How Can We Help?

Creating New Earnings Types and Payslip Items

This guide is about creating new earnings types and payslip items for your organisation in Parolla. There are a number of important considerations when creating new earnings types and payslip items. These include whether it is subject to tax, consideration for pension contributions, and the accrual of annual leave.

It is important to note that if an earnings type or payslip item is not set up correctly, it will have financial implications for the employer, employee, and financial obligations to Revenue.

Please consider this when using this guide.

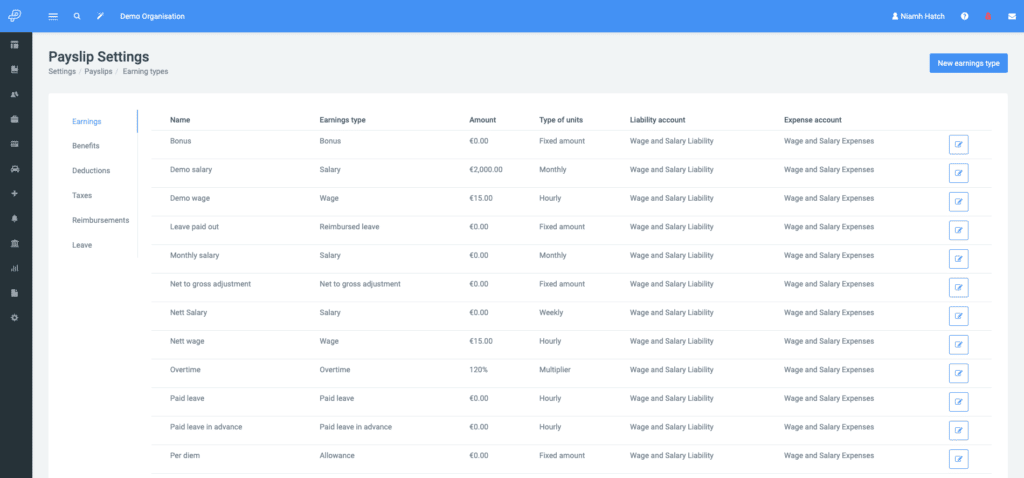

Where to find Earnings Types and Payslip Items

To access the Earnings Types page, go to the left-hand menu > Settings > Payslips.

Any earnings, benefits, deductions, taxes, reimbursements, and leave types are created here.

How to Create a New Earnings Type

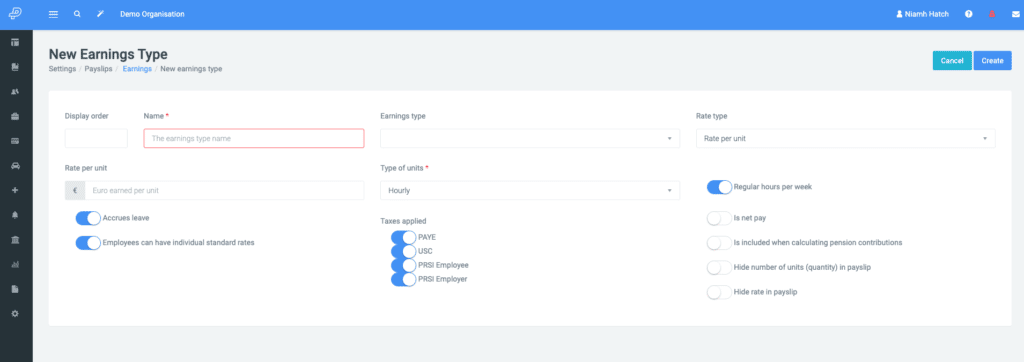

To create a new earnings type, click on the New earnings type button in the top right of the page.

This page gives all the options that need to be considered depending on the type of earning to be set up.

For example, Overtime will accrue Annual Leave as this is worked time. However, Commission will not accrue Annual Leave as it is not time worked, rather it is generally performance/sales based.

Depending on the Earnings type used from the drop-down menu, options for setup will change.

Once all relevant information is entered, click on the Create button in the top right.

An important note is that once an Earnings Type has been created, it should not be deleted.