How Can We Help?

How to Process a Post-Cessation Payslip

This guide will explain what a Post-Cessation Payslip is and how to process it for an employee who has been ceased.

What is a Post-Cessation Payslip?

A post-cessation payslip is a payslip that is processed after an employee has left employment with an organisation. Their cessation date should have already been reported to Revenue on their final payslip in a previous period as per the Ceasing Employments guide.

Post-cessation payments can occur due to several reasons, for example, Commission payments which could not be calculated in time for the final payslip or unpaid leave owing.

You can find more information on Revenue’s website by following the link.

Accessing the Existing Employee Profile for Ceased Employees

An employee should only have one Employee Profile. They can have numerous “employments” within this profile. A subsequent profile should therefore not be set up for ceased employees.

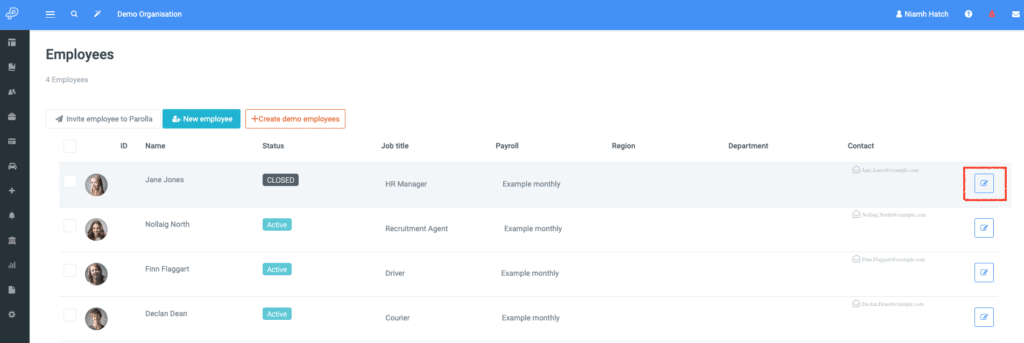

To access an existing profile for a previously ceased employee, go to the left-hand menu > Employees > All Employees.

Click the Edit button beside the returning employee to open the profile.

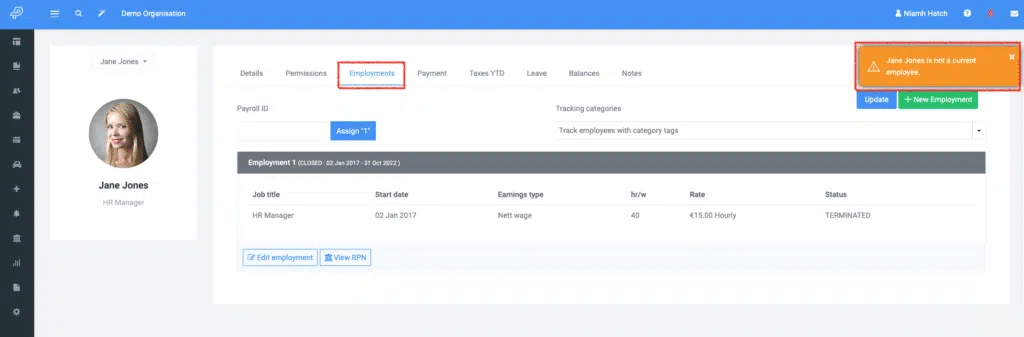

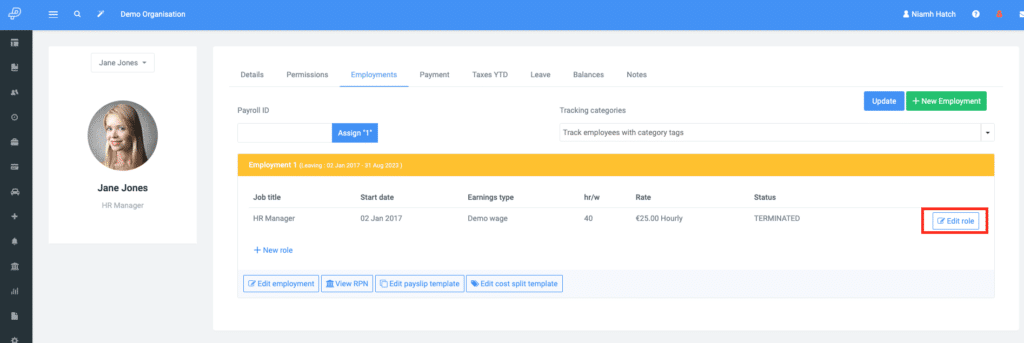

Choose the Employments tab from the top menu. An orange pop-up box notifies that the person is not a current employee.

