How Can We Help?

Enhanced Reporting Requirements(ERR) Setup

This is a guide for setting up Enhanced Reporting Requirements in your organisation.

Parolla offers an adaptable system for customising payslip items and elements to match your company’s needs. Payslip items that are tagged as ERR within a payrun will be reported to Revenue as part of the payroll submission.

What you need to do to become ERR compliant

- Review and decide which benefits, allowances and travel and subsistence you must now report.

- Ensure your ROS certificate that is linked to Parolla is ERR enabled.

- Download your ERN’s within Parolla.

- Ensure the benefits, allowances and earnings payslip settings you are using in Parolla are ERR enabled.

Review your Benefits & Allowances

Starting in 2024, The Revenue has established a variety of categories and subcategories for reporting:

- Small Benefit Exemption: You’ll need to report the value of the benefit and the date it was given to the employee or director. Employees are permitted up to two benefits untaxed, not exceeding €1000 in the year for 2024. From January 2025 employees are permitted up to three benefits untaxed, not exceeding €1500 in the year.

- Remote Working Daily Allowance: Report the total number of remote working days, the amount paid, and the payment date. Employees are permitted €3.20 per day, however there is a maximum defined by the number of days.

- Travel and Subsistence: For each subcategory (vouched/unvouched travel, vouched/unvouched subsistence, site-based employees, and emergency travel), report the amount paid and the date of payment.

These categories may be updated in the future.

ROS Certificate

All ROS Admin certificates have ERR reporting permissions as standard. Any Sub-user certs need to be updated to ERR enabled in the admin area of ROS.

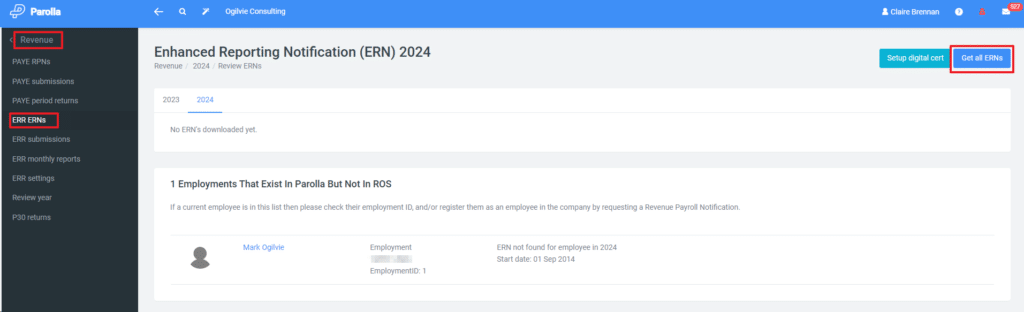

Download the ERN within Parolla

Parolla Payslip Settings for ERR

If you are using Parolla for the first time from the 1st January 2024 the relevant earnings, benefits and reimbursement types have been automatically tagged for ERR reporting.

If you have created customised earnings, benefits or reimbursements types on Parolla in the past and you wish to keep using them you will need to tag them for ERR as per below.

If you have never created any customised earnings, benefits or reimbursements types on Parolla you can use the newly created codes.

To check that all codes under your company profile are ERR enabled and tagged correctly use method 1 below.

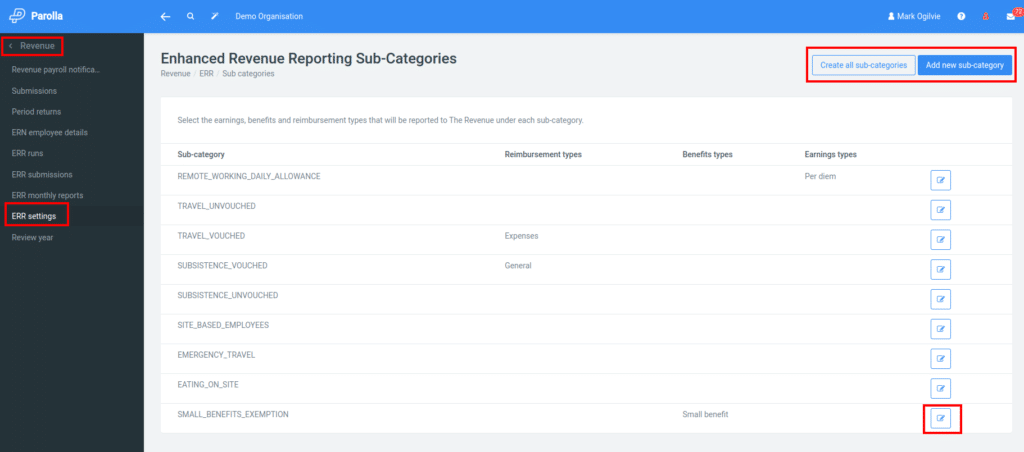

Method 1: Mapping and Reviewing all Benefits, Earnings, and Reimbursements

- Go to Revenue > ERR Settings.

- Create All or add Sub Categories

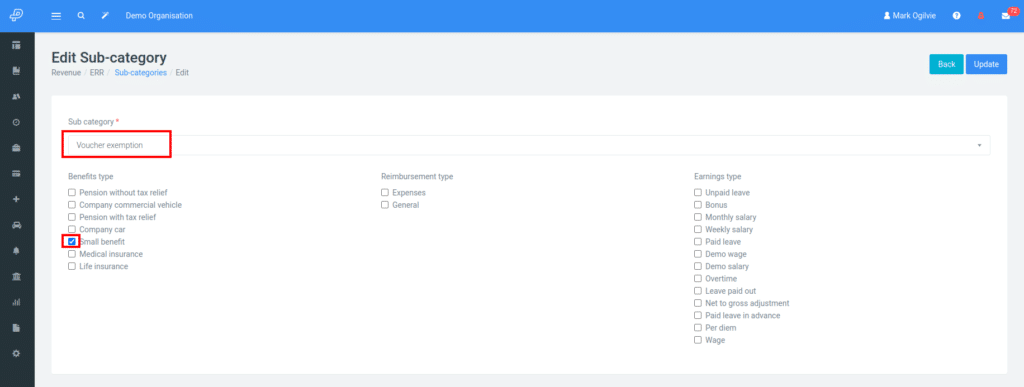

- Edit the type of ERR Sub Category.

