How Can We Help?

EWSS Public Health Restrictions

Those businesses who were directly impacted by the public health restrictions introduced in December 2021 will be eligible for an additional month of EWSS supports at full rates.

The EWSS scheme had been scheduled to move to a reduced subsidy rate of €203 per eligible employee on the 1st of February. Down from the previous banded rates of between €203 to €340, depending on the employee Gross income.

Existing Dates For Unaffected Businesses

This remains unchanged for those businesses not Directly impacted by the December public health restrictions. Those rate are:

| Gross pay per week | 20 Oct 2020 to 31 Jan 2022 | 01 Feb 2022 to 28 Feb 2022 | 01 Mar 2022 to 30 Ap 2022 |

| Less than €151.50 | No subsidy applies | No subsidy applies | No subsidy applies |

| €151.50 – €202.99 | €203 | €151.50 | €100 |

| €203.00 – €299.99 | €250 | €203 | €100 |

| €300 – €399.99 | €300 | €203 | €100 |

| €400.00 – €1,462 | €350 | €203 | €100 |

| Over €1,462 | No subsidy applies | No subsidy applies | No subsidy applies |

New Dates For Directly Affected Businesses

Businesses that were required to limit their trading as a result of the public health restrictions will stay at the higher rates of subsidy for one month longer than the rest of the eligible businesses.

| Gross pay per week | 20 Oct 2020 to 28 Feb 2022 | 01 Mar 2022 to 31 Mar 2022 | 01 Apr 2022 to 31 May 2022 |

| Less than €151.50 | No subsidy applies | No subsidy applies | No subsidy applies |

| €151.50 – €202.99 | €203 | €151.50 | €100 |

| €203.00 – €299.99 | €250 | €203 | €100 |

| €300 – €399.99 | €300 | €203 | €100 |

| €400.00 – €1,462 | €350 | €203 | €100 |

| Over €1,462 | No subsidy applies | No subsidy applies | No subsidy applies |

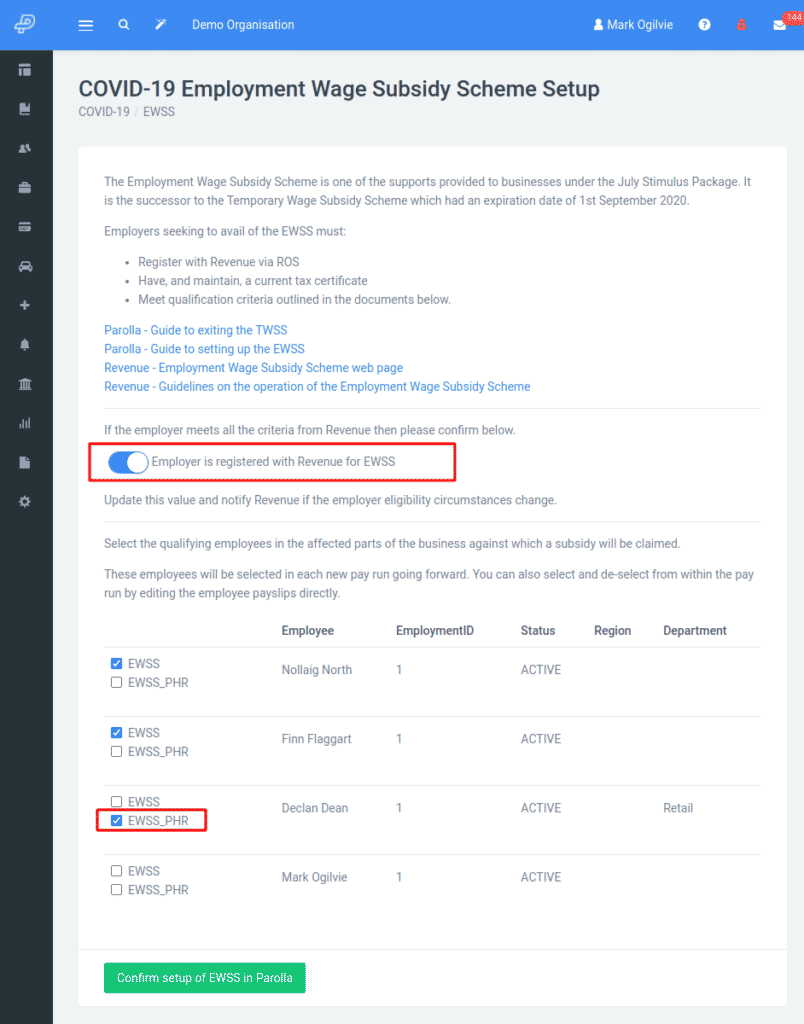

How To Select EWSS PHR In Parolla

The process for claiming the extended EWSS subsidy remains largely similar, and can be entered under the wizard menu in the top left of the navigation bar.

In your declaration within Parolla, instead of selecting EWSS on or off, now you must select which version of EWSS you are claiming for:

The submission to Revenue will claim the highest subsidy level of whichever you select. So if you select both EWSS subsidies, only the EWSS_PHR will be submitted.

All other processes are as normal, however there is a small catch.

Limitations

The EWSS PHR entitlement applies to any eligible employer and qualifying employee with a payment date on or after 1st Feb 2022.

However, The Revenue Systems will be unable to accept or process the new rates until after the 4th of Feb 2022.

Their advice is the submit your pay run as normal, on or before the date of payment, and then to make amendments to that pay run after the 4th of February.

If your business is eligible, and your pay payment date is between the 1st to the 3rd of February (inclusive) then you should select the EWSS_PHR rate and submit as normal. Parolla will apply the standard EWSS rate.

You must then resubmit the pay run again, on or after the 4th of February, at which point Parolla will resend the submission with the desired EWSS PHR rate. You do not need to make any changes to the pay run. Just resubmit it.

For more information please see Citizens Advice, and The Revenue.

You can also see your earlier documentation here.