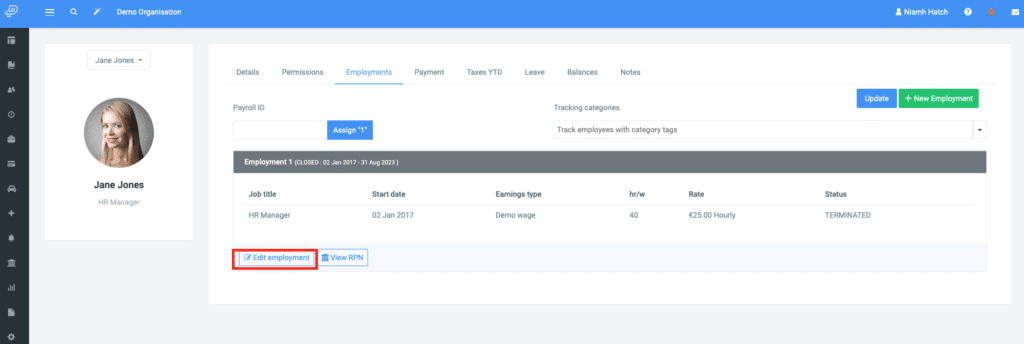

When choosing an Employment to temporarily re-activate, it should be the latest Employment which will be the top Employment box; as above, this is Employment 1.

Two places need to be changed to re-activate an employment; Employment and Role, in that order.

Click Edit Employment.

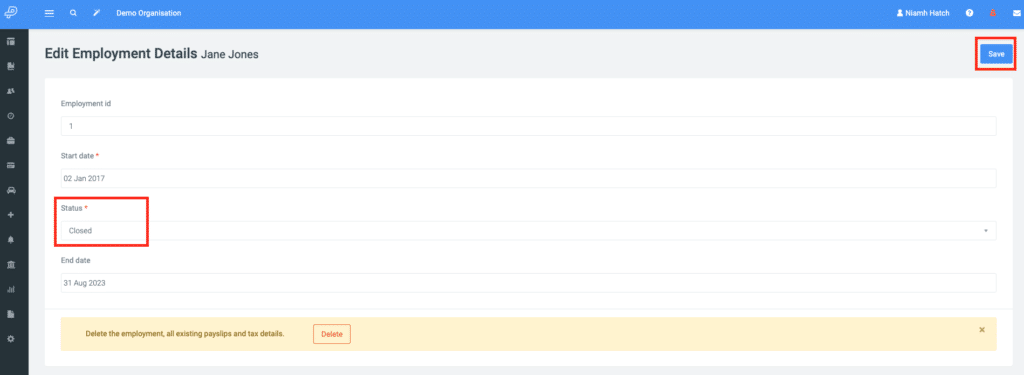

On the next screen, change the Status to Leaving and click Save in the top right corner.

You will be returned to the previous Employments tab screen where the Edit Role button is now available.

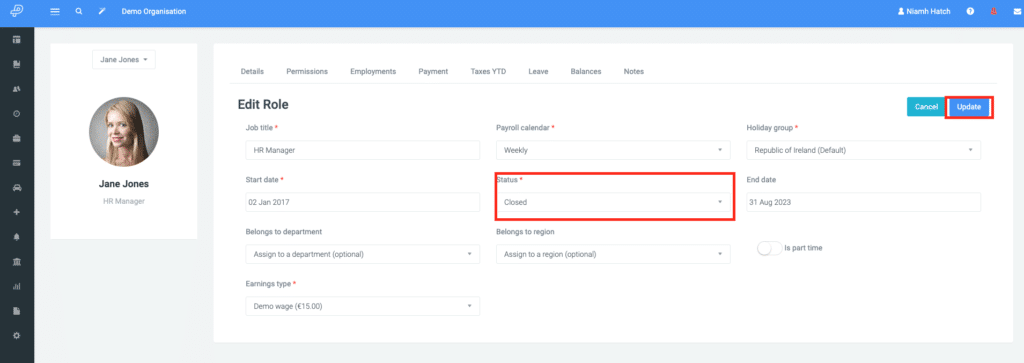

Click Edit Role and on the next screen, change the Status to Leaving and click Update in the top right.

The employee is now Active and can be added to a pay run.

