How Can We Help?

Enhanced Revenue Reporting for Employer-Provided Gifts and Benefits

This guide provides instruction on Enhanced Revenue Reporting for Employers provided gifts and benefits outside of the payroll cycle.

In 2024, the introduction of the Enhanced Revenue Reporting system mandates a new level of transparency for employers. This system requires detailed reporting of various gifts and benefits provided to employees. Understanding and complying with these requirements is crucial for businesses to avoid any legal pitfalls.

Key Features of the Enhanced Revenue Reporting System

- Categorisation of Gifts and Benefits: Employers are now required to categorise and report any non-salary compensations, including gifts and benefits, to their employees.

- Timely Reporting: It is essential to report these compensations on or before the date they become available to the employee. This ensures that all benefits are accounted for in a timely manner.

- Historical Overview: While the taxation and reporting legislation for such benefits has existed for some time, adherence has been lax. The new system aims to rectify this oversight.

- Using Parolla for Streamlined Reporting: Our solution, Parolla, simplifies this process. It includes a dedicated ‘Other Compensations’ page, specifically designed for reporting these benefits separately from the standard payroll cycle.

Step-by-Step Guide to Using the Other Compensations Feature in Parolla

Prerequisites

Before making an ERR submission to The Revenue you will need to have defined which of your benefits are required to be reported under The Revenue defined Sub Categories. To review this setup please read our guide here.

Accessing Other Compensation Screen

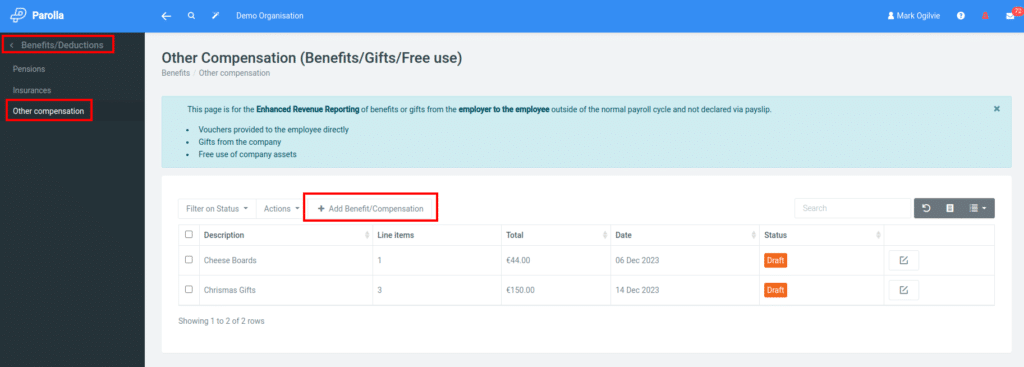

Navigate to the ‘Other Compensations’ menu on the left side of the Parolla interface, located under ‘Benefits/Expenses’.

Creating a New Compensation Event

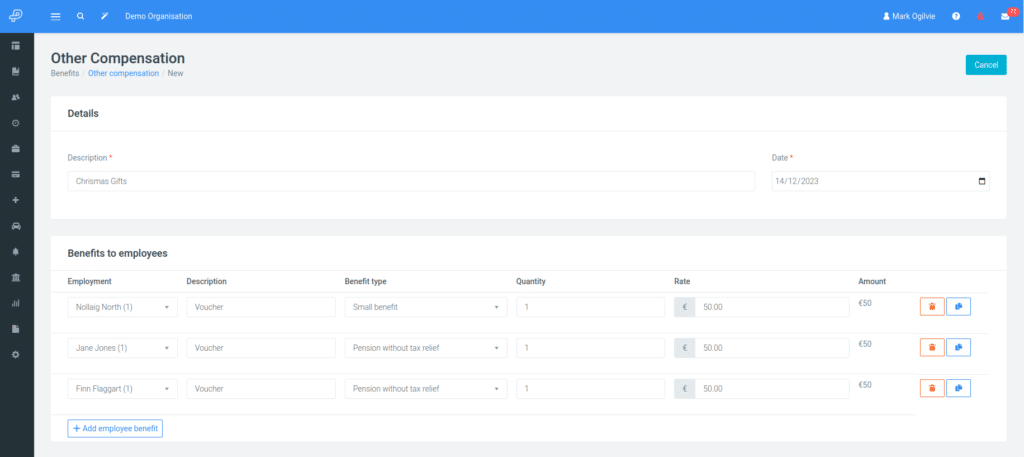

Set up a new event, naming it and specifying the date when the benefits will be available to the employees.

For each employee, add a line item detailing the benefit, its type, quantity, and cost per item.

Finalising and Submitting

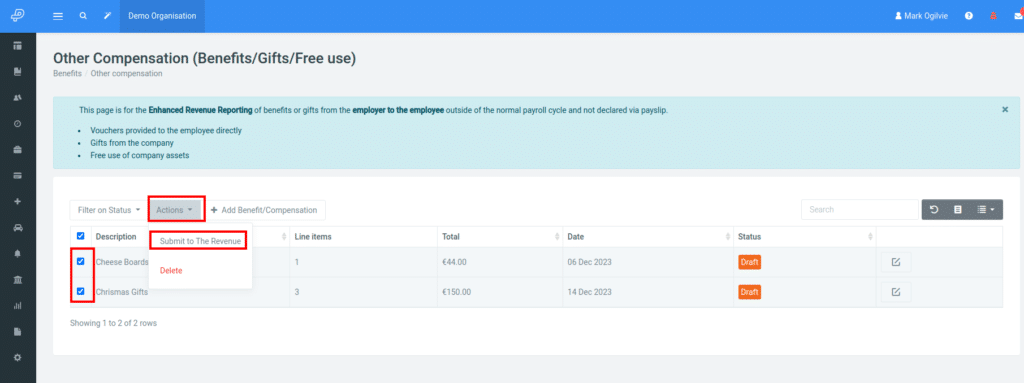

Once the Other Compensation entry is complete, save and submit it to the revenue authorities, ensuring this is done before the benefits are made available to the employees.

Conclusion

Adhering to the Enhanced Revenue Reporting guidelines is vital for businesses in 2024. By accurately reporting gifts and benefits using tools like Parolla, employers can ensure compliance and maintain transparency in their financial reporting. This guide aims to simplify the process and help businesses stay ahead in their reporting obligations.