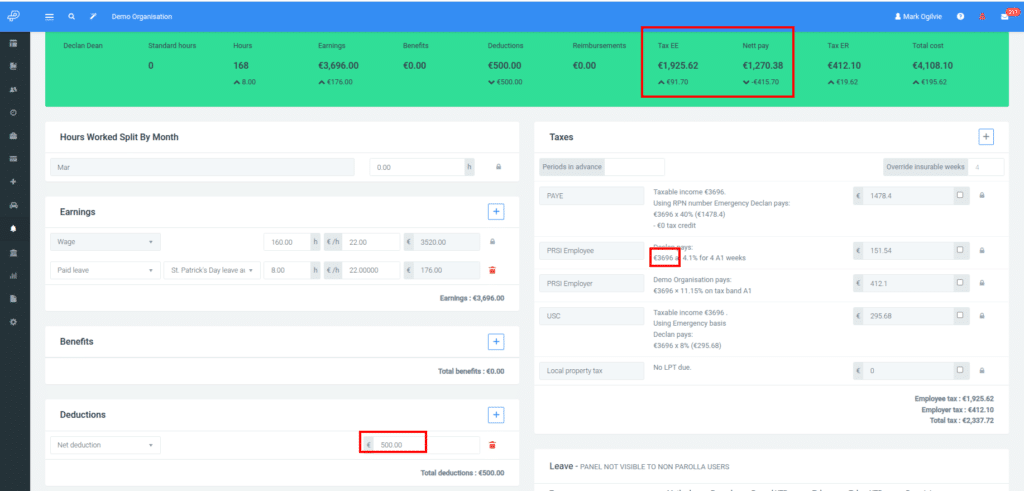

If we apply a €500 net deduction, their gross taxable income and taxes deducted remain the same. However, their net pay reduces to €1270.38, a reduction in take home of €500.

If we apply a gross deduction the employee taxable income is reduced, their tax is reduced, and the actual net pay only goes down to €1530.88. The net take home pay is €239.50 less.