How Can We Help?

View and Download a Payslip

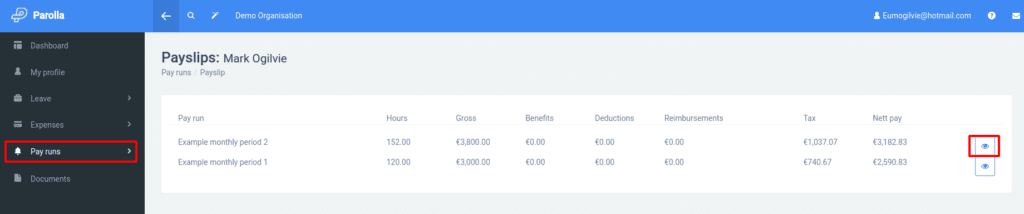

In the left-hand menu, choose the Pay runs link, and then select your pay run. This will direct you to the pay run page below:

This is a table summary of all your payslips. You can view the actual payslip itself by clicking on the view icon to the right of the payslip summary.

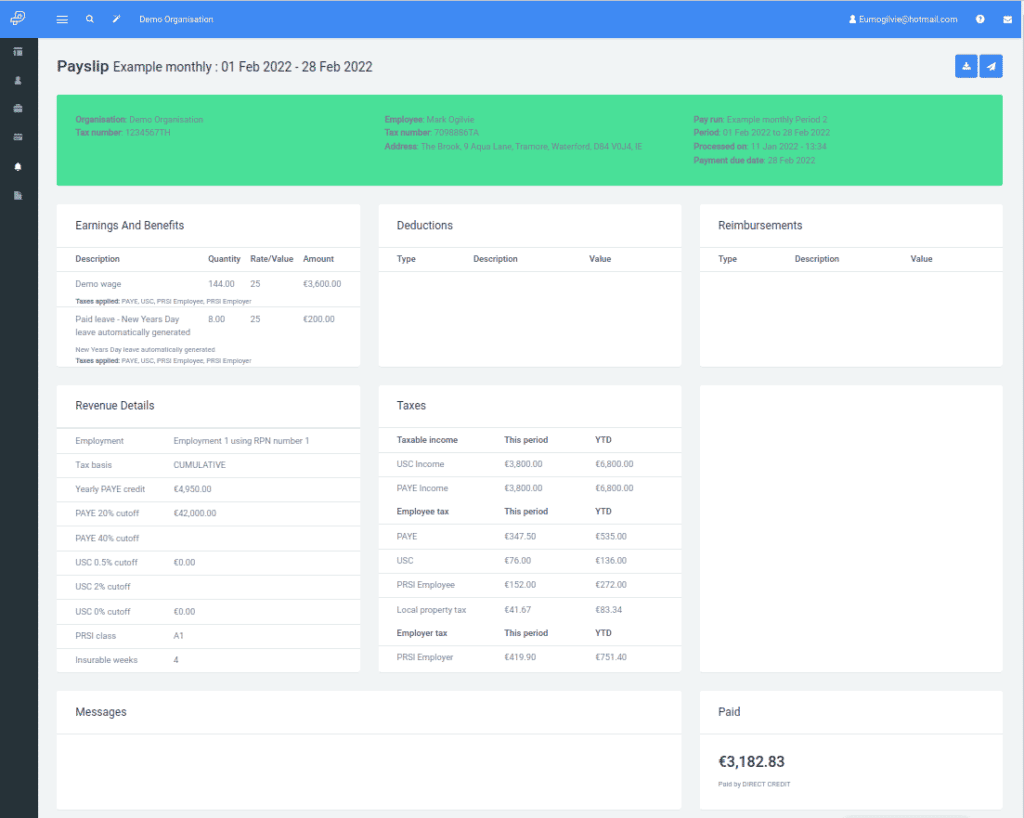

Viewing the Payslip

The top panel of the payslip (in green) contains a summary of the employer & employee basic details, as well as a summary of the dates that the payslip covers, was processed on, and is due for payment.

Earnings and Benefits

The earnings and benefits box contains a list of all earnings and benefit payslip elements. Each element might contain a fixed amount, rate per unit, and quantity of units, along with a Gross amount being paid.

Each line item also tells you what taxes are being applied.

Deductions

The deductions and items that have come off your gross pay, such as employee pension deductions, salary sacrifice amounts, transport sacrifices, etc.

Each line item also tells you whether that deduction was made before or after taxes.

Reimbursements

The reimbursements are for items like General Expenses paid back to the employee by the organisation, or for Expense Claims made through the Parolla software.

Revenue Details

The Revenue details box contains information on the tax basis that this payslip was calculated. It itemises the method of calculation, the tax band percentages applied and the band cut-off points. It also records the insurable weeks for this pay run only, and at which class.

Taxes

The taxes box keeps a track of the taxes deducted in this payslip, and this tax year to date.

Messages

Your employer can pass group messages to everyone in the pay run, and personal messages specific to individuals in this box of the payslip.

Paid

The net pay element is in the bottom right, along with the details of how the payment was made.

Downloading the Payslip

There is a link in the top right of the page to download a PDF version of the payslip. The PDF file is encrypted with the PPS number of the employee.

If you don’t have a PPS number then the password will be the employee ID allocated by the employer.

Emailing the Payslip

The PDF payslip can be sent by email to the nominated employee email address on the Employee Details page.