How Can We Help?

TWSS Reconciliation

Purpose

The Temporary Wage Subsidy Scheme was reasonably complex, went through multiple phases and relied heavily on payroll software and employers to calculate the level of subisdy.

This was largely due to the speed at which the scheme was rolled out, and it was accepted that there would be over and under payments as a result.

The TWSS reconciliation process is the Revenue means of collecting information about what was actually paid by employers to employees on behalf of the government.

The process is split into two stages:

Stage 1 – Every employer on the scheme needs to report what was paid to employees by way of a subsidy. This should be done by October 14th 2020.

Parolla automatically reconciled all J9 TWSS payslips for our customers on 1st weekend of October. No further action is required.

Stage 2 – Revenue will issue statements outlining what they consider should have been paid out including a balancing statement line. This is tentatively scheduled for November 2020.

Stage 1 – Uploading subsidy data

The transition stage of the TWSS scheme required that employers calculate the ARNWP for each employee, and only pay out the level of subsidy that the employee was entitled to.

Revenue paid every employer the equivalent of a max subsidy regardless of what the employee was paid. The employer was supposed to ring-fence the difference and pay that back to Revenue when the scheme finished.

The ARNWP calculation was complicated and open to significant errors.

Furthermore, Revenue’s servers were initially unable to accept any information about how much subsidy was actually paid.

This feature was added in May of 2020, and was adopted by some payroll software, but not others. Parolla has been reporting subsidy paid since May 2020.

