How Can We Help?

View and Correct Errors

This guide will explain how to view and correct errors that appear in your pay runs from time to time.

It is important to note that ‘Warnings’ and ‘Errors’ are not the same in the eyes of Revenue. ‘Warnings’ are accepted by Revenue whereas ‘Errors’ can be a number of different issues and in some cases are rejected payslips.

How to View Error Information?

Errors will show to the left of a pay run under the Status heading and be highlighted in RED.

To view the information relating to an error, go to the left-hand menu > Revenue > Review Year. The listing will show a RED Triangle symbol beside any period submission containing an error.

The link will display the submission summary page. This is what was sent to Revenue including the submission ID, date of submission, number of payslips, deletions, and all tax information. The latest submission will be at the top in the Recent Submission panel.

Active Items listing is the list of payslips submitted within a submission. The Line item ID shows the Submission ID followed by the line number. Each payslip is a separate line item. The Line item ID should start with the latest Submission ID shown in the Recent Submission panel.

To view detailed error information, click the Eye Icon to the right of the latest submission. Error information will be displayed in a RED panel at the top of the page.

How to Correct Errors?

Depending on the error, this will decide the process to correct the error.

Generally, the error will be detailed on the submission page by a RED banner, highlighted payslip and an explanation.

The first place to look is the bank record and determine what amount was paid to the employee. Was the payslip reversed and not resubmitted to Revenue?

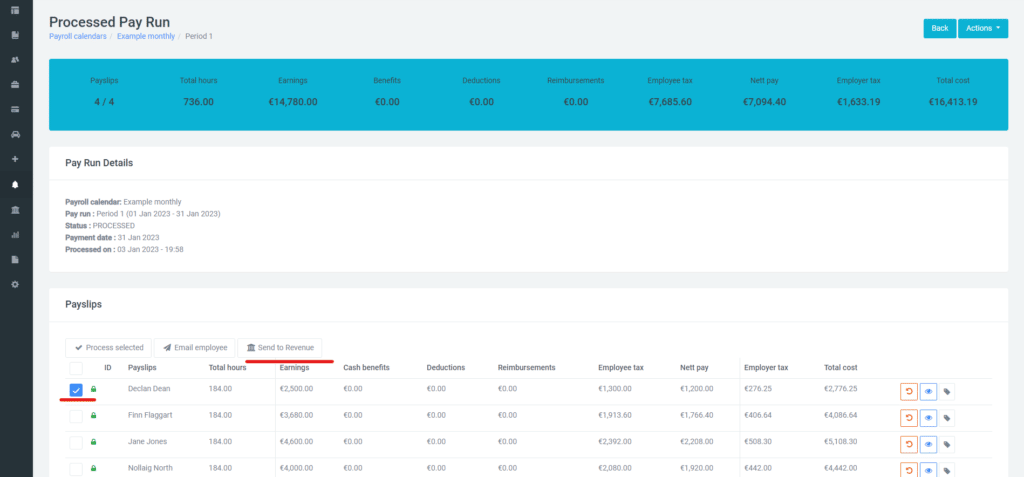

A single payslip can be re-submitted to the Revenue via the payrun as per below.