- Check the corresponding boxes for each Parolla benefit, expense, or reimbursement.

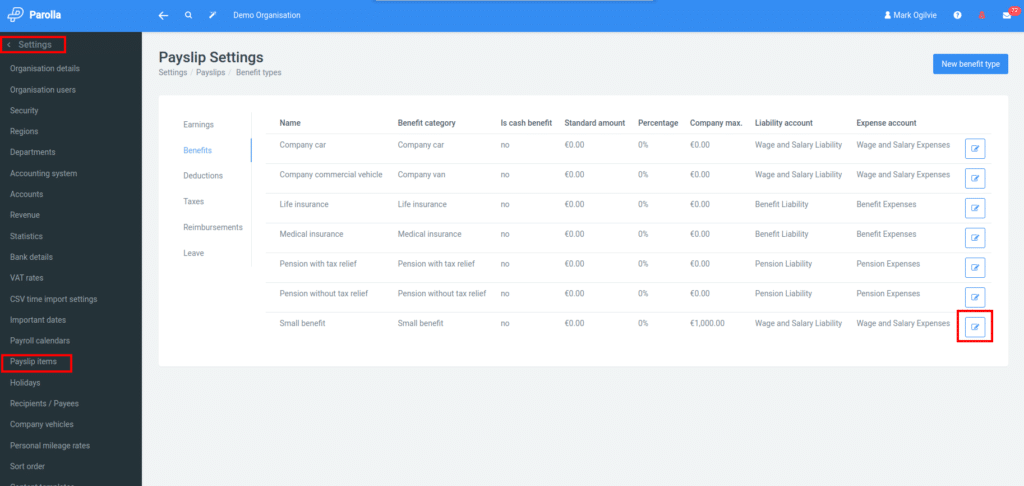

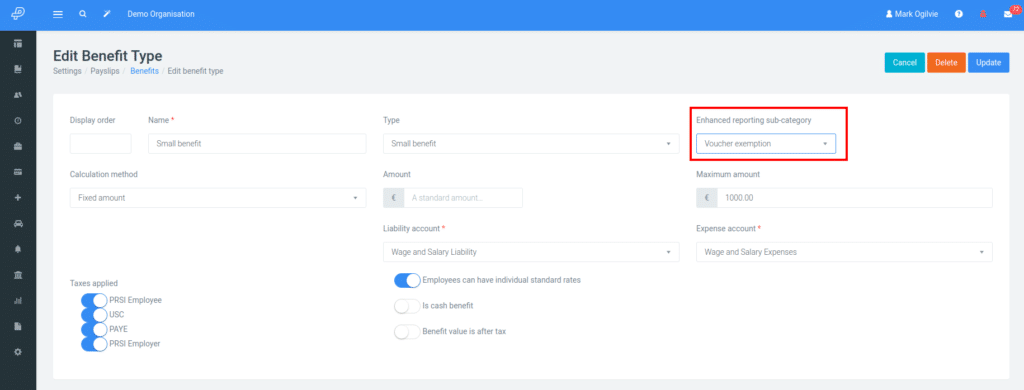

Method 2: Mapping Payslip settings Individually

- Navigate to Settings > Payslip items.

- Edit the type of benefit, expense, or reimbursement.

- Choose the appropriate Sub Category for this payslip item.

What Happens Now?

The next time you submit a payslip to The Revenue, if it contains a Payslip item that is tagged with an ERR Sub Category, we will also generate an ERR Submission for the payslip. You will then be able to view this submission in Parolla under Revenue>ERR Submissions.

In addition, if you declare benefits/expenses paid to the employee using our Other Compensation module under the benefits & deductions tab and/ or the Expenses & Reimbursements pages, we will match the benefit type against the Sub Category and report that as well.

Reporting items outside of payroll cycle.

ERR items reported to Revenue as part of a payslip are included in all existing packages.

If you pay employees for expenses or benefits outside of the payroll cycle these need to be reported on or before the date of payment to The Revenue.

In this instance you can use the reimbursement option under the Expenses & Reimbursements module and/ or the Other Compensation option under the Benefits & Deductions module.

The Expenses and Benefits module allows you to enter details of receipts or calculate the mileage costs and report to Revenue as part of or outside of Payroll. Parolla Expenses module = €2 per employee usage per month

If you wish to invite your employees to enter their Expenses and Mileage directly to their profile you can invite them to use the Parolla employee self service module. Employee Self Service = 50cent per Employee sign in per month.

Important Note:

Each payslip item can only be assigned to one subcategory. If a benefit or expense comprises multiple items, they must be itemised separately.

Period to 2024 : many companies just grouped all reimbursements into one line item and repaid those to the employee. Going forward you may need to define new Payslip Items and report each sub category of item separately on the payslip and the ERR submission.

Additional Resources:

For further information, The Revenue provides detailed documentation, examples, and guidance at The Revenue’s Reporting Guide.

This guide ensures that your revenue reporting through Parolla is accurate, efficient, and compliant with the latest requirements.