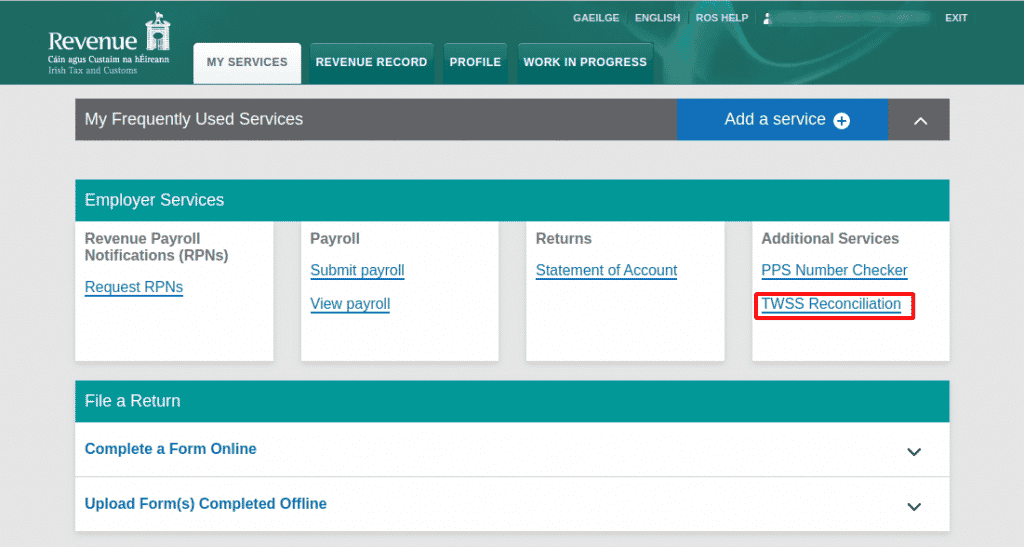

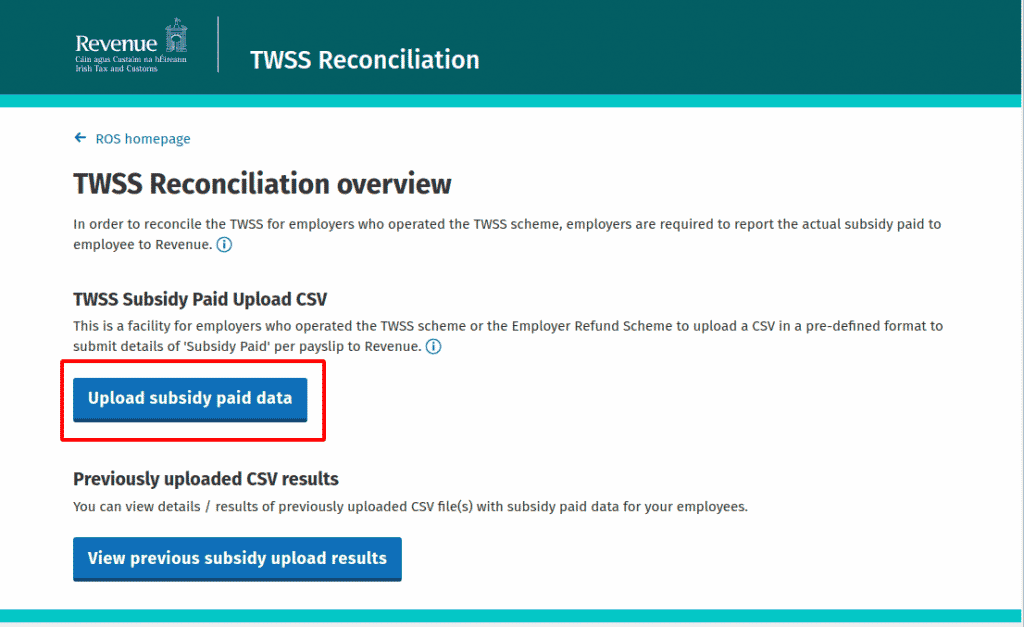

Employers can submit their payslip subsidy amounts to Revenue by:

- Direct Method re-submission

- CSV file upload

We use the Direct Method connection to Revenue’s servers. So Parolla automatically ran the Stage 1 TWSS reconciliations on the weekend of the 3rd October 2020.

No action is required from our users, other than the check their balances in ROS.

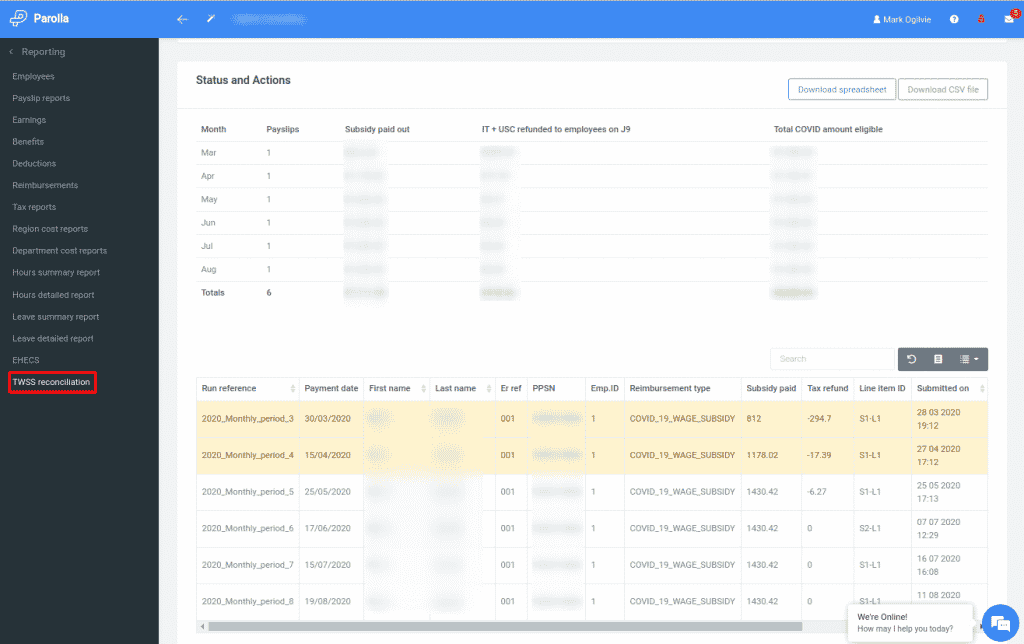

We also support CSV file upload, and have created page under Reporting >TWSS reconciliation where an employer can:

- View monthly balances

- View all submission payslip lines

- Download an excel of all subsidies

- Download a CSV file for upload to ROS

Uploading Subsidy Paid Data To Revenue

You can update the Revenue data by either resubmitting the payslip via Parolla, or by generating a CSV file containing all subsidy line items.

Stage 2 – Statements

Stage 2 is the settling of monies owed. Revenue first need to collect all the information from Stage 1 and then create a statement.

We expect this to occur sometime in November 2020.