How to Process a Post-Cessation Payslip

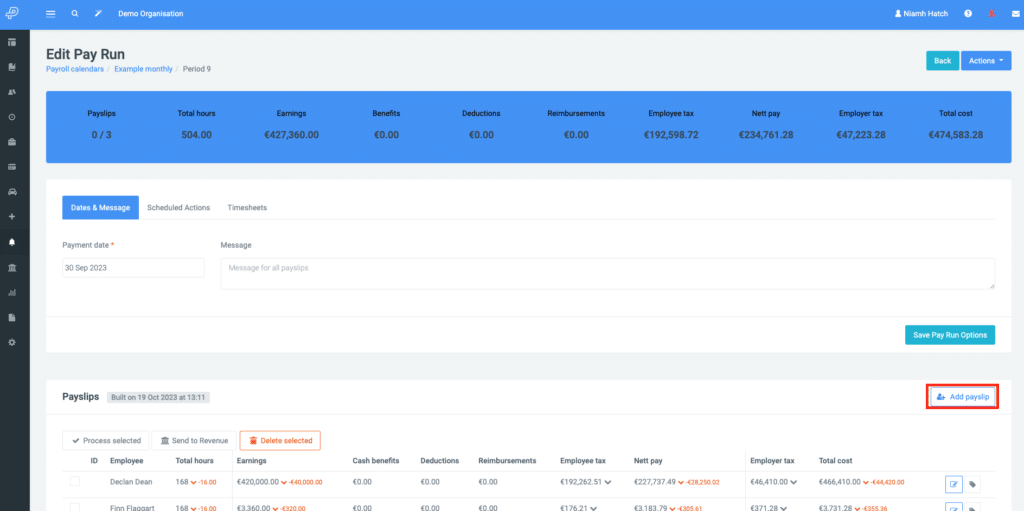

Open the pay run you want to add the payslip to and click on Add Payslip. The employee will appear in the drop-down menu.

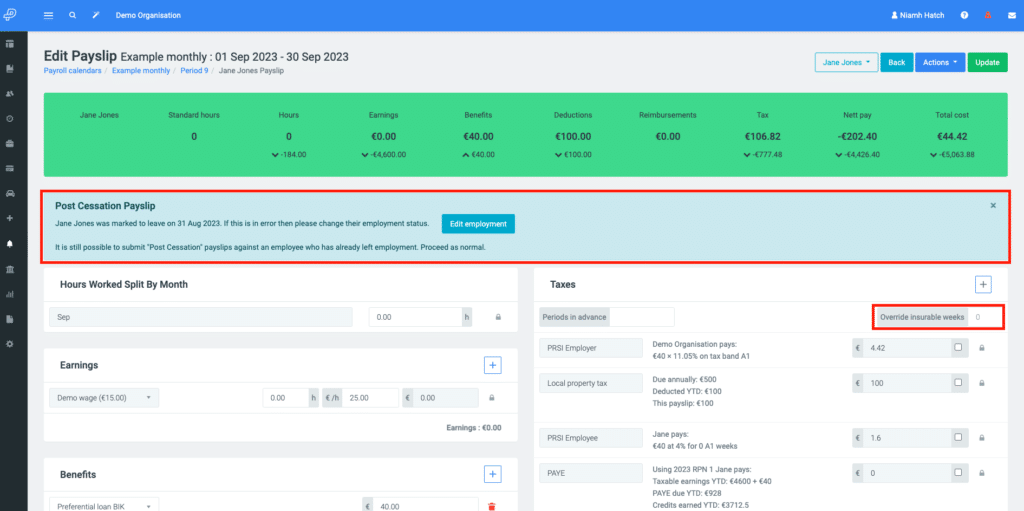

When the payslip is added to the pay run, it will show a note it is a Post-Cessation payslip.

If the payment is not related to time worked (not previously reported), the insurable weeks should be zero.

Tax Implications for a Post-Cessation Payslip

Taxation of a post-cessation payslip will depend on whether the ceased employee has moved all their tax credits and SRCOP to another job or removed them from their employment with your organisation.

If it is a case that the employee has no tax credits or SRCOP allocated to their employment with you, you can select an older RPN from the RPN page to reduce the applicable tax.

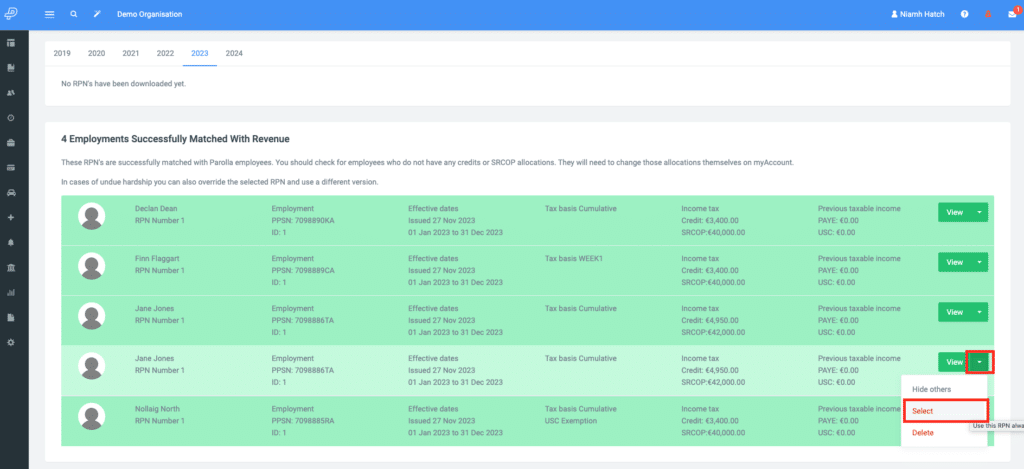

To choose an older RPN, go to the left menu > Revenue > Revenue Payroll Notifications.

Click the down arrow beside the employee, choose Show Others, and Select the last RPN that was used for their employment.

Once you have processed and submitted the post-cessation payslip for the past employee, the last step is to return to the employee profile and change the Status to Closed in the Role and lastly in the Employment.